Risk Management in

Islamic Financial Instruments

168

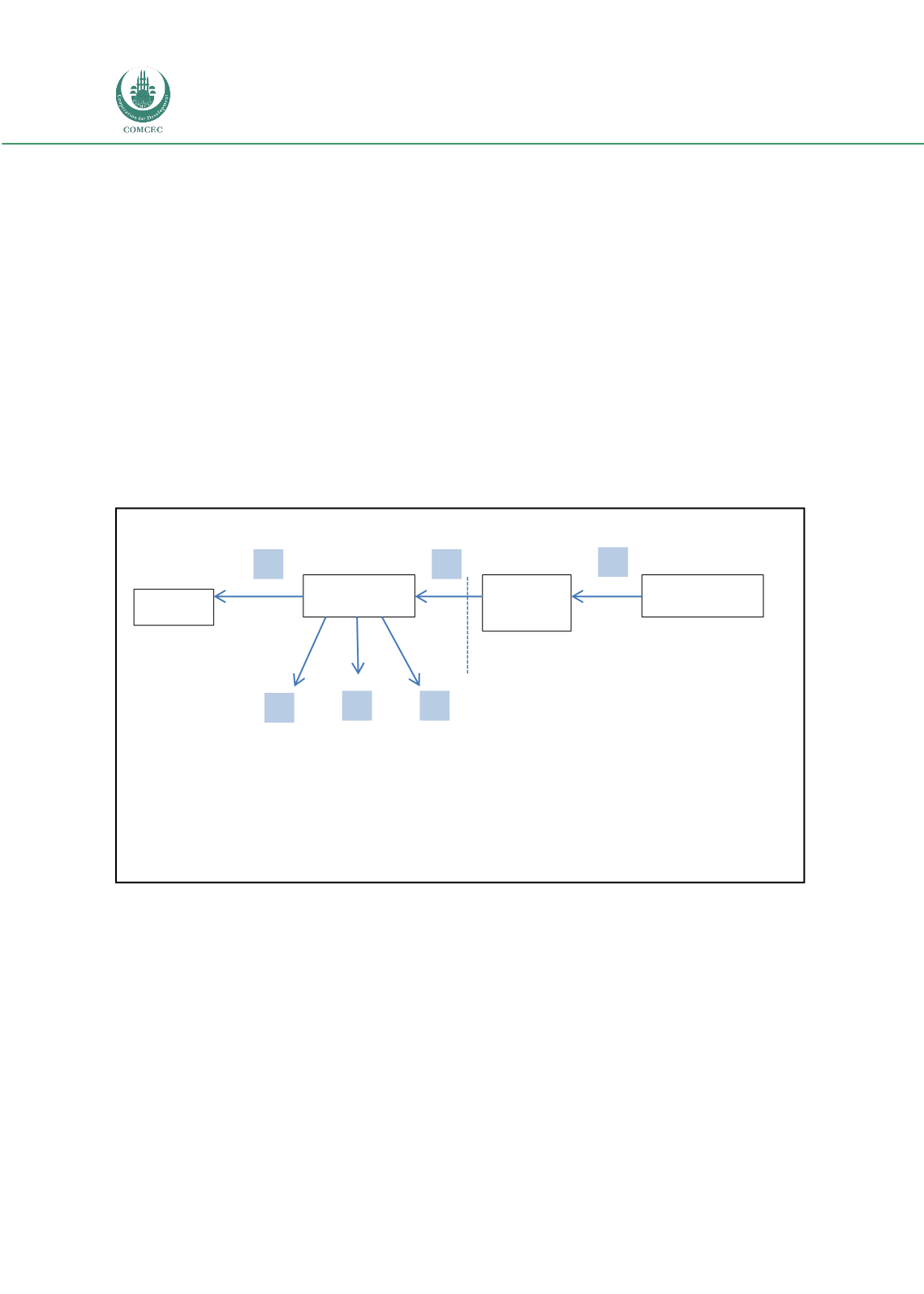

A.2.5.1.2 The SPV

A SPV was formed, namely the East Cameron Gac Company (ECGP), incorporated in the

Cayman Islands.

A.2.5.1.3 Type of contract

A Musharakah (co-ownership/joint venture) type of contract was used as the underlying

contract in which sukuk investors had the ownership “Overriding Royalty Interest (ORRI)” in

two gas properties located in the shallow waters offshore the State of Louisiana through an

SPV acting as a trustee of the sukuk holders. Like the sukuk investors, the originator also

contributed its funds into the musharakah. The assets of the musharakah were co-owned by

the sukuk holders and the originator company, ECP.

Figure A.2: East Cameron Gas Co. Sukuk Issuance

A.2.5.1.4 ECP’s Sukuk Structure

The issuer, East Cameron Gas Company (ECGP), incorporated in Cayman Islands, issued

sukuk worth USD165.7 million. The proceeds from sukuk issuance were used to buy the

ORRI from the Purchaser SPV, mentioned in a Funding Agreement for USD$ 113.8 million.

The remaining amount, USD 51.9 million was set aside for future development, a reserve

account and the purchase of put options for natural gas to hedge against the risk of fall in

gas prices.

ECP

Purchase SPV

Issuer SPV

Sukuk Holders

3

2

1

4

5

6

U.S.A.

Cayman Islands

1 – Sukuk Subscription of $165.67 million

2 – Funding $ 165.67 million

3 – Purchase of ORRI $113.84 million

Source: East Cameron gas Co. FIR 2006 and Wijnbergen and Zaheer (2013)