Risk Management in

Islamic Financial Instruments

126

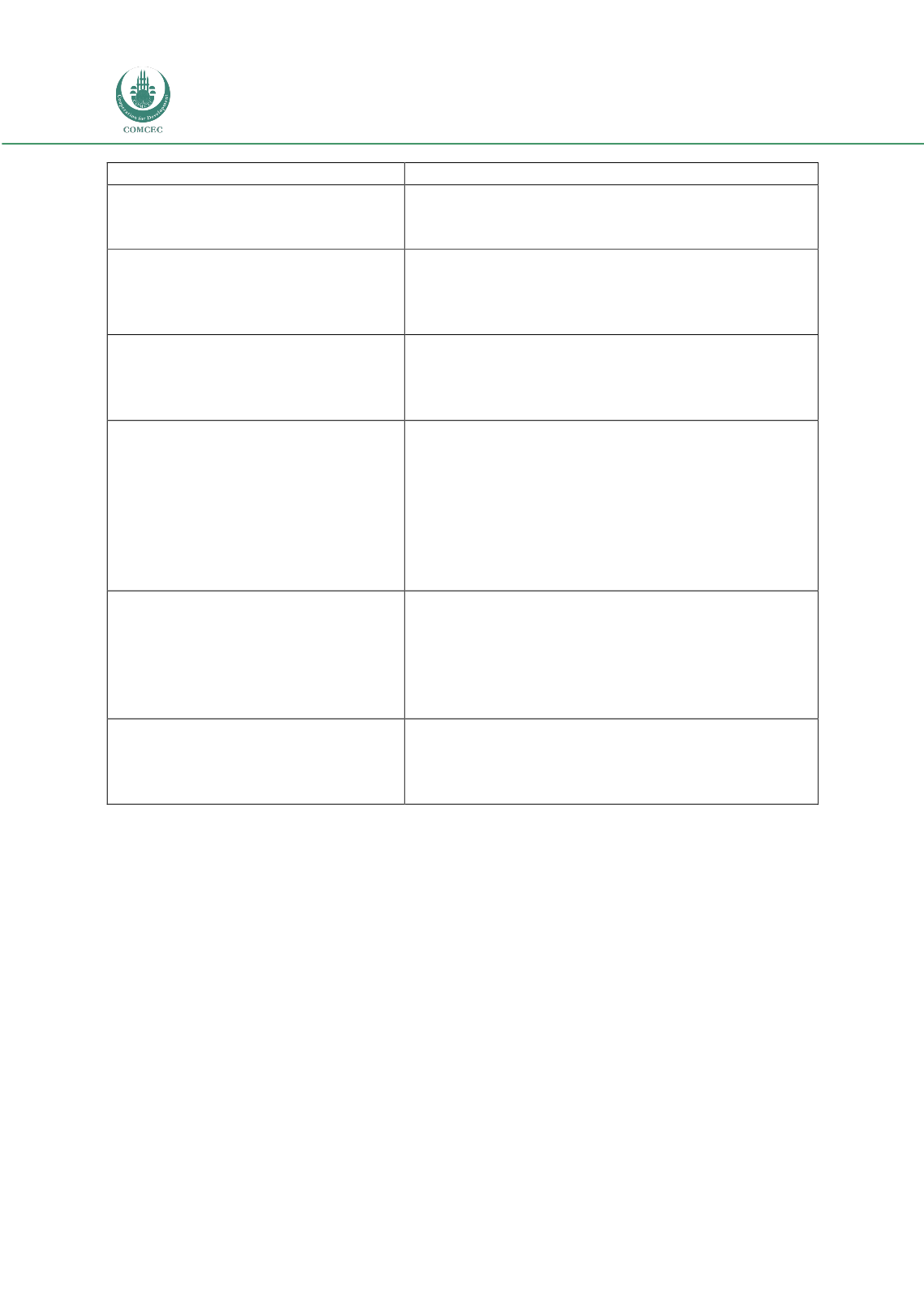

requirements

5.

Investment opportunities in

sovereign issues

Most member countries have not yet issued sovereign Sukūk

or other Sharī`ah-compliant instruments. Two large economies

that have done so in recent years are Turkey and Indonesia.

6.

Proper understanding of Islamic

banking services and their equal

treatment vis-à-vis conventional

product

As noted earlier, most central banks treat Islamic products on

par with their conventional counterparts.

7.

A clearer understanding of the

Sharī`ah governance structures

and efforts to facilitate them

further

Some member countries have specific requirements for

Sharī`ah governance; most do not.

8.

Extension of safety net systems

such as Sharī`ah- compliant

deposit insurance

Only 31% of regulators in our survey reported having

Sharī`ah-compliant deposit insurance in their jurisdictions.

Throughout recent crises, deposits and investment accounts of

Islamic banks have enjoyed the safety nets available to all

licensed banks.

It is noted that “investment accounts” based on Mudarabah or

Mushārakah may not qualify for deposit insurance in certain

jurisdictions.

9.

Ensuring that the legal system is

supportive

Among regulators responding to our survey, 65% reported

having banking regulations for Islamic banking. Such

regulation, however, does not always ensure that commercial

laws and the overall legal system support Islamic banking.

Forty-two per cent (42%) reported having “guidance for

Sharī`ah- compliant contracts”.

10.

Ensuring tax neutrality for Islamic

financial contracts

Among regulators responding to our survey, 46% reported tax

neutrality for Islamic banking contracts. Additional focus is

thus required in the tax neutrality of Islamic banking contracts.

The matter of Zakāh treatment also calls for consideration.

Source: Islamic Research and Training Institute 2014

6.3.2 Accounting and Auditing

The seventh recommendation pertains to enhancing the implementation of accounting and

auditing standards for the IFSI. Its KPIs involve finding the percentage of members requiring

compliance with Islamic accounting and auditing standards and determining the level of

collaboration between standard setting bodies such as the Basel Committee, IAIS, IOSCO, and

IASB (

A Mid-Term Review

106). Within the IFSI, central banks and supervisors will need to

adopt and implement both the general standards, such as the Basel standards, and industry

specific standards, such as the AAOIFI. Governments, private institutions and multilateral

bodies will each have a role to play. Governments will have to facilitate the adoption of the

standards. Private institutions, who will be clients and investors to these accounting and

auditing services, will serve as to ensure accountability, as they will demand proper

compliance to Shariah. Multilateral organizations will provide international standards and