Single Window Systems

In the OIC Member States

12

Customs Services are often advanced in terms of IT resources and skills, have an independent

budget, and control all trade transactions. The challenge of this approach is to ensure

involvement of other agencies and a strategy design that not only caters to the efficiency of the

customs clearance process but also to the objectives of other government departments, i.e. the

physical movement of goods and food and sanitary control.

Another approach is to set up a new entity for the Single Window operations that is neutral and

specifically tasked to develop and manage the Single Window. Such an entity can take different

legal forms; public or private. Governments contract out the development and operation of the

SingleWindow through a contractual Private-Public Partnership (PPP) arrangement to a private

or joint venture public private company, or through a special enactment to a public enterprise.

In terms of ownership and funding, Single Windows follow two different approaches. In the

public model, the government funds the initial investment and, depending on the financial

arrangement, and may also cover the operational expenses from its regular budget. In the

public-private model a private company alone or in cooperation with the government provides

the funding for the investment and operational expenses. In return, under a PPP contract, the

profit generated by the Single Window is retained by the private company, which may also

receive an annual payment from the government budget for its service.

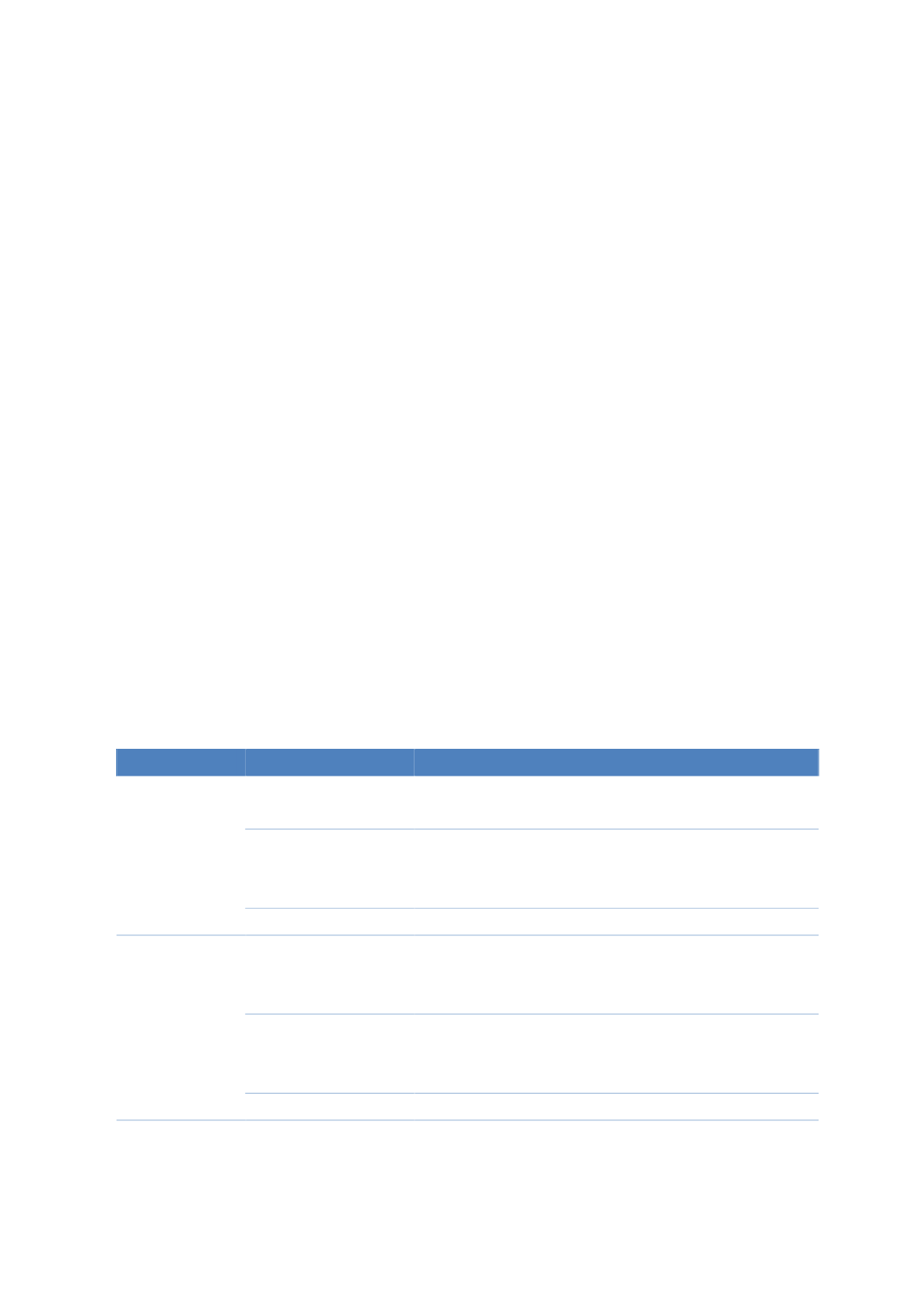

The majority of the Single Windows charges fees for their services. There are different types of

fees – see Table 1 below. Commonly Single Windows combine a registration/subscription fee

and a usage based charge, which is either document a volume based.

Table 1: Type of Fees and Charges

Type of fee

Calculation basis

Single Window Examples

Registration fee

Annual

Morocco: Annual subscription 300 US$

Hong Kong: Annual Fee 129 US$

One-time

Malaysia registration (one time): ~ US$125 or US$65 for SME

Hong Kong registration (one time): 640 US$

Senegal registration fees (one time): 200 US$

Mailbox charges

Malaysia: ~40 US$ or 20 US$ for SME

User charge

Volume / transaction

based

Morocco: 1,000 US$ to 2,400 US

Senegal: per transaction: 10 US$ plus additional document: 2

US$ per document

Document based

Malaysia: 0.25 US$/kilobyte; or 1.25 US$ per document

Singapore: per declaration basis 2.8 US$

Hong Kong: 0.64 US$ per document

Value based Percentage

Ghana fixed fees at 0.4% of declared FOB value on import

Source: Authors’ own compilation from information on websites and different publications