Islamic Fund Management

105

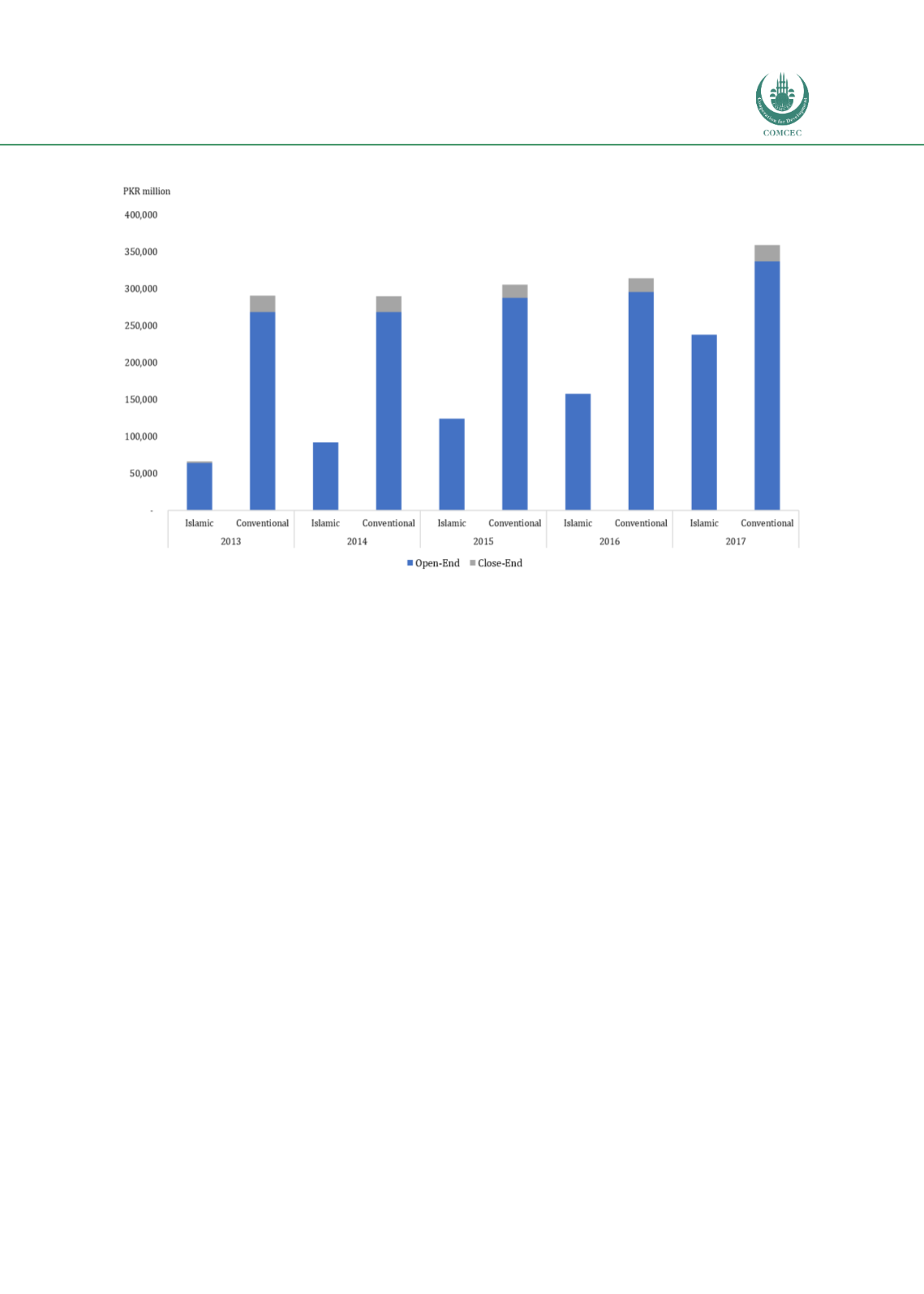

Chart 4.13: Total AuM of Mutual Funds – Open-End and Close-End (2013-2017)

Source: MUFAP (2017)

Note that the figures exclude the total assets of pension funds.

Islamic Pension Funds/Voluntary Pension Schemes

As mentioned earlier, pension funds under the Voluntary Pension Scheme (VPS) represent

another category of funds within Pakistan’s asset management industry. VPS is a personalised,

defined, savings-cum-investment vehicle that generates a stable source of income for

employees after retirement. The VPS had been established under the Voluntary Pension

System Rules 2005, under which employed and self-employed individuals can voluntarily

contribute to a pension fund (either Islamic or conventional) during their working life. The

structure of VPS, which comprises four main components (i.e. Approved Fund Manager,

Approved Pension Fund, Trustee, and Participant/Investor), are depicted in

Figure 4.10 .There are stringent licensing requirements for pension fund managers under the SECP’s

regulation; the fees are lower than those of normal mutual funds. An individual can diversify

his or her savings (contributions) among more than one fund manager and can transfer the

account to other fund managers.