Risk Management in

Islamic Financial Instruments

125

and minimizes the central bank’s time and resources on Shariah issues (

A Mid-Term Review

29).

6.3 DEVELOPING SUPPORT INFRASTRUCTURE AMONG MUSLIM

COUNTRIES

6.3.1 Legal

Recommendation 8 of the Ten-Year Framework focuses on creating a legal, regulatory and

supervisory framework for the IFSI that will be conducive to growth. Table 6.1 indicates the

ten legal and supervisory areas identified and their progress. The models for the regulatory

bodies vary from country to country. Flexibility of the legal and supervisory frameworks is

necessary, due to the great variety in the size, function, products and operations of the

institutions. As IRTI states, “The laws should provide for tiered regulation, whereby different

institutions would be regulated with different intensities depending on their sizes, functions,

products and operations (38).” Different approaches include creating regulations that vary

depending on the legal format of the institution, or a model where all financial institutions are

treated the same. The KPIs of this recommendation include the percentage of member

countries with tax neutrality and legal enablers of Islamic banking. Adoption of social media

was identified as a second indictor (

A Mid-Term Review

107).

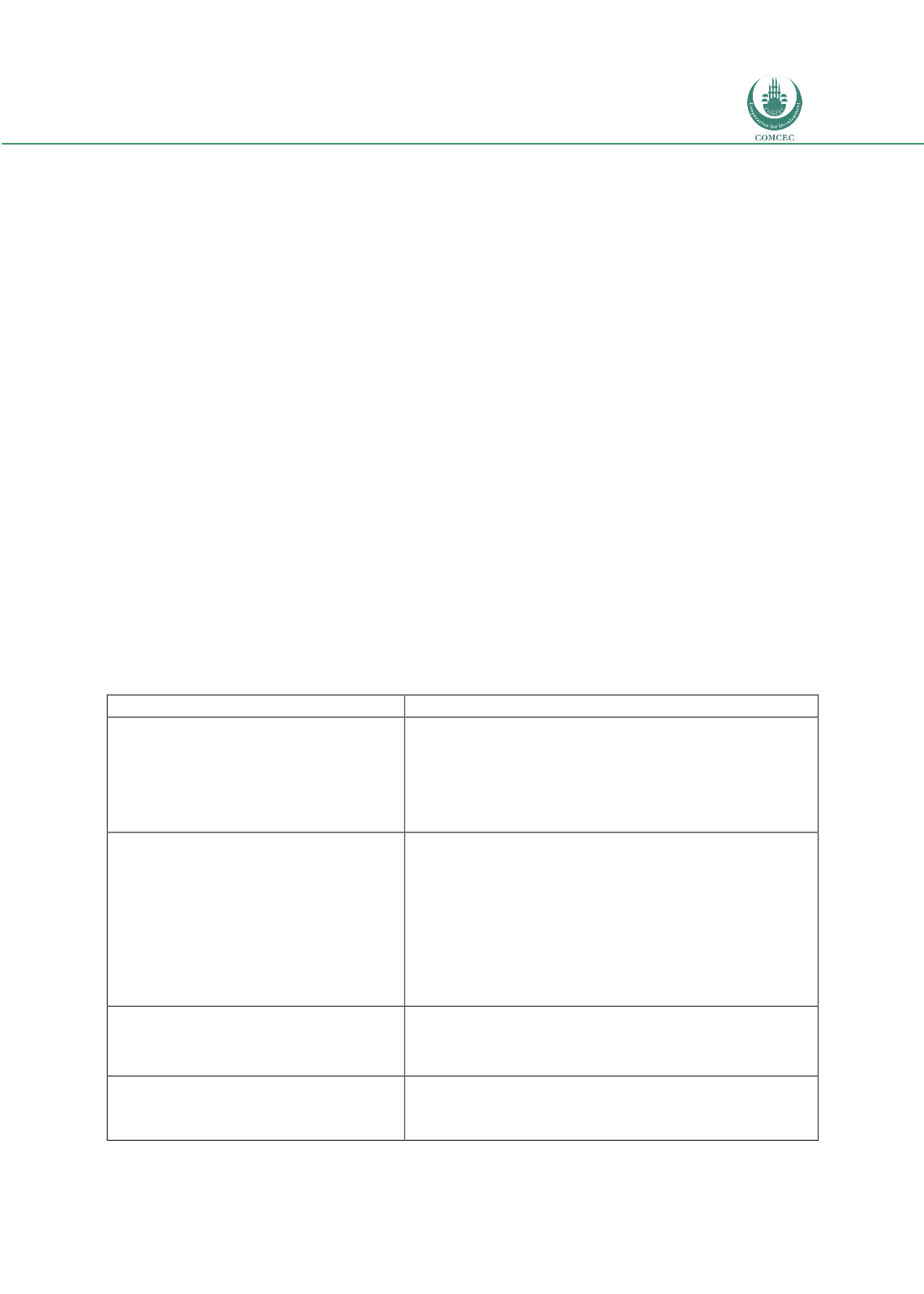

Table 6.1: Progress Made in Ten Areas for Legal and Supervisory Enablement

Recommendation Enablement

Progress to Date

1.

Liquidity support, such as lender of

last resort (LOLR) facilities

Central banks have generally positioned themselves as lenders

of last resort, even in times of crisis, for all banks (both

conventional and Islamic) under their supervision. Whether

the financing to Islamic banks would be undertaken on a

Sharī`ah-compliant basis is often less clear.

2.

Neutrality regarding capital

requirements to be accorded to

assets of Islamic banks as

compared to those of conventional

banks

As noted earlier, Islamic banks are generally subject to the

same capital requirements as their conventional counterparts.

The unique attributes of the assets of Islamic banks call for

appropriate risk-weighting. The IFSB standards have covered

this aspect and have been recently updated and enhanced by

IFSB-15 (Revised Capital Adequacy Standard).

3.

Sharī`ah-compliant return on bank

reserves held at central banks

Greater focus is required by central banks to provide Sharī`ah-

compliant returns on statutory reserves; only a minority of

member countries do so today.

4.

Appropriate treatment of

investment accounts for

mandatory reserves and capital

The IFSB has produced standards on the treatment of

investment accounts.