157

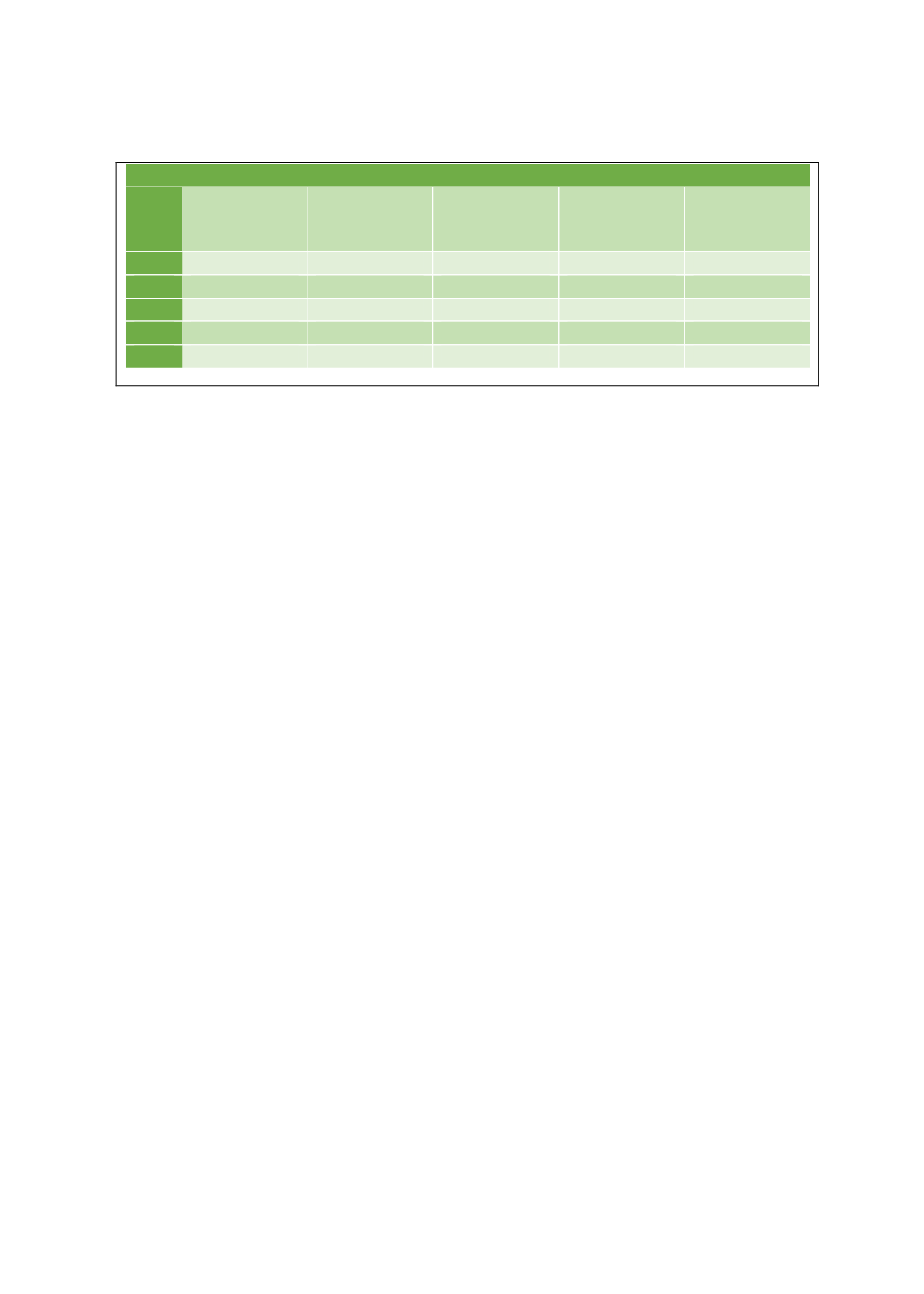

Industry Sector Sub-Indices

Rank

Banking

Investment

Management

Insurance

Professional

Services

Government

and Regulatory

1

London

London

Shanghai

London

London

2

New York

New York

Hong Kong

New York

New York

3

Hong Kong

Hong Kong

New York

Hong Kong

Singapore

4

Singapore

Singapore

London

Singapore

Hong Kong

5

Shanghai

Shanghai

Singapore

Shanghai

Beijing

Source: The Global Financial Centres Index 22 (2017: 30)

For more than a century, Hong Kong has served as a gateway for Mainland China. As a

forerunner in international finance, Hong Kong can bank on its sophisticated financial

infrastructure to provide investors with exposure to China’s different market segments and

access to its expanding wealth. For instance, investors that wish to access China's property

market can make use of the REITs listed in Hong Kong, with underlying exposures to

properties in Mainland China. In turn, it serves as the wealth-management centre for the

increasingly affluent residents of Mainland China and Asia. Hong Kong ranked third in

investment management, after London and New York, in the 2017 Global Financial Centre

Index.

Hong Kong’s international bond market is characterised by vibrant activities and global

issuers. It offers open access to both domestic and international issuers and investors, in

domestic and foreign currencies. Offshore RMB bond issuance (also known as dim sum bonds)

is becoming increasingly more significant, which renders Hong Kong one of the most

frequented international bond markets in Asia (Financial CBonds Information). Besides, Hong

Kong is the first venue outside China to have developed an RMB bond market, attracting

issuers such as the government, enterprises and financial institutions from Hong Kong,

Mainland China and different parts of the world. Relative to GDP, as shown in Box 4.17, Hong

Kong’s bond market ranked seventh among the Asian bond markets as at end-2016, after

Japan, South Korea, Malaysia, Singapore and Thailand. Chart 4.53 shows the increasing bond

issues in Hong Kong by the government, quasi-government entities and corporates, from

USD43.8 million in 2006 to USD414.7 million in 2016.