Muslim Friendly Tourism:

Developing and Marketing MFT Products and Services

In the OIC Member Countries

59

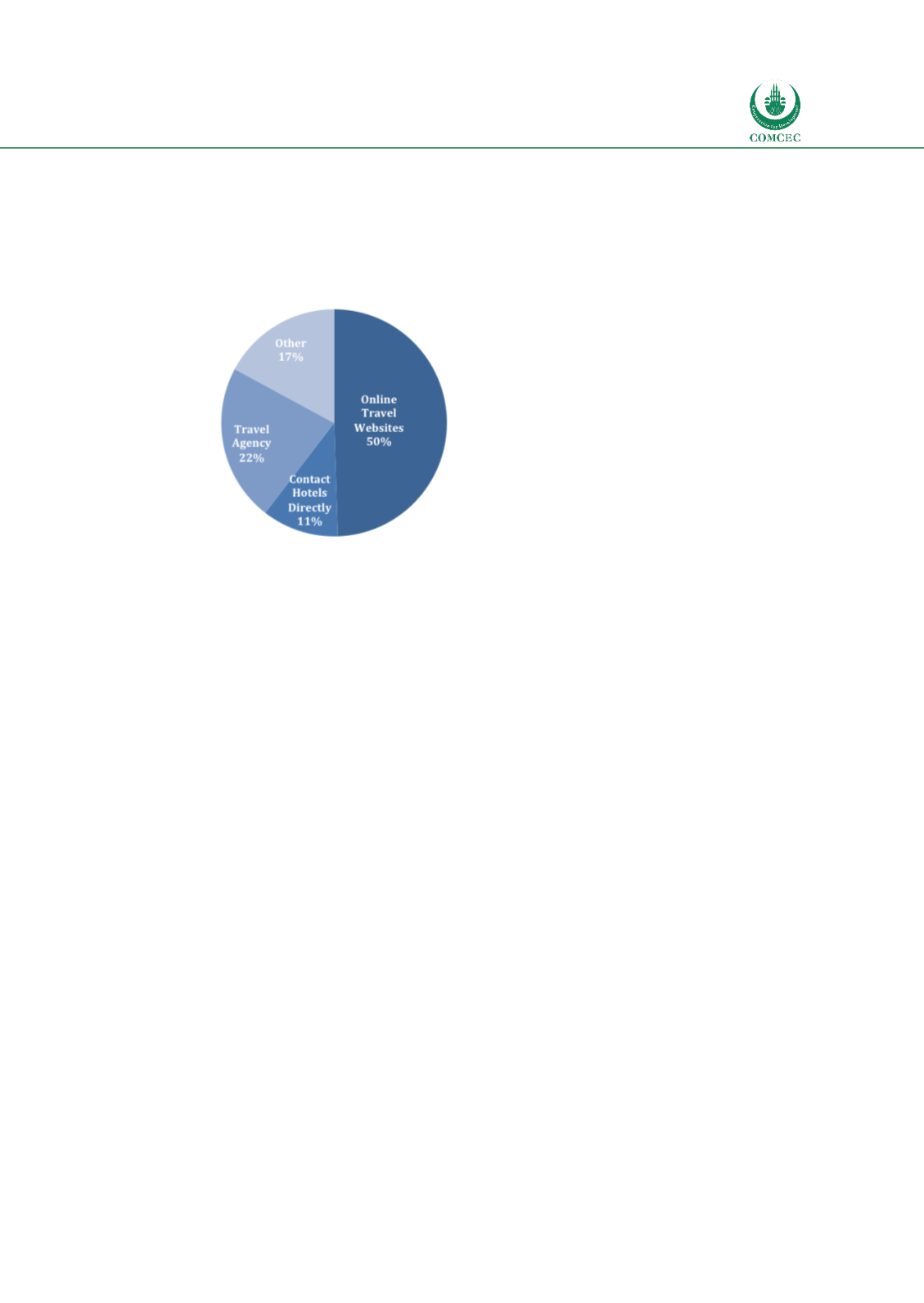

respondents cited staying with friends and family or getting accommodation through walk in

method. However, it is worth noting that since the survey data was collected through the

internet that the results may be skewed in favor of online reservations.

Figure 17: Accommodation Booking Method

“What channel did you use to book the accommodation for this trip?”

3.4

Value and Pricing of MFT Products and Services

As indicated by the consumer survey findings, total cost is the most important element in

destination selection that highlights the importance of having a competitive price for MFT

products and services in relation to mainstream tourism products. Product and service

providers have a choice between three main pricing strategies depending on the stage of the

development of their products, demand and the level of competition in their market. These

strategies include pricing based on cost, demand, and competition.

Interviews conducted within the scope of the case studies with MFT products and services

providers indicate that tourism products and services providers are aware of the need to

remain competitive and are pricing their products and services accordingly. In certain cases,

however, some providers increase prices due to high demand for MFT products in peak

seasons, as mentioned by the Malaysian PNB Perdana management prices are hiked up

during what they refer to as the “Arab Season” consisting of the Middle East’s three month

summer break.

Still, most MFT providers interviewed within the scope of this study, whether from OIC or

Non OIC countries, acknowledged that higher pricing was only used during peak seasons due

to higher demand as in the case with mainstream products. The exception to this was in the

case of higher incurred cost that is generally the case in non OIC countries where tourism

providers need to make major changes to their establishments or production process.

However, non OIC countries which are eager to attract Muslim travelers have provided

support to their MFT products and services providers to enable them to remain competitive

as in the case of Japan, South Korea and Thailand among others.

Survey respondents were asked if they were willing to pay extra to receive products and

services tailored to meet their religious needs, almost three quarter of the respondents (74%)

mentioned they would be willing to pay more. When asked how much more in terms of a