Preferential Trade Agreements and Trade Liberalization Efforts in the OIC Member States

With Special Emphasis on the TPS-OIC

38

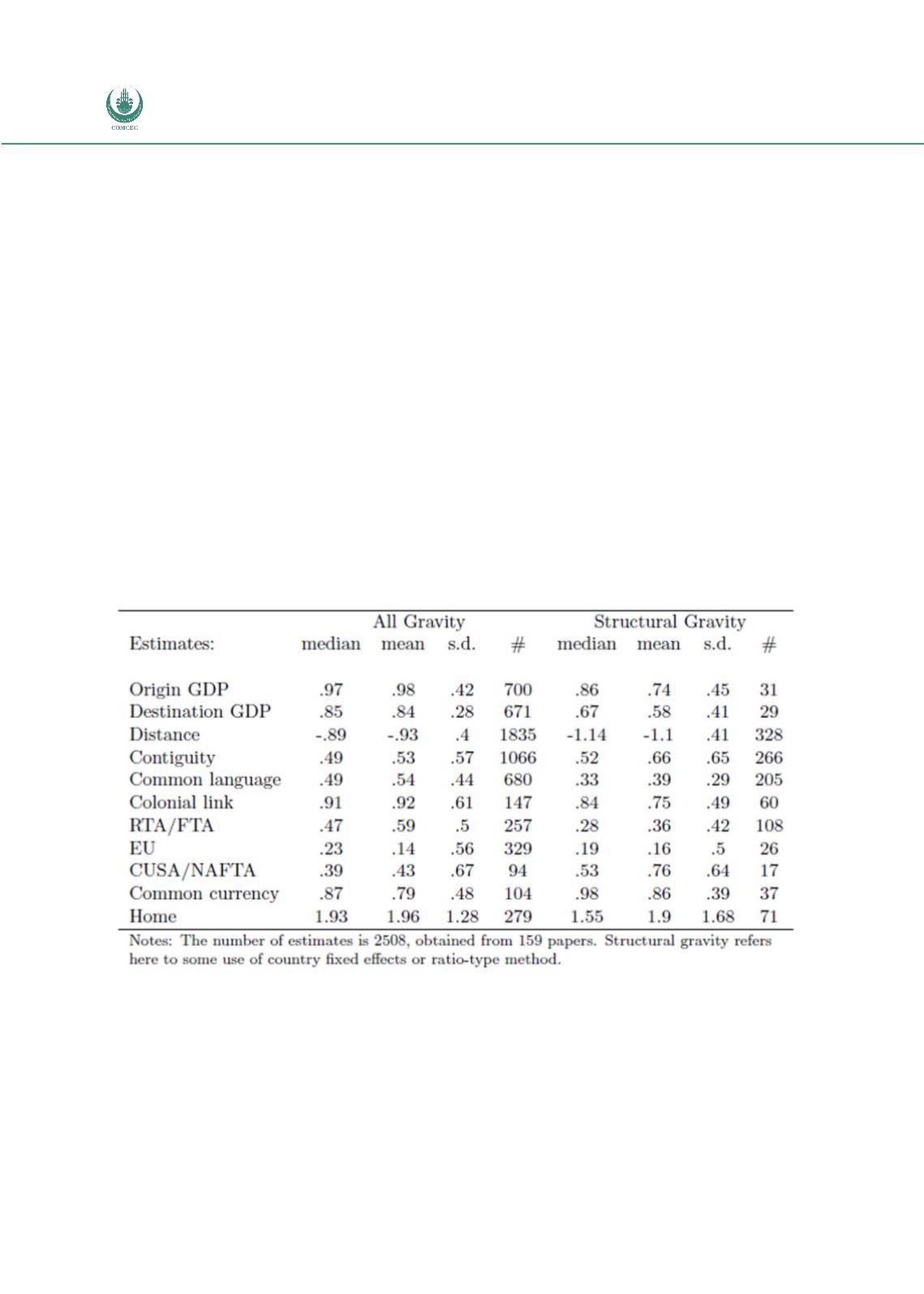

point of view of this study, what is of interest are the coefficients on RTA (and also EU and

CUSA/NAFTA). These are the coefficients which capture the extent to which an RTA is

associated with higher trade. From the table it can be seen that the RTA coefficient is positive

and statistically significant and ranges from 0.28 to 0.47. This translates into saying that on

average trade between countries who have an RTA is between 32% to 80% higher. Note that

causality cannot be attributed here. In other words we cannot conclude from this that trade is

higher because of the RTA.

More recently (Eicher, Henn and Papageoriou, 2012) analyse the trade creation and diversion

effects of many different multilateral and bilateral trade agreements between 1960 and 2000.

They also added additional control variables such as if the pair of countries share the same

colonizer or if the country is an island. The analysis is very comprehensive as the authors also

considered the accession dynamics involved in these agreements where the effects of them are

faded in rather than being immediate. They found, as in many analysis, that agreements such

as MERCOSUR or NAFTA tend to be dominated by trade diversion as a result of maintaining

relatively high external tariffs.

Figure 1:

Head and Mayer Summary Gravity Modeling Results

Source: Head & Mayer, 2013

In general, agreements such as CARICOM or APEC tend to be dominated by trade creation

factors. However, when dynamic accession effects are considered, the trade creation effects

tend to increase, particularly in regional agreements. This is explained by the fact that the

effect of an FTA may impact before the accession or the implementation day. For example, the