116

The reasons include the following:

1.

The government’s persistent budget deficits have relied on a significant portion of

local liquidity to meet budgetary funding gaps. Limited participation by NBFIs has

further reduced liquidity intermediation in funding corporate bonds.

2.

The Indonesian rupiah’s history of hyperinflation and volatility has compelled

companies to borrow and also bill in USD for many local goods and services (Reuters,

2015).

3.

Access to lower-cost funding.

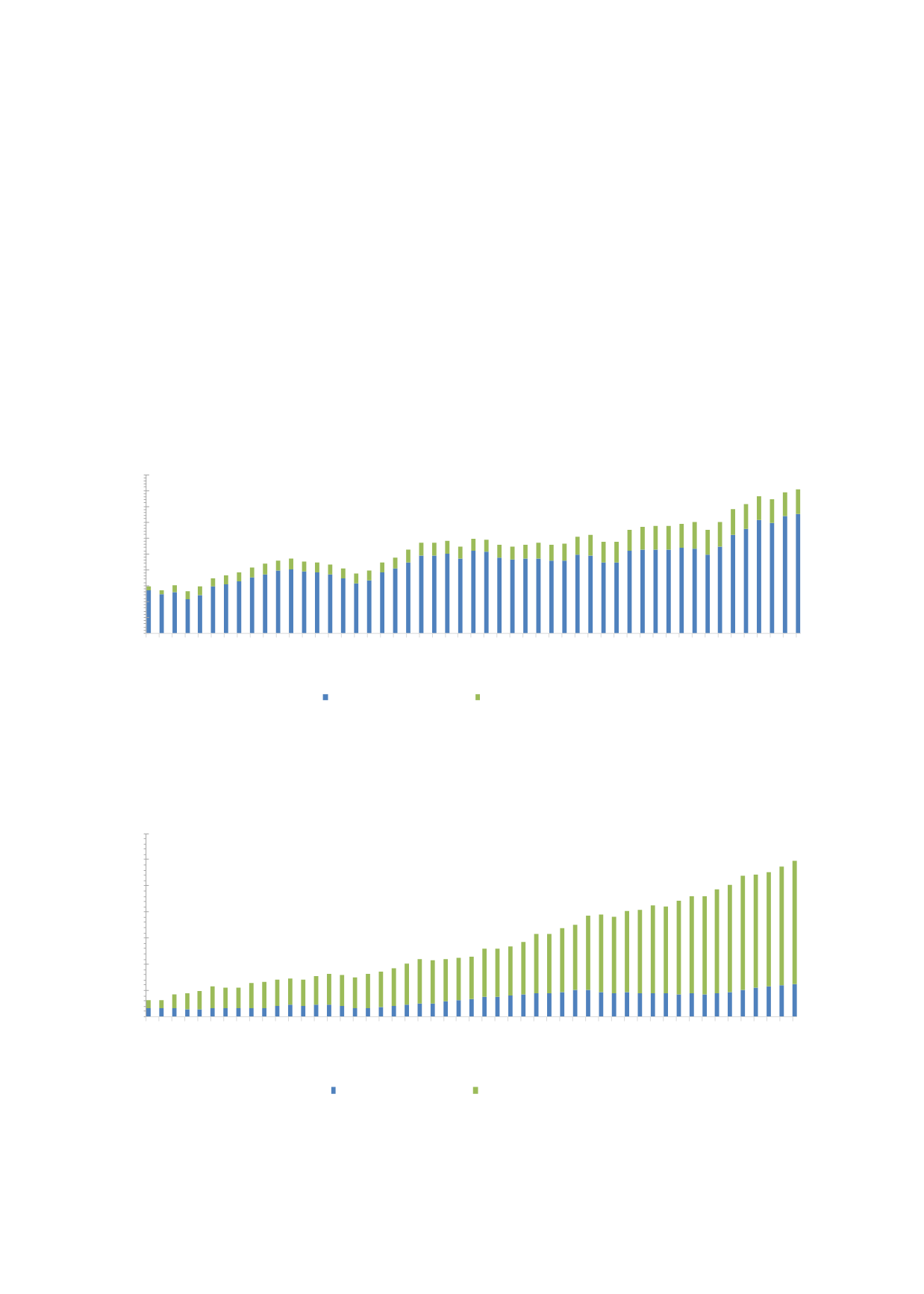

Chart 4.31: Outstanding Government Bonds (December 2004-June 2017)

0

20

40

60

80

100

120

140

160

180

200

Dec-04

Mar-05

Jun-05

Sep-05

Dec-05

Mar-06

Jun-06

Sep-06

Dec-06

Mar-07

Jun-07

Sep-07

Dec-07

Mar-08

Jun-08

Sep-08

Dec-08

Mar-09

Jun-09

Sep-09

Dec-09

Mar-10

Jun-10

Sep-10

Dec-10

Mar-11

Jun-11

Sep-11

Dec-11

Mar-12

Jun-12

Sep-12

Dec-12

Mar-13

Jun-13

Sep-13

Dec-13

Mar-14

Jun-14

Sep-14

Dec-14

Mar-15

Jun-15

Sep-15

Dec-15

Mar-16

Jun-16

Sep-16

Dec-16

Mar-17

Jun-17

USD billion

LCY Government (in USD billions)

FCY Government (in USD billions)

Source: Asian Bonds Online

Chart 4.32: Outstanding Indonesian Corporate Bonds (December 2004-June 2017)

0

20

40

60

80

100

120

140

Dec-04

Mar-05

Jun-05

Sep-05

Dec-05

Mar-06

Jun-06

Sep-06

Dec-06

Mar-07

Jun-07

Sep-07

Dec-07

Mar-08

Jun-08

Sep-08

Dec-08

Mar-09

Jun-09

Sep-09

Dec-09

Mar-10

Jun-10

Sep-10

Dec-10

Mar-11

Jun-11

Sep-11

Dec-11

Mar-12

Jun-12

Sep-12

Dec-12

Mar-13

Jun-13

Sep-13

Dec-13

Mar-14

Jun-14

Sep-14

Dec-14

Mar-15

Jun-15

Sep-15

Dec-15

Mar-16

Jun-16

Sep-16

Dec-16

Mar-17

Jun-17

USD billion

LCY Corporate(in USD billions)

FCY Corporate(in USD billions)

Source: Asian Bonds Online