Risk Management in Transport PPP Projects

In the Islamic Countries

141

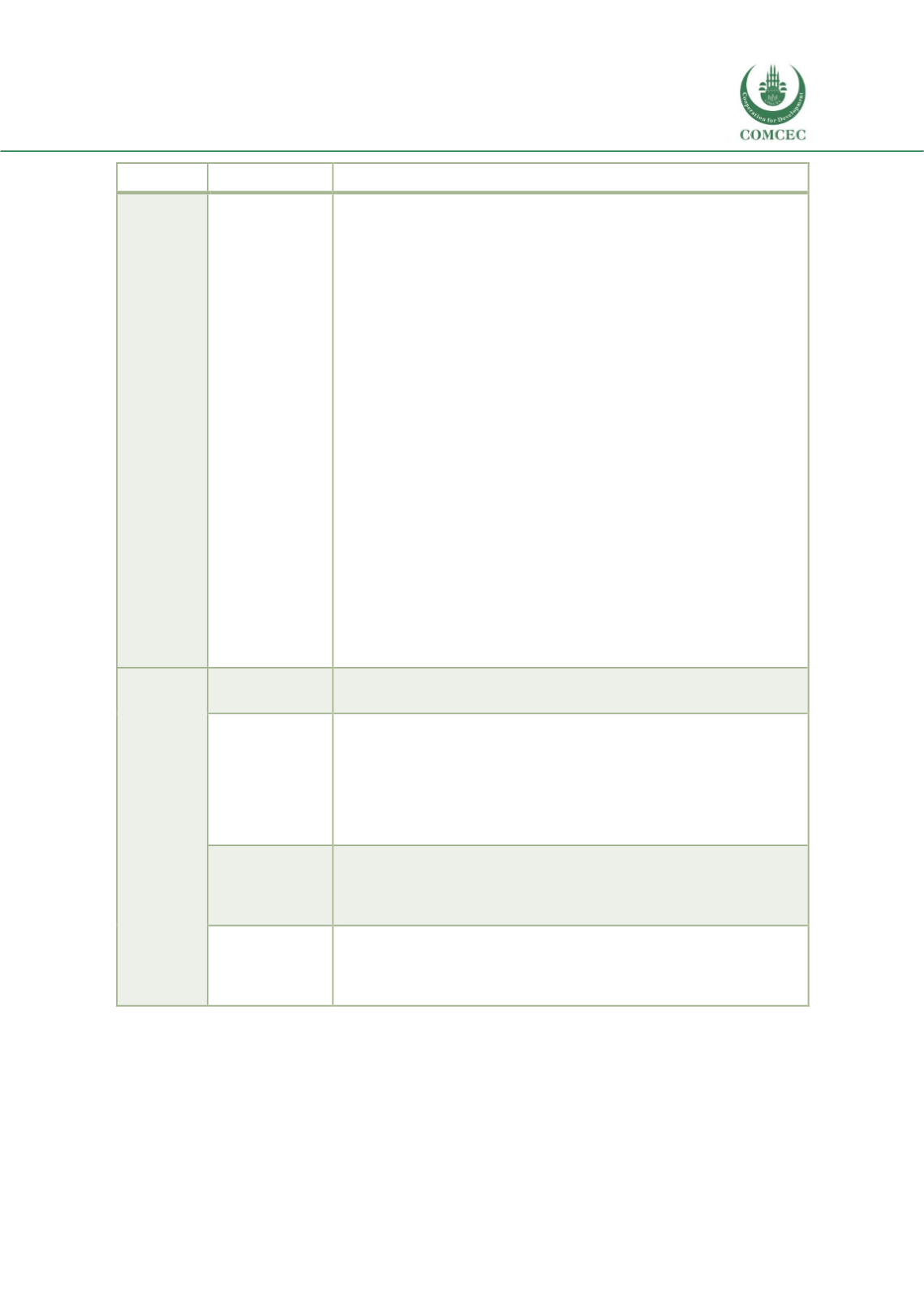

Risk type

Risk category

Usual allocation of risks (public/private/shared)

Macroeconomic

risks

Macroeconomic risks are

primarily borne by the private party

.

Inflation related risks impact on the concession financial performance of

the projects and are particularly impacting on the private sector, both at

the construction stage and operation stage. Inflation risk is particularly

relevant for those contracts regulated according to the Mozambican

Metical. It shall however be noticed that the public sector retains the

risks associated with the management of the liabilities and fiscal risks

possibly applicable to the PPP contract. In this regard the definition of

PPP included in the Mozambican Public-Private Partnership law is worth

recalling, according to which PPPs are conceived as undertakings in a

public domain (excluding mineral and petroleum resources) or a public

service area, in which, by contract and under financing, in whole or

partly by the private partner, the latter undertakes to make the

necessary investment and to exploit its activity for the efficient provision

of services or goods whose availability to the users shall be granted by

the public sector. According to legislation the PPP model shall thus be

adopted for Value-for-Money initiatives where the private sector can

bring to the public the required know how and competences for a more

cost-effective if not profitable implementation and operation of projects.

Notwithstanding this overall principle, the PPP model can be also

adopted for country strategic projects not financially viable in which case

the state should contribute to its viability. Accordingly, financial

guarantees may be granted to the contractor by the entity responsible

for financial supervision (by means of co-financing or providing financial

guarantees, facilitating access guarantees for financing, subsidies or

compensation for the provision of services or sale of products below

their actual cost).

Project

risks

Financial credit

risks

Financial credit risks are generally retained by the

private sector

, who

is also responsible for defining the project financing structure.

Design,

construction and

operation risks

The

private party

is responsible for the risks associated with the

conception and design of the project, as well as for engineering and

construction defects and associated to impacts on the environment

attributable to facts occurred after the start of the PPP concession. The

contractor is also responsible for the management and operation of the

infrastructure. The public sector retains the risks related to land

concession and public planning.

Financial

sustainability

risks

The

private sector

is responsible for economic and financial risks,

business, commercial as well as management and performance risks,

including demand risks, except from those contracts where subsidies are

foreseen.

Other risks

(force majeure

and early

termination)

Force majeure and early termination risks are

shared

and the effects of

force majeure events should be mitigated on fair terms by both parties.

Cases of force majeure and early termination are to be specified in the PPP

contracts.

Source: Authors.

The above risk allocation matrix is generally applicable to the PPP projects in Mozambique, with

no specific differences between BOT and ROT initiatives.