131

Source: MOF

Analysis of Sukuk Investments – Demand (Buy Side)

Historical data shows strong interest from foreign investors since Indonesian government

yields are the highest among its peers in emerging East Asia (Asian Development Bank, 2017).

Banking institutions are also the main investors in government bonds while pension funds,

mutual funds and insurance companies are the principal investors in corporate bonds. The

high percentage of foreign participants is primarily due to the relative openness of Indonesia’s

capital markets to non-resident portfolio investments, although there are notable restrictions

and regulations on foreign investments in bonds and FCY transactions. Although foreign

investors’ participation in the local bond market is subject to regulatory approval, such

restrictions are not applicable to Indonesian government bonds.

As at end-March 2017, foreign investors’ share of LCY government bonds stood at 38.2%.

Locally, banking institutions were the largest investor group, accounting for 26.2% of the total

stock of LCY central government bonds as at the same date. However, banks’ market share had,

in fact, declined due to an increasing trend in holdings by pension funds, mutual funds and

insurance companies (refer to Chart 4.42).

The OJK has announced a slew of policy changes to allow greater investment opportunities for

domestic mutual funds. These will review the percentage ruling on overseas investment and

type of investment products. In August 2017, the OJK amended its rules governing investments

by NBFIs; the options for required investment products were expanded to include debt

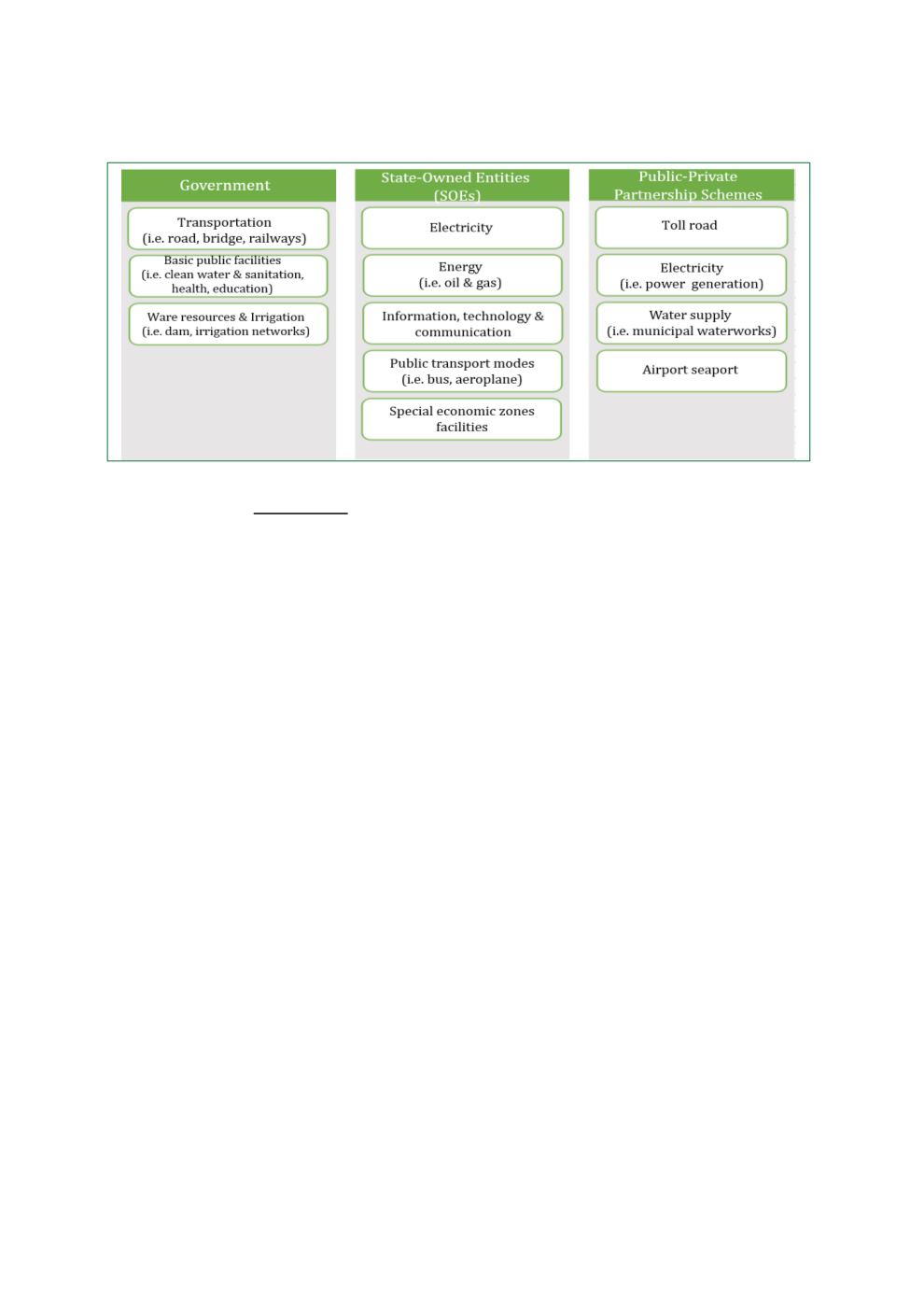

instruments issued by SOEs (Reuters, 2017). This is aimed at encouraging SOEs to issue sukuk

to fund public infrastructure projects.