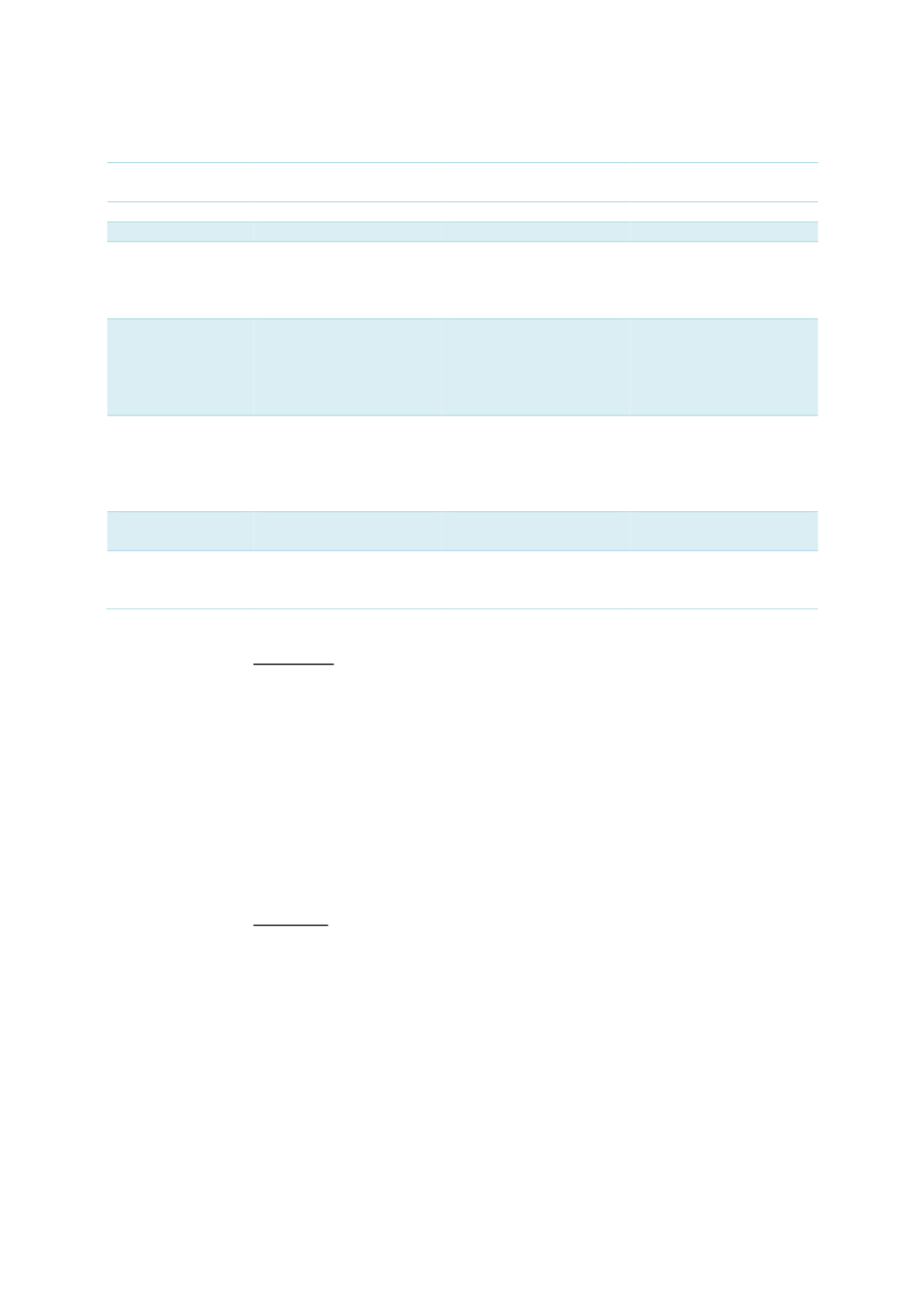

163

SPV issuer

Hong

Kong

Sukuk

2014 Limited

Hong

Kong

Sukuk

2015 Limited

Hong Kong Sukuk 2017 Limited

Amount

USD1 billion

USD1 billion

USD1 billion

Profit rate

2.005%

1.894%

3.132%

Order book

Oversubscribed

4.7

times

with

USD4.7

billion

of

orders

received.

Oversubscribed 2 times

with USD2 billion of

orders received.

Oversubscribed

1.72

times with USD1.72

billion

of

orders

received

Listing

Hong Kong Stock

Exchange

Bursa Malaysia

Nasdaq Dubai/DFM

Hong Kong Stock

Exchange

Bursa Malaysia

Nasdaq Dubai/DFM

Hong Kong Stock

Exchange

Bursa Malaysia (Exempt

Regime)

Nasdaq Dubai

Arrangers

CIMB Islamic HSBC National Bank of Abu Dhabi Standard Chartered CIMB Islamic HSBC National Bank of Abu Dhabi Standard Chartered CIMB Islamic HSBC National Bank of Abu Dhabi Standard CharteredAdvisors

Allen & Overy

Norton Rose Fulbright

Linklaters

n/a

Geographical

distribution of

investors

Middle East (36%), Asia

(47%), Europe (6%), US

(11%),

Middle East (42%), Asia

(43%), Europe (15%)

Middle East (25%), Asia

(57%), Europe (18%)

Sources: Sukuk prospectuses for 2014, 2015 and 2017 sovereign issuances,

sukuk.comAnalysis of Sukuk Structures

As of 2017, Hong Kong had issued 3 sukuk with an issuance size of USD 1 billion each. The

structure of the first sukuk is based on the concept of

ijarah,

which requires underlying

tangible assets of at least 100% of the issuance amount. This had been a problem for Hong

Kong as the funding cost was too high. It had consequently changed the structure of the second

and third sukuk to

wakalah,

which uses less tangible assets, resulting in a lower funding cost,

with a third of the assets underpinned by selected units in an office building in Hong Kong; the

other two-thirds were underpinned by Shariah-compliant commodities. According to the

Financial Secretary, the government hoped that by adopting a more “asset light” structure in

the form of the

wakalah

structure, it could set a benchmark for potential issuers in the private

sector (South China Morning Post, 2015).

Analysis of Sukuk Issuances – Supply (Sell Side)

The inaugural sukuk, which was issued on 11 September 2014, had a 5-year tenure and

received USD4.7 billion of orders from 120 global institutional investors. Of these, 36% were

from the Middle East, 47% from Asia, 6% from Europe and 11% from the US. According to

investor type, 56% comprised banks and private banks, 30% wealth funds, central banks and

supranationals, 11% fund managers and 3% insurance companies. The sukuk was listed in

Hong Kong, Malaysia and Dubai. The profit rate came up to 2.005%, with an AAA rating by S&P.

An SPV had been established for this particular sukuk, i.e. Hong Kong Sukuk 2014 Limited. The

sukuk adopted an

ijarah

structure, underpinned by selected units in 2 commercial properties

in Hong Kong.