165

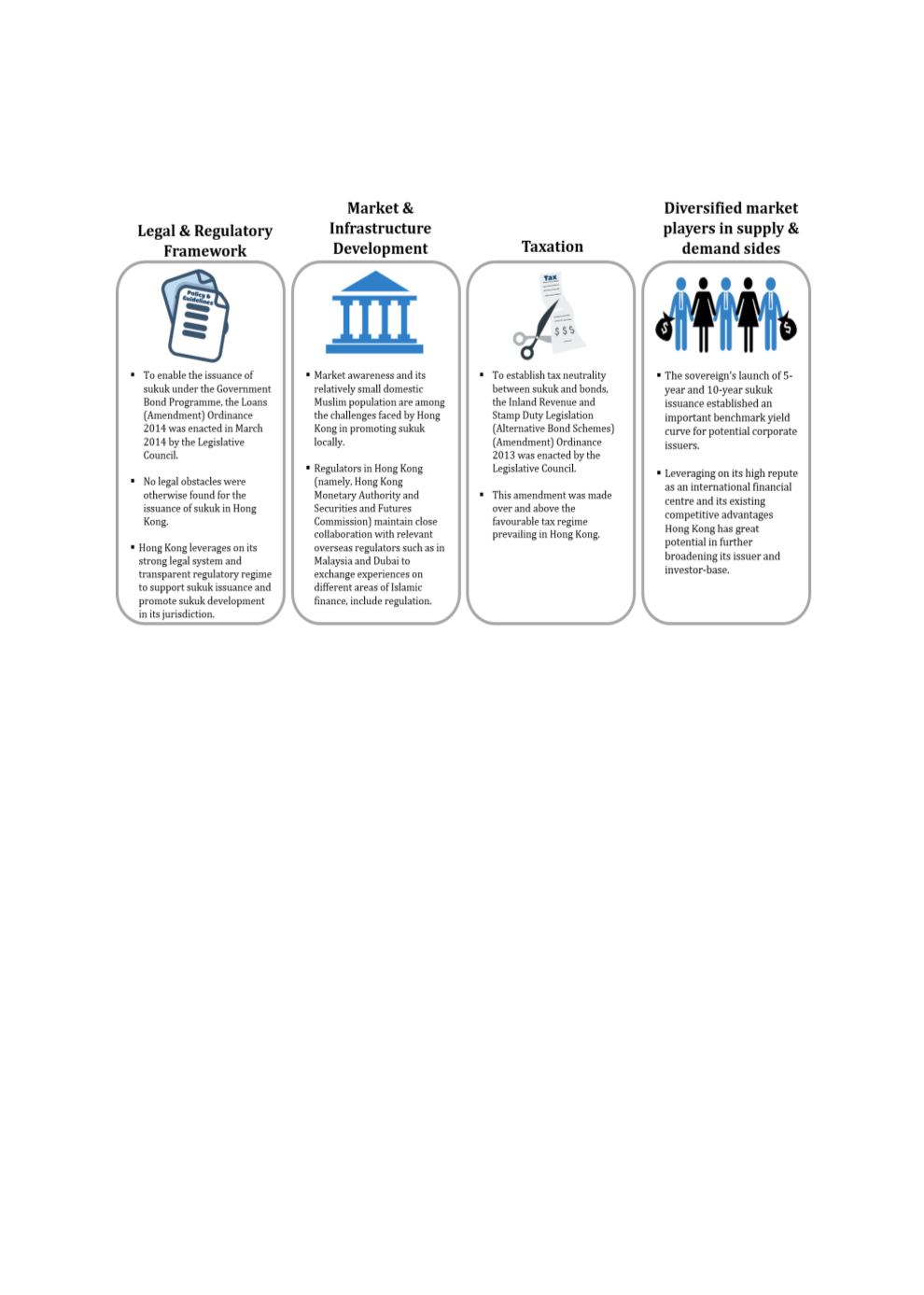

Figure 4.19: Key Factors Underpinning the Growth of Hong Kong’s Sukuk Market

Sources: RAM, ISRA

Still, Hong Kong is relatively a newcomer in the sukuk market. Its interest in developing a

sukuk market only started from 2007. Since then, it has taken the necessary steps to facilitate

sukuk issuance. Figure 4.20 briefly delineates the phases of Islamic finance’s inclusion in Hong

Kong’s financial landscape. Undoubtedly, Hong Kong still has a long way to go in enhancing its

integration in the Islamic finance arena. In the future, it should look at developing a more

facilitative environment in the form of tax incentives to attract foreign issuers to utilise its

sukuk platform, further improve its Shariah governance, achieve greater diversity in its issuer

and investor bases, and examine the possibility of issuing more innovative sukuk, e.g. green

and SRI sukuk.