Increasing Broadband Internet Penetration

In the OIC Member Countries

146

of the joint venture. This would give Tele2 a fully diluted economic interest of 31%, taking into

account Asianet’s 18% earn out.

103

The transaction combined Altel 4G presence with Tele2

marketing expertise.

The exit of TeliaSonera and the consolidation of Tele2 and Altel have resulted in an increase in

the HHI concentration index in mobile broadband (see table 84).

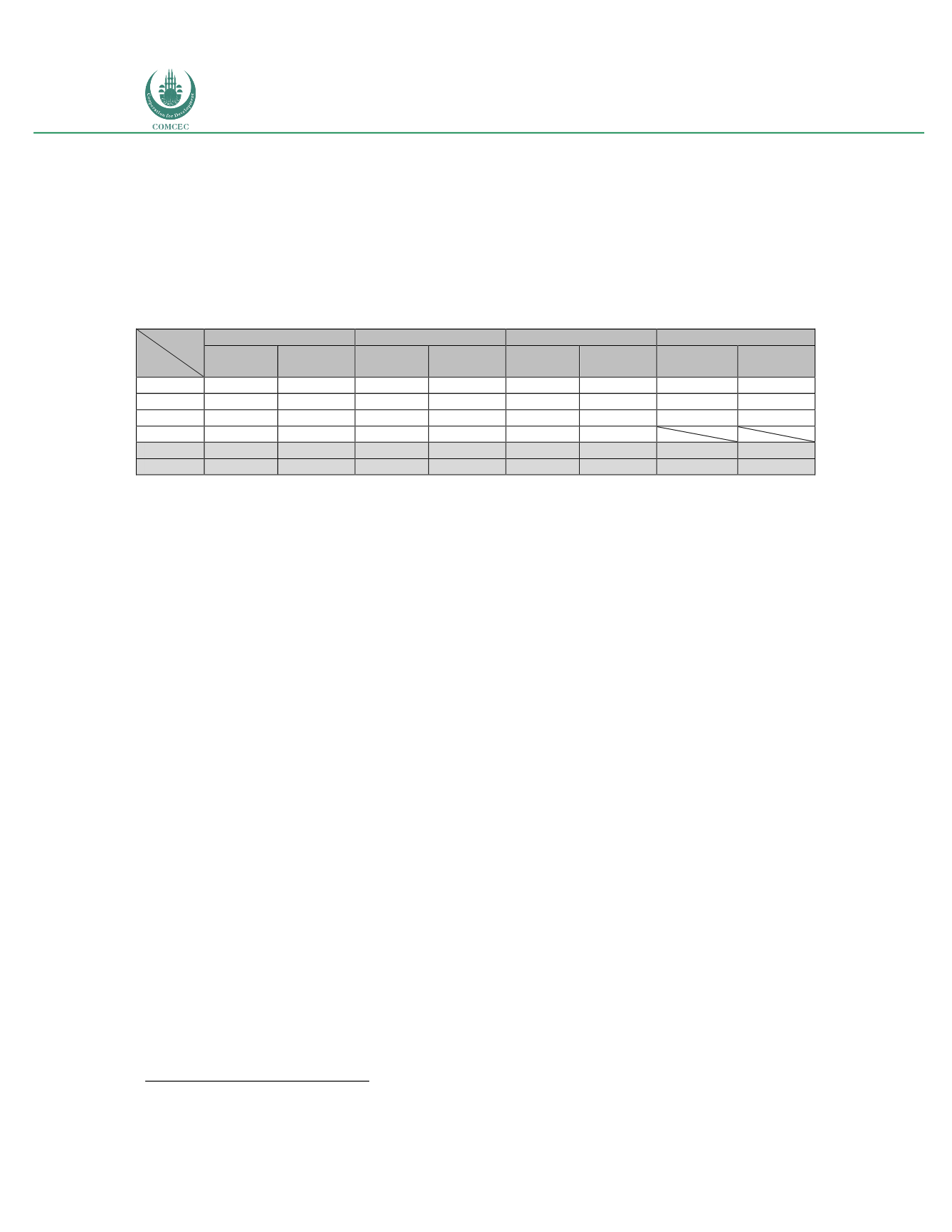

Table 84: Mobile broadband market shares (by subscribers) (2011-2016)

2011

2012

2015

2016

Lines

Share

(%)

Lines

Share

(%)

Lines

Share

(%)

Lines

Share

(%)

Altel

971,100

15.60 667,000

9.70 1,035,000

11.00 2,874,000

23.00

Beeline 3,808,000

61.17 3,031,000

44.08 3,763,000

40.00 4,998,000

40.00

K-Cell

1,289,000

20.71 2,525,000

36.73 3,575,000

38.00 4,623,000

37.00

Tele2

349,000

5.61 652,000

9.49 1,129,000

12.00

TOTAL 6,225,000

100 6,875,600

100 9,406,900

100 12,495,374

100

HHI

4,446

3,476

3,309

3,498

Source: Kazaktelecom Annual reports; GSMA Intelligence; International Telecommunications Union; Telecom Advisory

Services analysis

Between 2011 and 2015, the HHI industry concentration index was gradually declining as a

result of increasing competition primarily between Beeline and K-Cell. The pressure resulting

from price declines and the economies of scale advantage of Beeline and K-Cell on Altel and

Tele2 was a stimulus towards consolidation. The consolidation between the two smaller

players has resulted in an increase in the Herfindahl-Hirschman Index from 3,309 to 3,498.

However, this value is still within the range of acceptable competition. Some analysts predict

that the resulting industry concentration will reestablish some price discipline and that prices

will start increasing, and that unlimited plans are going to be phased out.

State of competition in the broadband market

As a result of the consolidations in mobile broadband and diversifications into fixed

broadband, the Kazakh market is composed of two convergent players (Kazakhtelecom and

Vimpelcom), one pure play wireless (K-cell), and several fixed broadband carriers focusing

primarily on the business market.

Given the saturation reached in the wireless market (penetration rates of approximately

158%) and the high adoption in broadband, the market has plateaued. Additionally, intense

price competition, coupled with mobile number portability has had an impact on carrier

profitability. In consequence, it is highly unlikely that new entrants will venture into the

Kazakh market in the near term.

Technologies and trends in the broadband market

The fixed technological infrastructure utilized for delivering broadband services in Kazakhstan

consists of a mix of ADSL, FTTB (Fiber to the Building), FTTH (Fiber to the Home), and fixed

103

Telegeography. Tele2 and Altel to combine Kazakh operations. 4 Nov 2015