Special Economic Zones in the OIC Region:

Learning from Experience

94

Any activity carried out within the free trade zone must be notified to its authority in

order to obtain permission; and

The authority shall permit customs offices to be established in a free trade zone and

shall provide adequate facilities for officers of customs whose duties require their

presence within or at the perimeter of the zone.

Licensing, Ownership and Zoning Restrictions

JTC adopts a light touch approach to administering activities in the zones. In order to qualify, a

firmmust adhere to a set of qualifying criteria which include, but are not limited to the following:

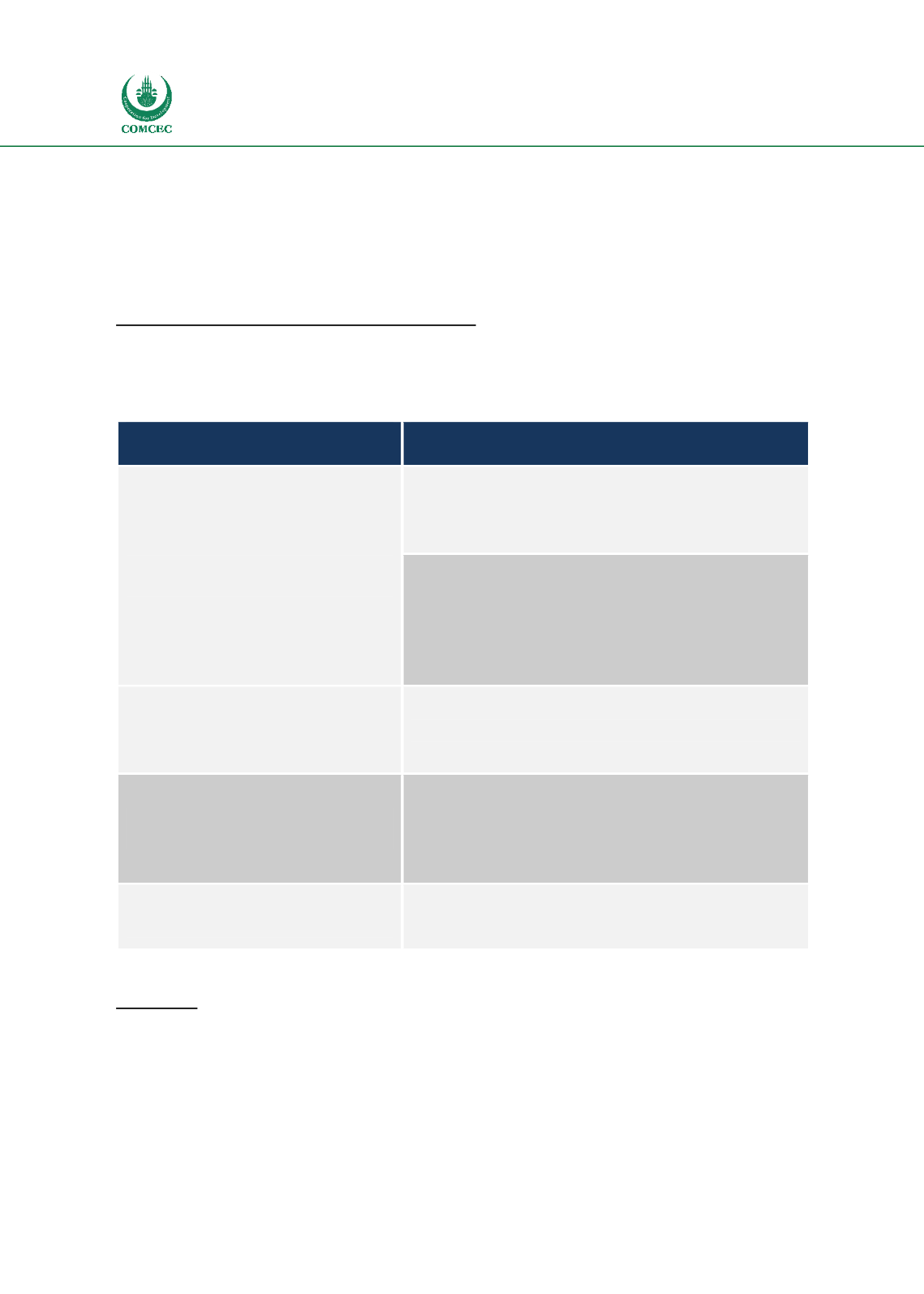

Table 5-9 - Jurong Qualifying Criteria

Criteria

Qualifying Characteristics

Fixed Asset Investment

Plant and machinery - A company locating will have to

declare their overall investment figures and state a

reason why they are that value

Buildings and civil works (B&C) - A company will also

have to meet the minimum buildings and civil

requirements. This includes a set of design standards.

Firms will have to provide a set of cost figures

indicating the expected building standard.

Plot Ratio

Companies are required to declare their plot ratio and

floor area requirements, these vary depending on site

usage.

Value Added

The firms will be considered on the value added, this is

the total difference between the total output and total

operating costs. Firms who project a higher value added

production will have a greater chance of entry.

Credibility of Firms Business Proposal

The credibility and quality of the business proposal will

benefit their application process.

Source: JTC (2017) Policies for Industrialists

Incentives

The key incentives offered to firms locating inside the zone include:

Jurong port- no taxes on the import , export or re-export of goods;

Investor is liable for 5 year tax holiday then a 5 year 10% corporation tax agreement;

and