Risk Management in

Islamic Financial Instruments

166

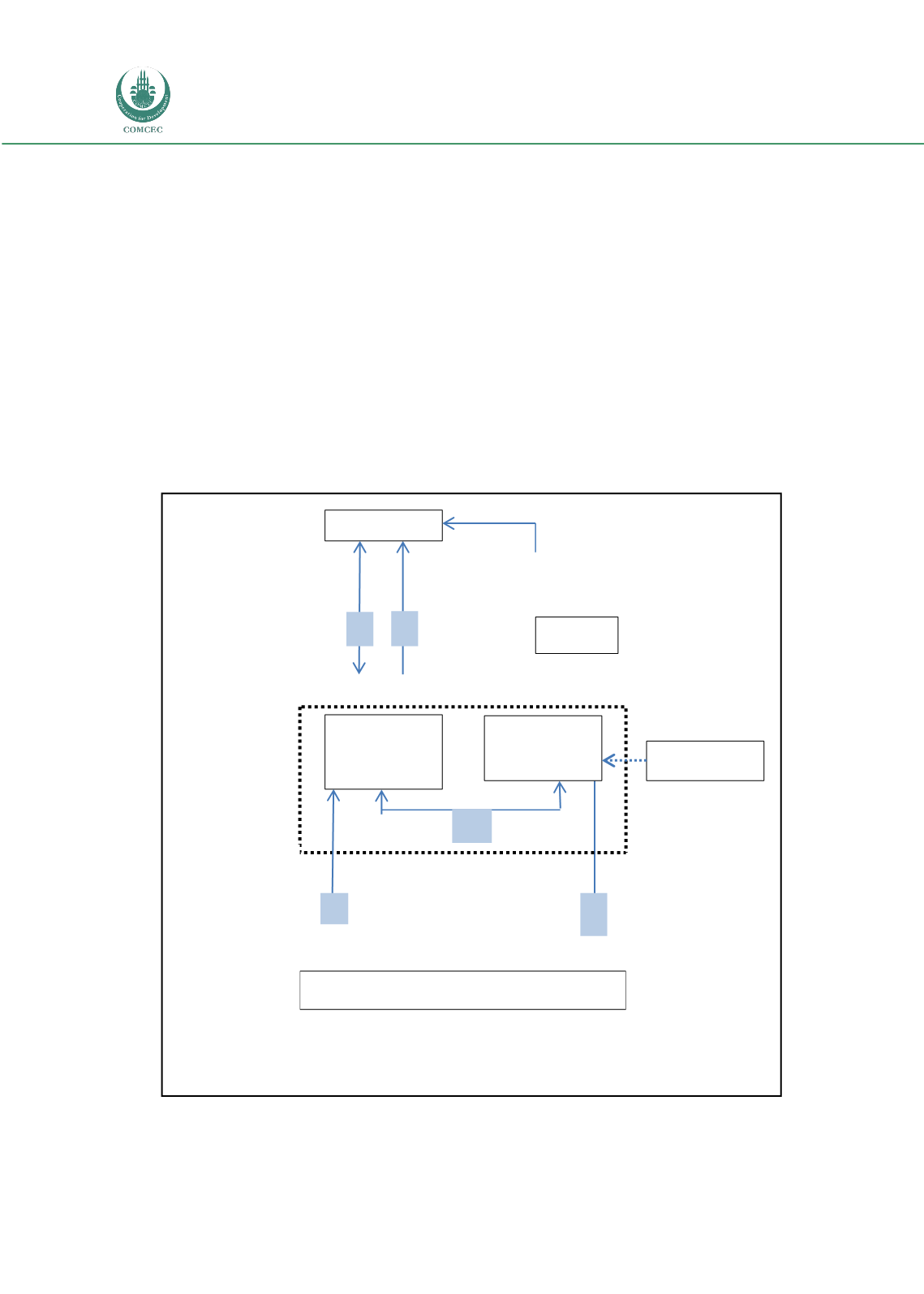

Trustee

overseeing the

Musharaka

Investors

KLSSB(as

Wakeel to

Investors)

KLSSB

KLSSB issues

sukuk and

receives proceeds

in return

Proceeds from PU

for Sukuk

redemption and

profit payments

5

1

KFHM

4

Purchase

Undertaking

Musharakah

partners

appoint KLSSB

as the project

Agent

2

3

Musharakah Venture to sell Project

Lands

Distributable

profit to be

shared semi-

annually based on

an agreed profit

sharing rate of

99%-1% to

KLSSB and Sukuk

Holders

Stake of Musharakah

partners based on

their capital

contributions of

74:26 from KLSSB

(in kind) and Sukuk

holders (in cash)

Source: Abdullah et al (2012) and RAM(2010)

represented by KLSSB in its capacity as agent (wakil) and initial trustee for the investors.

KLSSB, as the agent of the Investors, issues the sukuk to the investors.

A.2.4.2 The Musharakah agreement and profit sharing ratio

The Musharakah Venture, based on their respective capital contributions (Musharakah

Capital), are as follows: a) KLSSB - 26% in kind (RM254 million) and b) Investors - 74%

(RM720 million). Distributable profits between the musharakah partners are agreed based on

the Profit and Loss Sharing Ratio: a) Sukukholders: 1% (to be capped at RM1,000 p.a.) and

b)KLSSB: 99%. If losses are incurred, the loss shall be allocated in accordance with the

outstanding Capital Contribution Ratio which is on a basis Diminishing Pursuant to the share

installment schedule."

Figure A.1: Structure of KLSSB Sukuk Musharakah

Trustee