COMCEC Tourism Outlook-2016

23

Morocco (-1%) posted weaker results, affected by a decrease in arrivals from its major source

market France. It is expected that the strength of the euro against the Moroccan dirham,

combined with the increasing number of low-cost airlines and routes between European

countries and Morocco, will continue to drive up the number of inbound arrivals in the next five

years. However, it is important for the government to provide adequate incentives for banks and

private developers to invest in the Moroccan tourism industry, otherwise the country could lag

behind in its plans to start developing tourism areas in order to take the pressure off more

saturated ones.

Data from some destinations, however, is still pending, including the United Arab Emirates

(Dubai) and Kazakhstan. United Arab Emirates did not report not only 2015 data but also 2014

data.

Iran reported 5.4% increase in tourist arrivals. The government has defined twelve areas in the

Sixth Development Plan (2016-21) with solely focusing on tourism. Since desert-trekking

appears to be a favorite hobby of western travelers, the authorities have resolved to create 2,000

ecotourism resorts by the end of the sixth five-year development plan (2016-21), nearly a third

of which will be located in Lut Desert.

The government also expressed that Iran will unveil an investment package of 1,300 projects in

the coming days to attract foreign investment and boost the badly-hit tourism industry

(Dailymail, 2015 October).

In North Africa, international arrivals in Tunisia (-25.2%) and Algeria (-25.7%) declined

considerably in 2015 as a result of some security problems. Tunisia's crucial tourism sector

suffer from security issues, which result in weak tourist spending and delay the economic

recovery. (BMI Research, 2016).

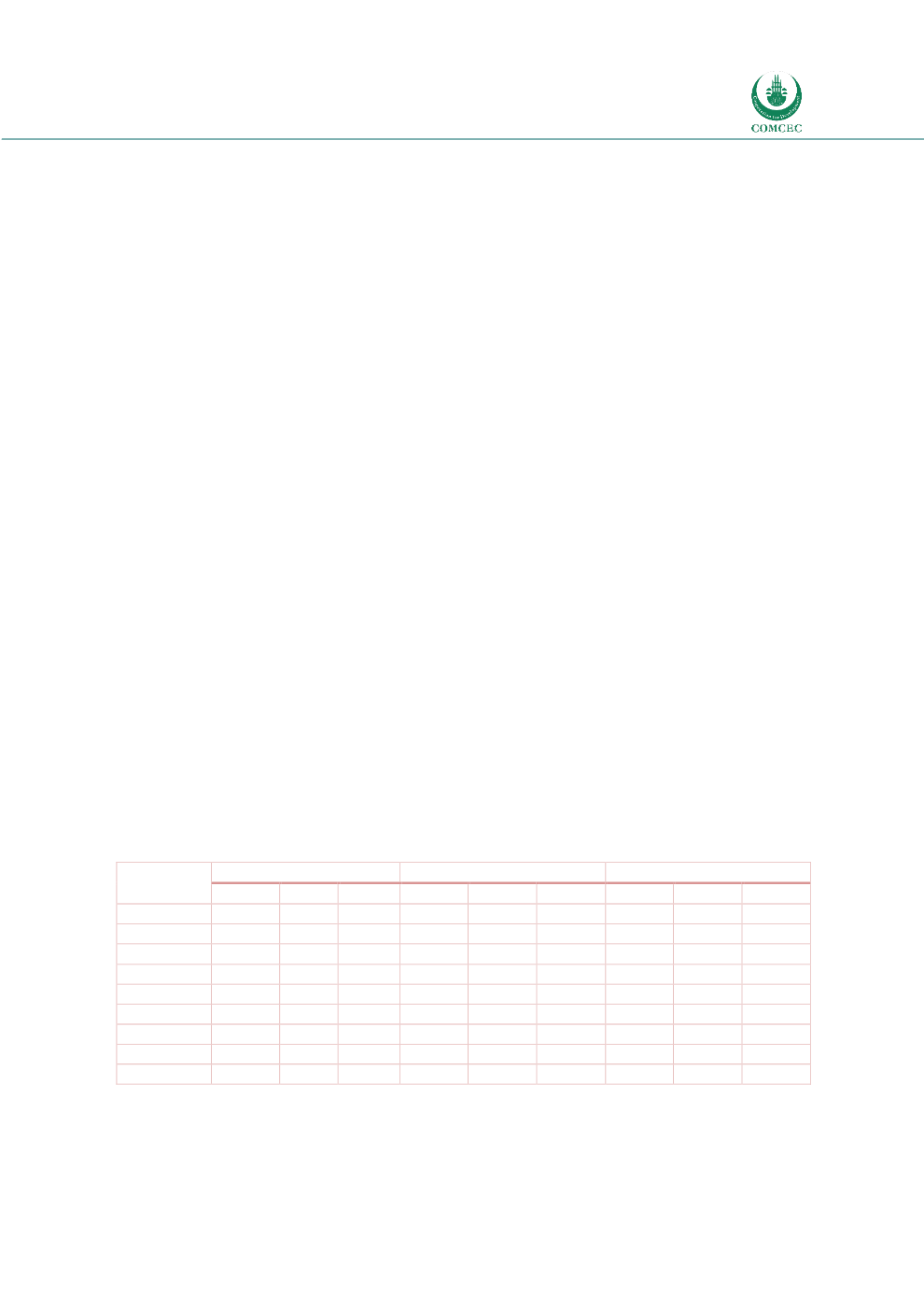

In order to compare the performance of the countries, major surplus on the travel balance would

be a useful tool, since it shows that more foreign exchange stays in the country. Table 4.2 shows

member countries by major surplus on the travel balance.

Table 4.2 Member Countries by Major Surplus/Deficits on the Travel Balance in 2013-2015

(US$ billion)

Source: UNWTO, 2016 Tourism Barometer Volume14, May 2016.

Tourism Receipts

Tour. Expenditures

Balance

2013

2014

2015

2013

2014

2015

2013

2014

2015

Turkey

28.0

29.6

26.6

4.8

5.1

5.4

23.2

24.5

21.2

Malaysia

21.5

22.6

17.6

12.2

12.4

10.5

9.3

10.2

7.1

Morocco

6.9

7.1

6.0

1.3

1.4

1.4

5.5

5.6

4.6

Egypt

6.0

7.2

6.1

3.0

3.1

3.4

3.0

4.1

1.7

Indonesia

9.1

10.3

10.7

7.7

7.7

7.3

1.4

2.6

3.4

Kuwait

0.3

0.4

-

11.6

11.3

-

-11.3

-10.9

-

S. Arabia

7.7

8.2

10.1

17.7

24.1

20.7

-10.0

-15.9

-10,6

UAE

12.4

14.0

16.0

13.8

14.4

15.1

-1.4

-0.4

0.9

Qatar

3.5

4.6

5.0

6.6

8.7

8.2

-3.1

-4.1

-3.2