Risk Management in

Islamic Financial Instruments

170

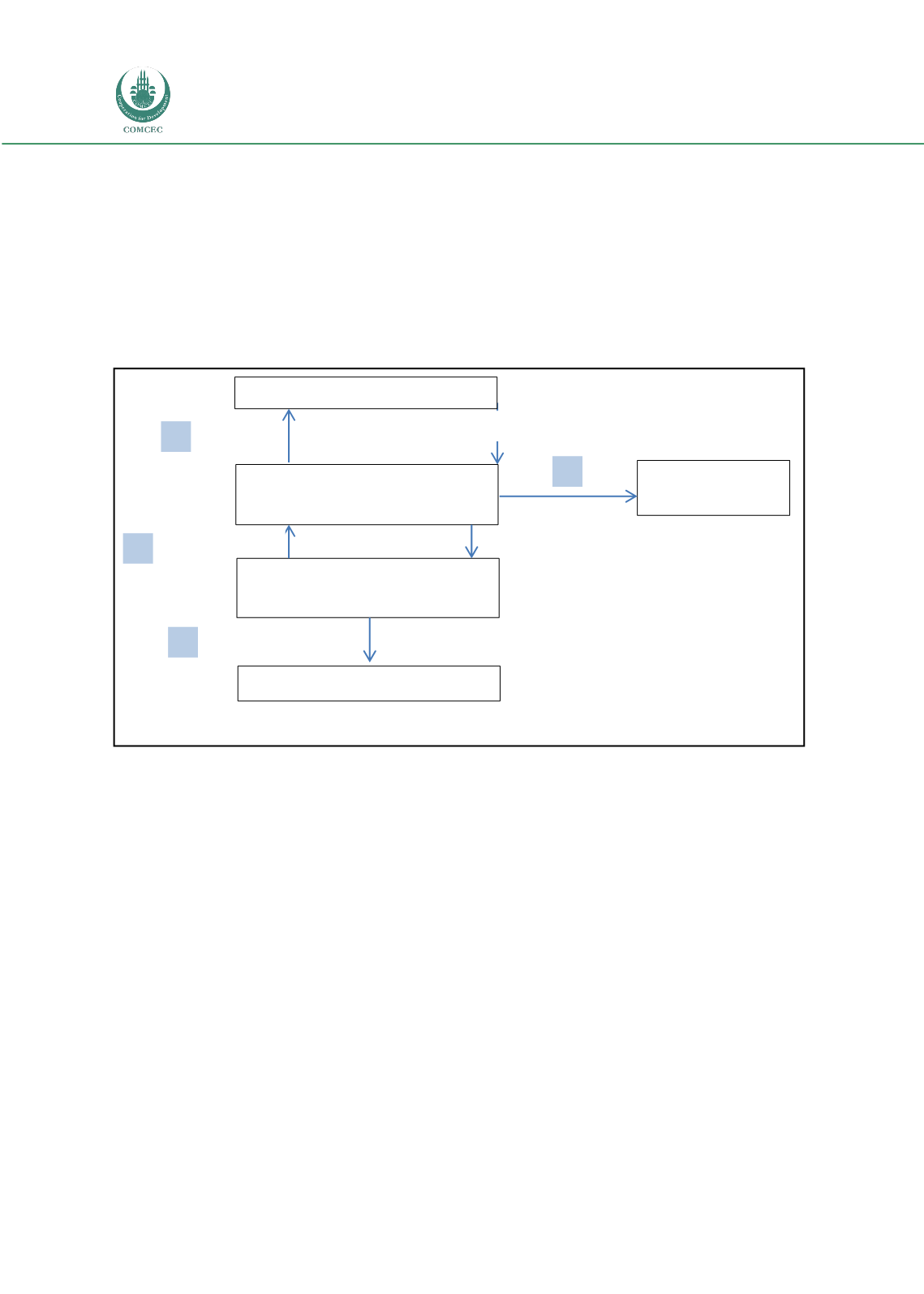

Since they were issued by a public sector enterprise, the sukuk were given the status of a

sovereign bond by the rating agency. Investors assumed an implicit government guarantee

for the sukuk. The sukuks were rated A1 by Moody’s and A+ by Standard & Poor’s. The

Structure of the Nakheel sukuk were based on asset based Ijarah manfaa (Salah, 2010), in

which sukuk holders, via an SPV, buy the leasehold interest of the primary assets without

transferring the title of the assets to them. The sukuk holders only had rights on the

stream of income generated by the assets, and not on the assets themselves. Figure A.3

depicts the structure of the Nakheel Sukuk.

Figure A.3: Structure of Nakleel Sukuk

A.2.5.2.1 Reasons for Insolvency/Default

Following the global financial crisis 2007-09, the macroeconomic situation led the Dubai

government to seek a standstill for USD59 billion debt owed by the Dubai World, including

Islamic sukuk of 3.5 billion (Smith and Kiwan, 2009). There were various factors which caused

Dubai World to, in effect, default. Huge short term borrowings, falling oil prices, the bursting of

the real estate price bubble due to excessive supply of residential and commercial properties,

and a liquidity mismatch owing to short term liabilities and long term receivables from the

property development, all contributed to the failure of Dubai World (IMF (2010 )).

In the end, the sukuk’s default was triggered by the specific financial condition of the obligor.

For the first half of 2009, the company had a net exposure of AED 12.8 billion to the parent

company, Dubai World. It is more than likely that, if the concentration of funds in related

parties had been managed prudently, the standstill request for at least the Nahkeel sukuk

could have been prevented.

Sukuk Holders

Nakheel Developent Ltd.

(SPV/ Issuer/ Purchaser)

Nakheel Holding 1

LLC (Seller)

Nakheel Co.

3

Certificates

Sukuk Proceeds

Leasehold Rights

Purchase Price

Funds

2

1

3 year lease of

Sukuk Assets

Nakheel Holdings 2

(Lessee)

4

Source: Wijnbergen and Zaheer (2013)