Risk Management in Transport PPP Projects

In the Islamic Countries

215

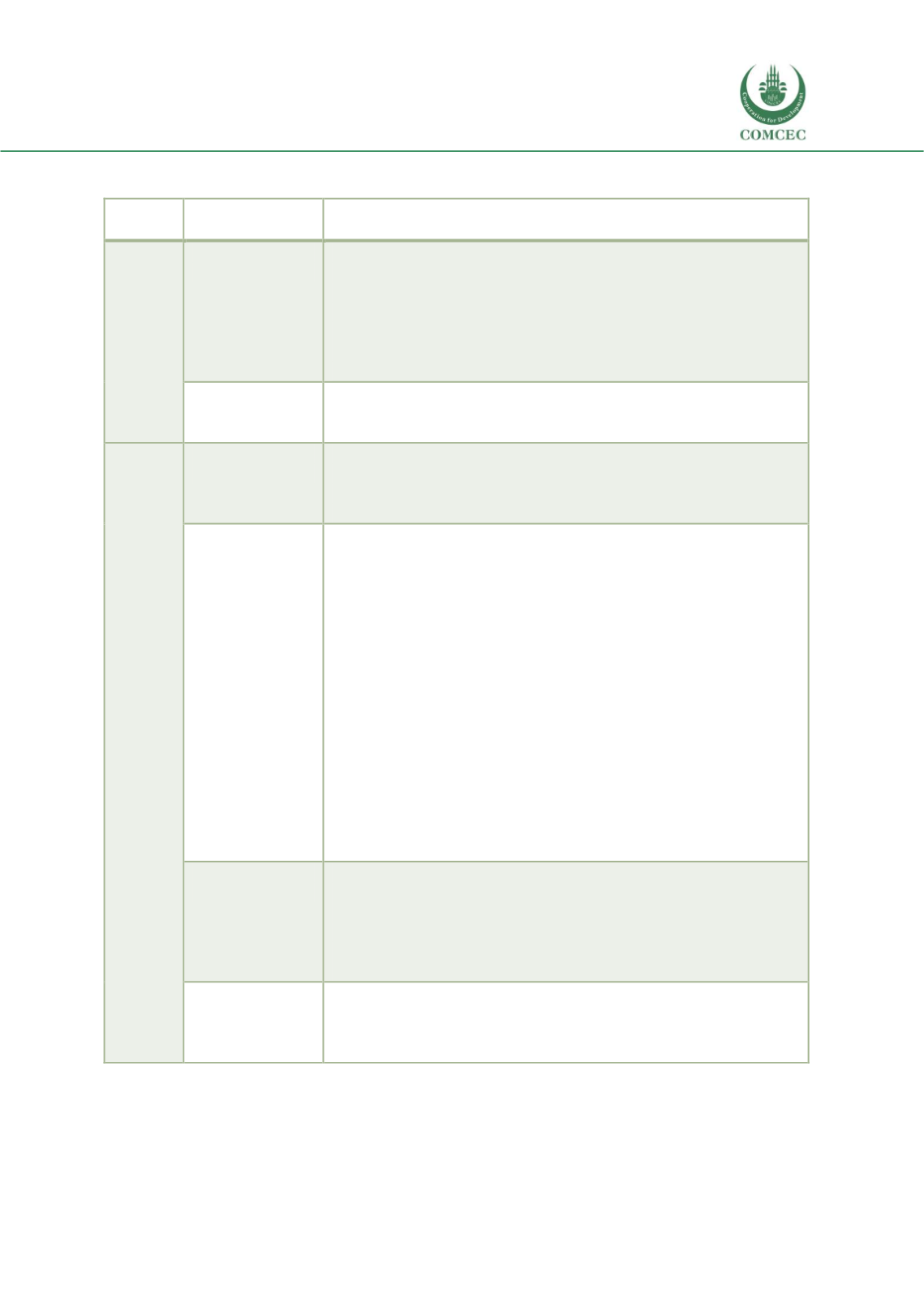

Table 38: Indicative risk matrix in transport PPPs in Malaysia (by risk category)

Risk

type

Risk category

Usual allocation of risks (public/private/shared)

Context-

related

risks

Political and legal

risks

In general terms, the

public party

is responsible for political and legislative

risks arising from unilateral measures taken by the government or public

institutions resulting in negative or adverse effects on the normal

implementation and management of the PPP contract and/or the

competitiveness of the project. Only the sovereign risks are borne by the

private party and often mitigated by Multilateral Investment Guarantee

Agency.

Macroeconomic

risks

Macroeconomic risks are

primarily borne by the private party

. The

public sector

retains the risks associated with the management of the

liabilities and fiscal risks possibly applicable to the PPP contract.

Project

risks

Financial credit

risks

Financial credit risks are generally retained by the

private sector

, who is

also responsible for defining the project financing structure. To some

extent, the project company shares the financial risks with the financial

institutions.

Design,

construction and

operation risks

Risks in the delay of projects approval and acquisition of permits is

generally

shared

by the parties even if it is caused by governments long

lasting procedures and bureaucracy. The design risk is also typically

shared

. The SVP is not liable for deficiencies in the project design after the

approval of technical committee, the ministry of transport and the Cabinet.

However, the private party is typically not compensated for the bad

consequences of weak design on the project performance.

For risks correlated to contract changes, such as “excessive contract

variation” and “late design change” the risk cost will be paid by the party

that proposes changes as sometimes parties share the cost of such

variations.

The

private party

is responsible for the risks associated with the

engineering and construction defects. The private party is also responsible

for the management and operation of the infrastructure. The SPV may

transfer obligation of construction and maintenance phase to contractors

which, in this case, become responsible to mitigate risks during the project

life-cycle, until handover back to government.

Financial

sustainability risks

The

private sector

is responsible for economic and financial risks,

business, commercial as well as management and performance risks,

including demand risks, except from those contracts where subsidies are

foreseen. Demand risk allocation is strictly correlated to the PPP model

adopted. While in the case of BOT and BOOT it is borne by the private sector,

in BLMT and BOO the public body takes this risk (Ahmad et al., 2017).

Other risks (force

majeure and early

termination)

Force majeure and early termination risks are

shared

and the effects of

force majeure events should be mitigated on fair terms by both parties.

Cases of force majeure and early termination are to be specified in the PPP

contracts.

Source: Authors.