145

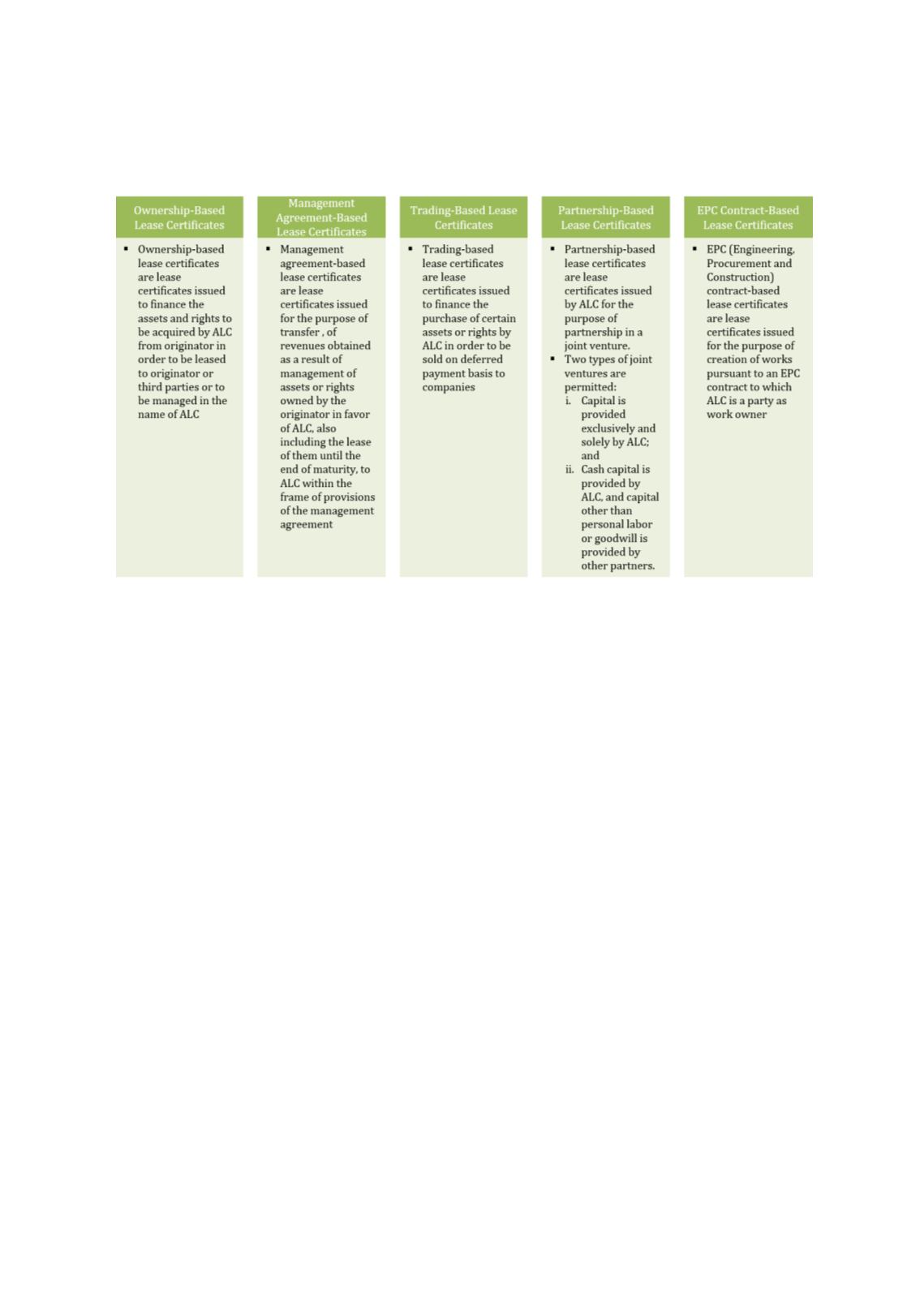

Figure 4.15: Types of Lease Certificates Approved by the Communiqué

Source: Communiqué on lease certificates, CMB

Note: Issuance under ownership-based lease certificates and partnership-based lease certificates require 90% of

the fair value of the assets and rights to determine the issuance limit.

Based on historical lease certificate issuances, ALCs were established by banks and financial

intermediaries. Some of the lease certificates issued by the ALCs are originated by corporates

that use the ALCs as a funding conduit. This has raised solvency questions from investors

where one ALC has several lease certificate issuances that have multiple originators. According

to the Communiqué, ALCs are allowed to purchase assets from different source companies. A

mandatory pre-emption right in favour of the source company is created in the land registry

when the assets are transferred to the ALCs. To protect the interest of investors, a provision in

the articles of association of the ALCs states if a commitment to the lease certificate holders is

not fulfilled, then the assets behind the lease certificates shall be sold and the sale proceeds

shall be distributed to lease certificate holders on a pro-rata basis according to their

investments. There are other governing restrictions imposed on the operations and activities

of the ALCs. Table 4.23 lists the number of lease certificates issued by corporates from 2010 to

August 2017.