Islamic Fund Management

123

completed by Law 68-12 enacted in June 2014―as an international business hub and a leading

financial centre in Africa

(www.casablancafinancecity.com). The development of Islamic

finance complements and expands the range of financial products offered, and increases the

attractiveness and dynamism of Casablanca as a leading financial centre in Africa. Casablanca

ranked 32

nd

in the Global Financial Centre Index 2018―and first among the African financial

centres―ahead of Johannesburg (52

nd

) and Mauritius (56

th

) (GFCI 23, 2018). It featured among

the 15 financial centres likely to become more significant in the near future.

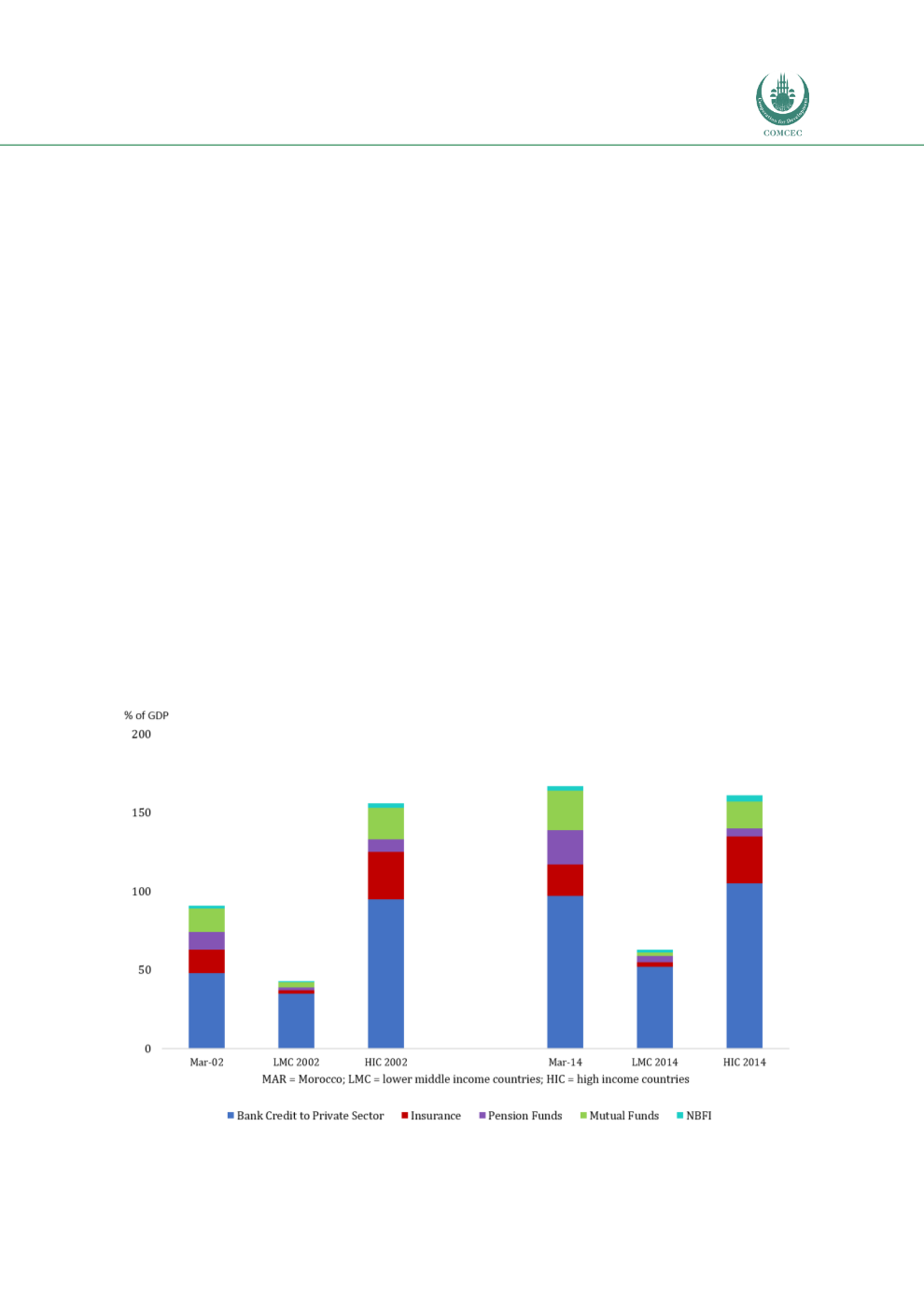

Morocco’s financial system is mostly concentrated on the banking sector while capital market

development is still nascent. Its banking system is among the largest in the region, with total

banking assets accounting for about 140% of GDP (IMF, 2016). This explains the country’s

strategy of venturing into Islamic banking first, before considering the development of other

segments of the Islamic financial sector, such as

takaful

and Islamic capital markets.

The IMF’s Financial Sector Assessment Report on Morocco (2016) notes that its financial

system assets (banking, insurance, pension funds, asset management) have reached levels

comparable to high-income countries, as reflected in

Chart 4.17 .The country’s insurance

sector represents 8% of GDP and is inter-connected with the banking and asset management

sectors. The financial system also comprises microcredit associations and finance companies,

the assets of which account for 10.5% of GDP. Morocco started upgrading its legal and

regulatory framework in 2014, with a new banking law enacted the same year, and

independent regulators created for the capital markets (Autorité Marocaine du Marché des

Capitaux, AMMC) and insurance sector (Autorité de Contrôle des Assurances et de la

Prévoyance Sociale, ACAPS). The regulator for the banking sector is Bank Al-Maghrib while the

Ministry of Economy and Finance oversees financial sector policies and development.

Chart 4.17: Assets of Main Intermediaries in Morocco’s Financial System

Source: IMF (2016)