Islamic Fund Management

124

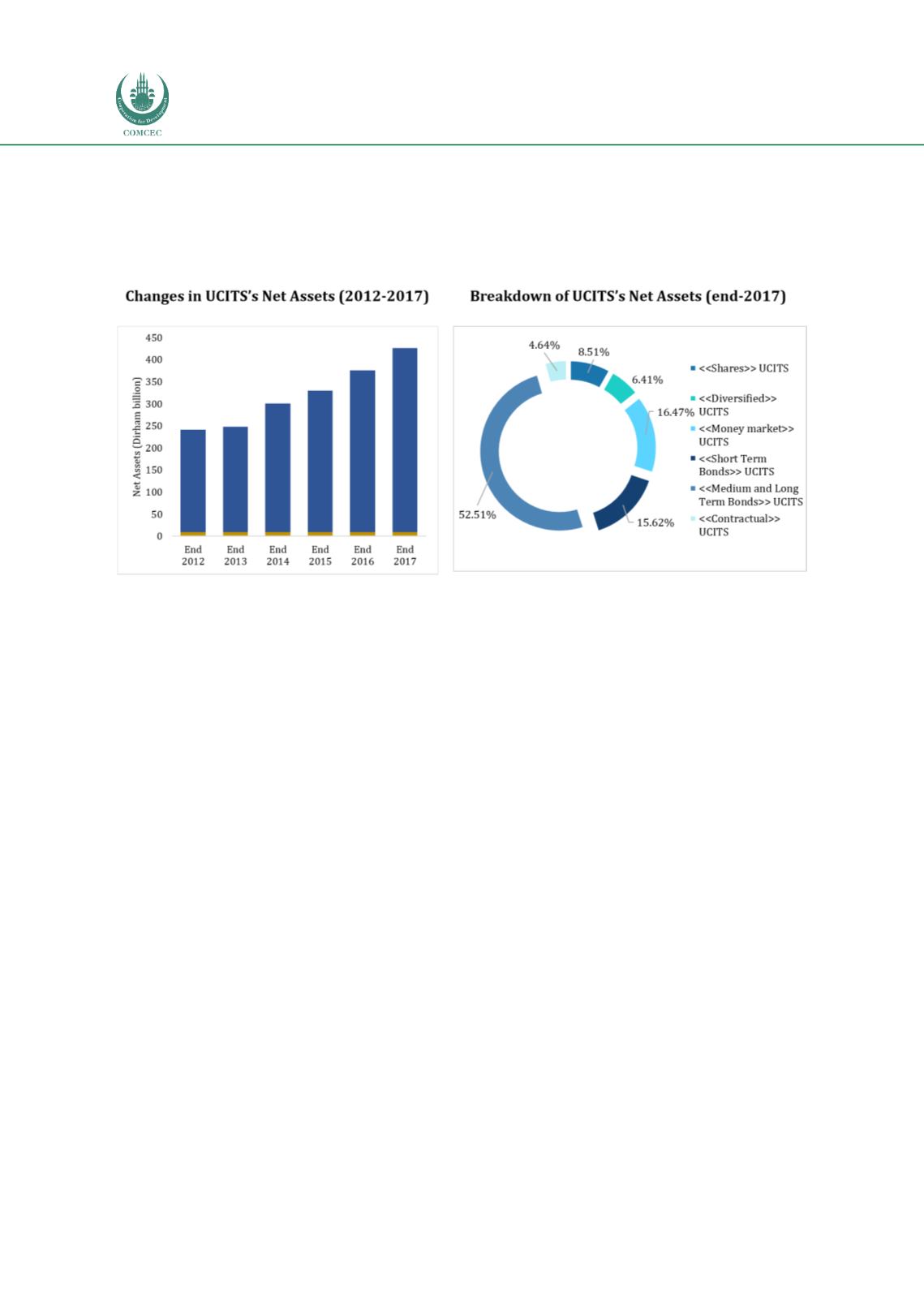

With regard to the fund management industry, UCITS reportedly constituted about 37% of

Morocco’s GDP as at end-2016, with changes in UCITS net assets having progressively

increased through the years (AMMC, 2016, p 37).

Chart 4.18depicts the changes in UCITS net

assets from 2012 to 2017 and the breakdown of UCITS net assets by category as at end-2017.

Chart 4.18: Net Assets of UCITS

Source: AMMC (2016, p. 38-40), AMMC (2017)

The fund management industry is relatively small in Morocco. The number of UCITS increased

from 425 as at end-2016 to 432 as at end-2017 (AMMC, 2017), with about USD43 billion of

AuM. These UCITS are managed by 17 asset managers. Their investments mainly comprise

fixed-income securities (more than 80% of AuM) while the main investors are pension funds

and the insurance sector. The fixed-income market is well developed, with risk diversity and

tenors of up to 30 years. Besides these companies, 3 other asset managers also specialise in

securitisation funds. As at end-2017, the number of securitisation funds stood at 9, about 6.3

billion Moroccan dirhams (about USD630 million) of net assets. In addition, 7 companies have

been licensed as managers of PE funds. Only 4 PE funds have been created; their net assets

came up to 500 million dirhams (about USD50 million) as at end-2017. General economic and

financial statistics on Morocco are provided i

n Figure 4.13 .