130

XL Axiata’s Ijarah Sukuk

Programme

(the largest corporate

ijarah

sukuk programme)

Subordinated

Mudarabah Sukuk

Bank BRI Syariah

Garuda Indonesia

Global Sukuk Limited

Wakalah Programme

Securities Trading

Limited (

SGX-ST

)

Geographical

distribution of

investors

More than 95% of the sukuk

had been offered to investors

domiciled in Indonesia,

comprising banks, pension

funds, insurance companies,

institutional investors,

securities houses and retail

investors

Indonesia (100%).

By investor type:

Insurance and pension

funds: 65%

Asset managers: 17%

Individuals: 15%

Banks: 3%

Middle East (56%),

followed by Asia

(32%), Europe (12%)

Sources: Islamic Finance News, Thomson Reuters,

sukuk.comIndonesia offers tremendous potential in building a healthy pipeline of corporates that issue

project-financed sukuk. Based on the government’s current budget requirements, a large

chunk of funding (via project-based sukuk) is already focused on infrastructure development.

In view of privatization benefits via public-private partnership schemes, the government and

the regulators are identifying potential SOEs and creditworthy corporates that can take the

lead in financing government infrastructure projects through sukuk issuance. The

government’s ambitious infrastructure plans are considered the biggest enabler in creating a

pathway for Indonesia’s Islamic finance since sukuk issuance serves as a natural hedge in

financing development projects (via project-based sukuk). Box 4.10 highlights the National

Medium-Term Development Plan (2015– 2019) for infrastructure development.

Box 4.10: Indonesia’s National Medium-Term Development Plan (2015-5019)

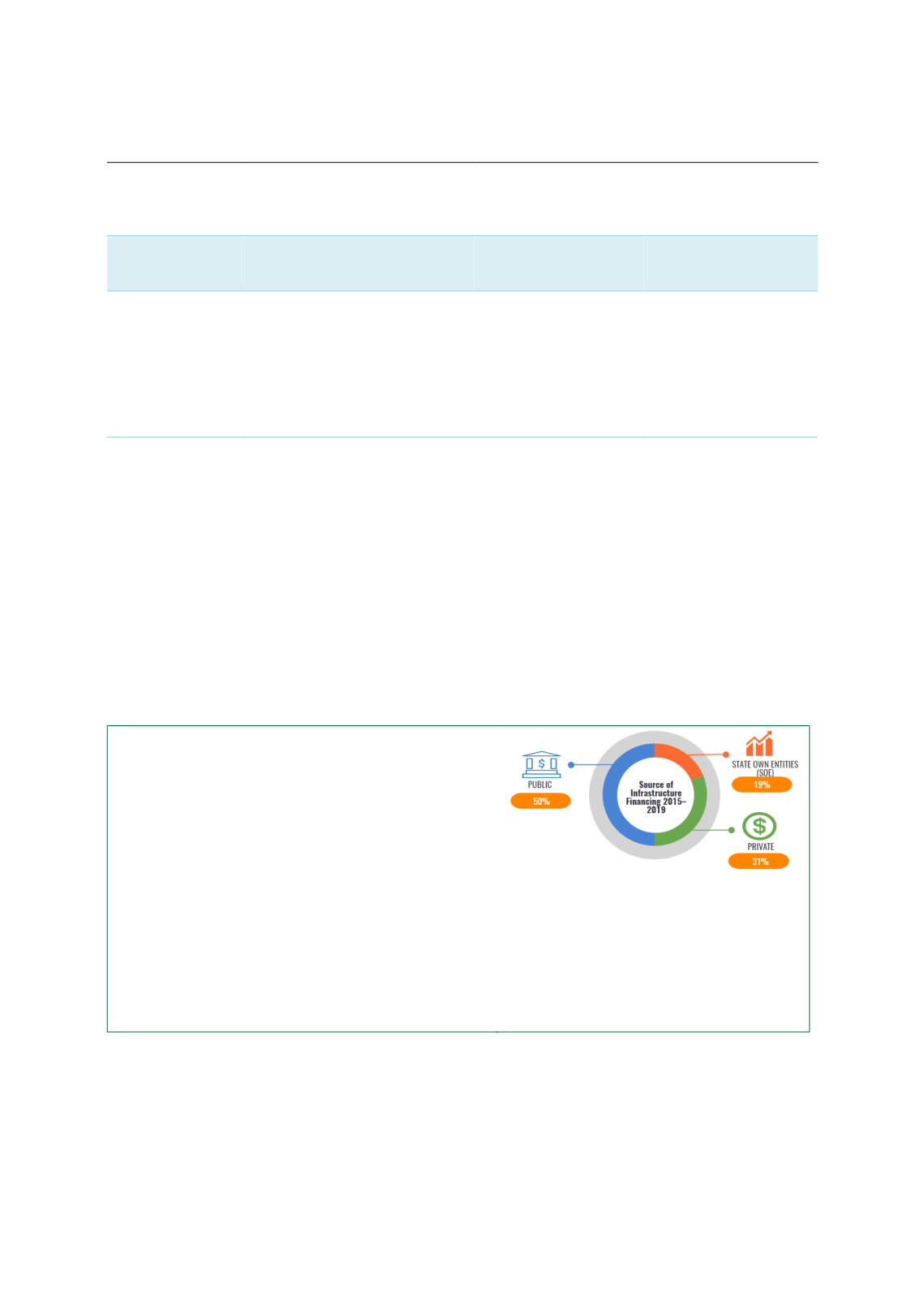

Under the National Medium-Term Development Plan

(2015– 2019), the infrastructure spending plan by

the Indonesian central government summed up to

IDR2,216 trillion (USD187.0 billion) over a 5-year

period or 2.9% of nominal GDP on an annual basis.

The government has set the overall investment target

at IDR5,519 trillion (USD465.7 billion) for the same

period, or 7.2% of annual GDP. State funding will

contribute 50% of the total investment, including

IDR545.0 trillion (USD46.0 billion) of sub-national

government funding, with 19% coming from SOEs

and 31% from the private sector.

The role of government, SOEs and private sectors in

developing infrastructure financing is summarized in

the following table: