Improving Customs Transit Systems

In the Islamic Countries

85

3.1.1.3

Guarantee management and monitoring system

83.3% of the respondents accept guarantees and bonds as a security measure for CTR, but also,

they accept cash deposit, international and regional guarantees

(Table 14).

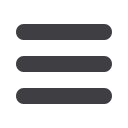

Table 14: Form of non-monetary guarantee

17. Form of non-monetary guarantee

N

Percent

Cash deposits (national or foreign currency)

4

66.7%

Temporary placement of funds on the Customs administration’s bank

account

1

16.7%

Tradable securities

1

16.7%

Movable property (e.g. means of transport) pledge agreement

0

0.0%

Non-movable property (e.g. office or production premises) pledge

agreement

0

0.0%

Bank guarantee

4

66.7%

Insurance policy

1

16.7%

Surety contract

1

16.7%

International guarantees

2

33.3%

Regional guarantees

2

33.3%

Source: Authors’ own compilation

In most cases, the guarantees are limited to the amount of duties and charges if the goods are

imported into the country

(Table 15). One country is not limiting the guarantees to the amount

of duties.

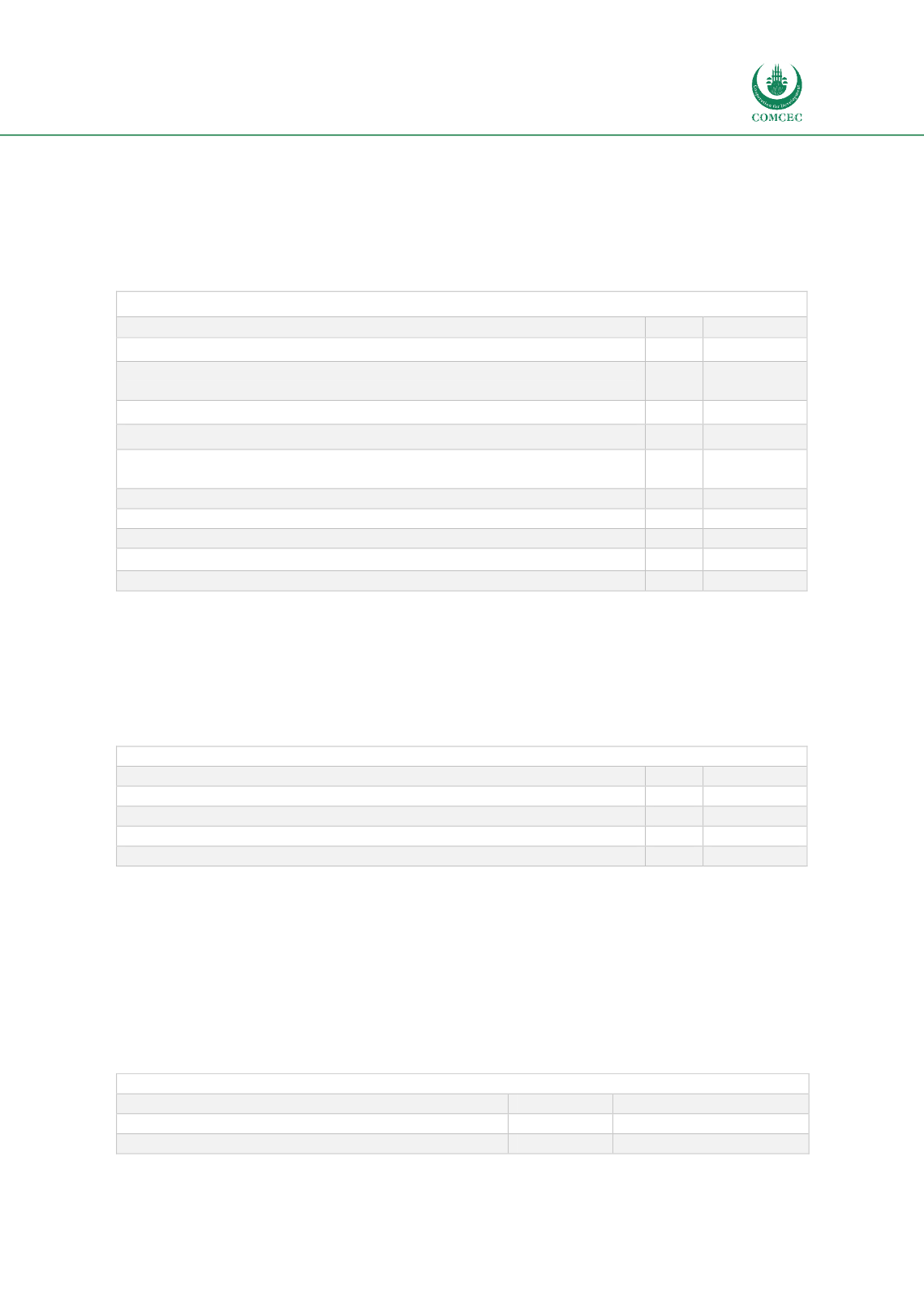

Table 15: Guarantees limited to the value of duties and charges

18. Are the guarantees limited to the value of duties and charges

N

Percent

Guarantees are not limited to the amount of duties and charges

1

20.0%

Guarantees are limited to the amount of duties and charges (taxes)

4

80.0%

Other

1

20.0%

Total

6

120.0%

Source: Authors’ own compilation

40% of the respondents calculate the guarantee amount according to risk level and guarantee

waiver, while 60% doesn't relate guarantee calculation with the risk level. In 66.7% of the cases

applicable regional or international agreements specify/support the issued transit guarantees.

In most of the cases, the release of the guarantee is done automatic or in one to three days that

is based on the time frame in which the goods exit the transit country

(Table 16).

Table 16: Guarantee release

21. Guarantee release

N

Percent

Automatic release

1

20.0%

Within 1 day

2

40.0%