Risk Management in Transport PPP Projects

In the Islamic Countries

5

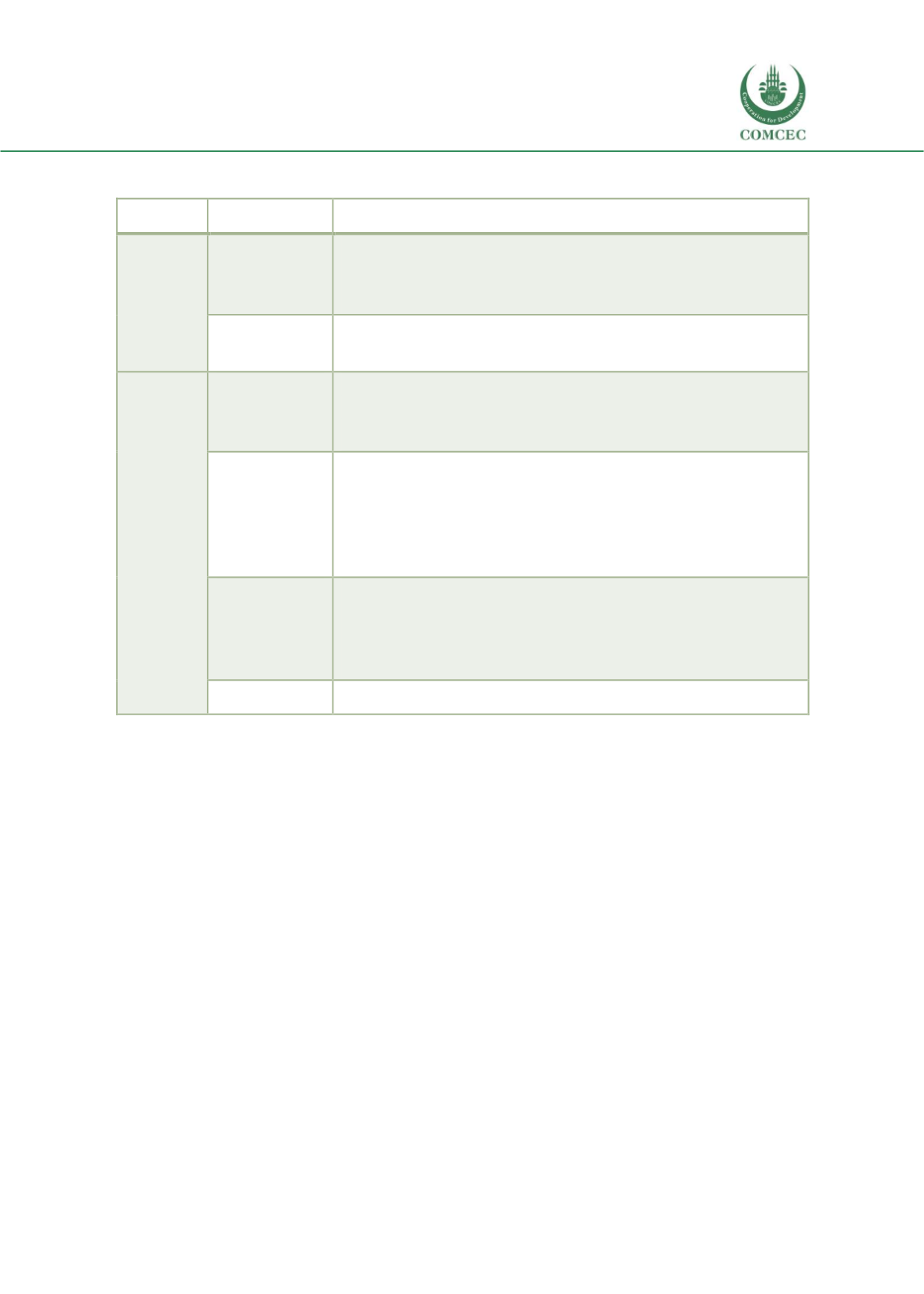

Table 1: Typology of risks affecting transport PPPs

Risk type

Risk category

Risks

Context-

related

risks

Political and

legal risks

Different investment preferences of alternating governments,

expansionary policies raising the cost of financing, risk of expropriation,

changes in law, corruption risk, fiscal risk

Macroeconomic

risks

Liquidity risk, exchange and interest rate risk, currency inflation

Project

risks

Financial credit

risks

Cost of financing, credit risk of the Special Purpose Vehicle (SPV), credit

risk of the construction and operating company, credit risk of the financial

institution, sovereign risk, transaction costs

Design,

construction and

operation risks

Site risks (availability of the site, permits, ground conditions),

construction costs, contractor failure risk, delays at various stages,

maintenance risk, environmental risk, technology risk, disruptive

technology risk, public acceptance, security risk, subcontractor

disputes/insolvency, renegotiation risk, residual value risk

Financial

sustainability

risks

Revenue risks (demand/usage risk - in user-pays and volume payment

mechanisms, price or tariff risk - in user-pays mechanisms, availability

and quality risks, third party revenue risks, etc.) and demand risks (traffic

volume, toll fee level, toll fee acceptability)

Other risks

Force majeure and early termination risks

Source: Authors.

The different risks can be relevant at different investment phases and have different potential

impacts on the performance of transport PPPs, as will be seen through the presentation of each

phase. Risks may also mutually reinforce each other. Crucially, anyway, while every risk may

require a tailored approach and management, no one can be managed outside of an integrated

risk governance framework, which commands a holistic approach as the one adopted for the

study.

Risk management practices in OIC Member Countries

The factual analysis of the practices based on literature and/or the level of information collected

from the interviews with the representatives of the institutions involved in the development and

implementation of PPPs does not allow to comment on all different types of risks and sub-risks

by country and with reference to specific projects. This is partially due to:

The

limited availability of consistent information for all countries and projects

(including the fact that contractual documentation is generally not of public domain and

that risk matrices and guidelines on risk management are not available by specific country

and project);