150

Box 4.14: Turkey’s Pension System

The private pension system is regulated and supervised by

the Undersecretariat of Treasury and CMB. The Turkish

private pension system law was first approved in 2001 and

started functioning in 2003. In August 2016, the Turkish

Parliament approved an amendment to the law governing

individual pension savings and the investment system.

Based on the amended law, the pension system will

incorporate an integrated automatic enrolment practice,

commencing January 2017. Participating employees have the

right to withdraw from the pension plan within 2 months

from the date when the employer notifies the employee of its

involvement in the pension plan. If the employee withdraws

from the pension plan, contributions will be returned to

them within 10 days, together with investment income, if

any. To encourage the working population, the employee will

receive a state subsidy in their pension accounts, at a rate of

25% of their paid contributions. Additional incentives have

been provided to Turkish working individuals to remain in

the system.

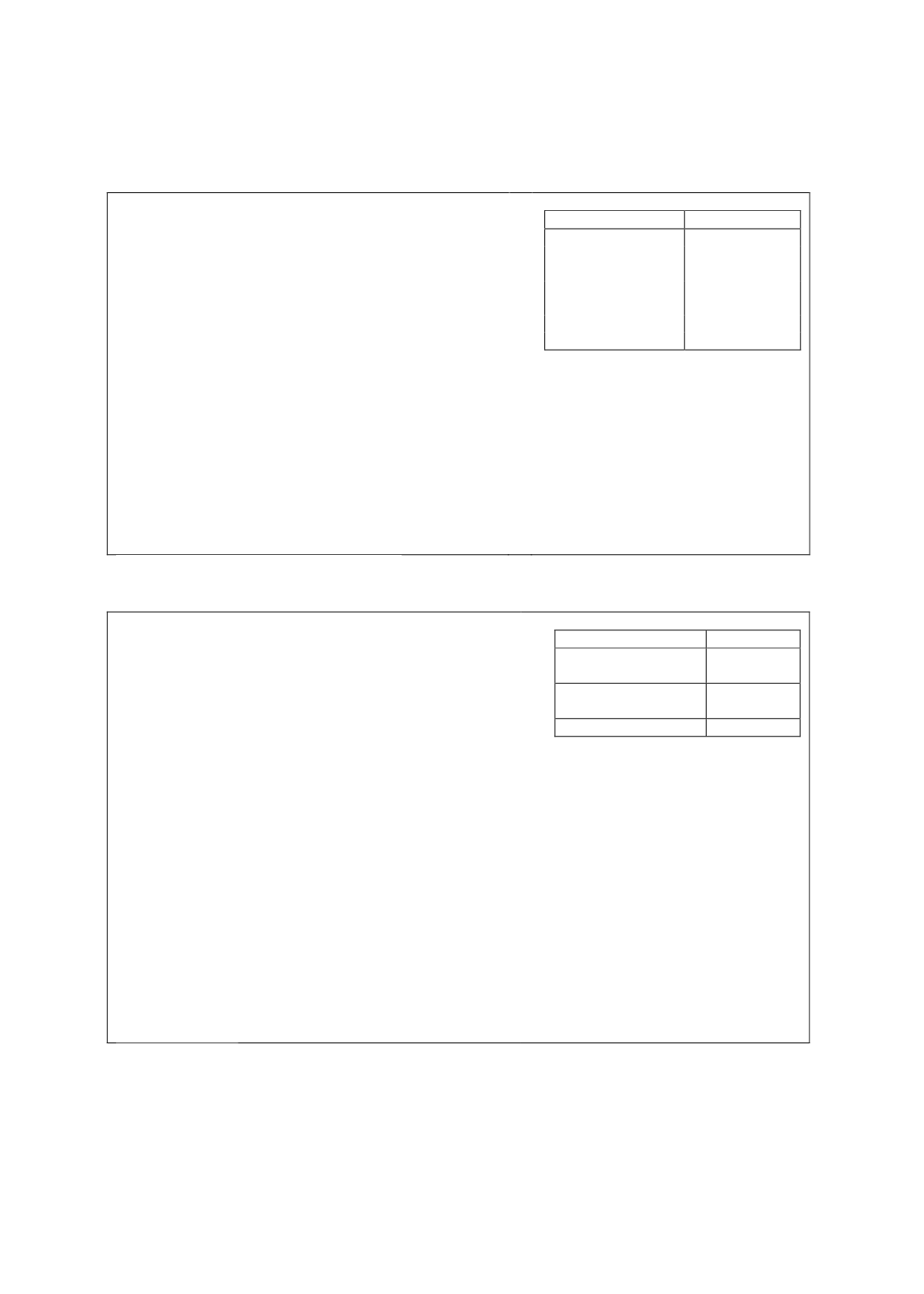

Fact sheet

End-2016

Participants

6,627,025

Pension Mutual

Funds (TL)

53,409,391,715

State Contribution

Funds (TL)

7,438,179,620

Intermediaries

39,680

Pension companies

18

Notably, 7.8 million contracts were in

force as at end-2016. The number of

participants had grown to around 10%

and exceeded 6.6 million

when

compared annually. Within the same

period, the total net asset value of the

funds surged 24% to TL53.4 billion.

Source:

Pension Monitoring Centre (2017, July)

Box 4.15: Turkey’s Investment Funds

Investment funds are the pool of asset which is established by

portfolio management companies under the fund rules in

conformity with the fiduciary ownership principles on the

account of the savers, with money or other assets gathered

from savers pursuant to the provisions of the CMB Law in

return for fund units in order to operate the portfolio or

portfolios consisting of assets and transactions specified by

CMB Communique.

Umbrella fund is the investment fund covering all funds the

units of which are issued under a single fund rules. Investment

funds are required to be founded in the form of an umbrella

fund. Umbrella funds may be founded in ten types which are

listed in Communique. According to portfolio sizes of

investment funds looking at the distribution of fund types,

“Debt Instruments Investment Funds” and “Money Market

Funds” constitute 82% of investment funds total portfolio size

at end-2016. Debt Instruments Funds are which at least 80%

of the fund net asset value is permanently invested in public

and/or private sector debt instruments. Money Market Funds

wholly and permanently invest in highly liquid money and

capital market instruments with maximum 184 days to the end

of maturity, and the daily calculated weighted average

maturity of portfolio of which is maximum 45 days.

Fact sheet

End-2016

Investment Funds

(TL billion)

43,755,33

Investment Funds

(Number)

433

Investors

3,089,530

The total net asset value of the funds

had grown to 12% to TL 43,75 billion

when compared annually.

Source: CMB (2016)

Due to the small base of domestic institutional investors (insurance companies, pension funds,

investment funds and other collective investment schemes), the funding of domestic

government debt has largely been sourced from corporates, financial institutions and foreign