FACILITATING INTRA-OIC TRADE:

Improving the Efficiency of the Customs Procedures in the OIC Member States

43

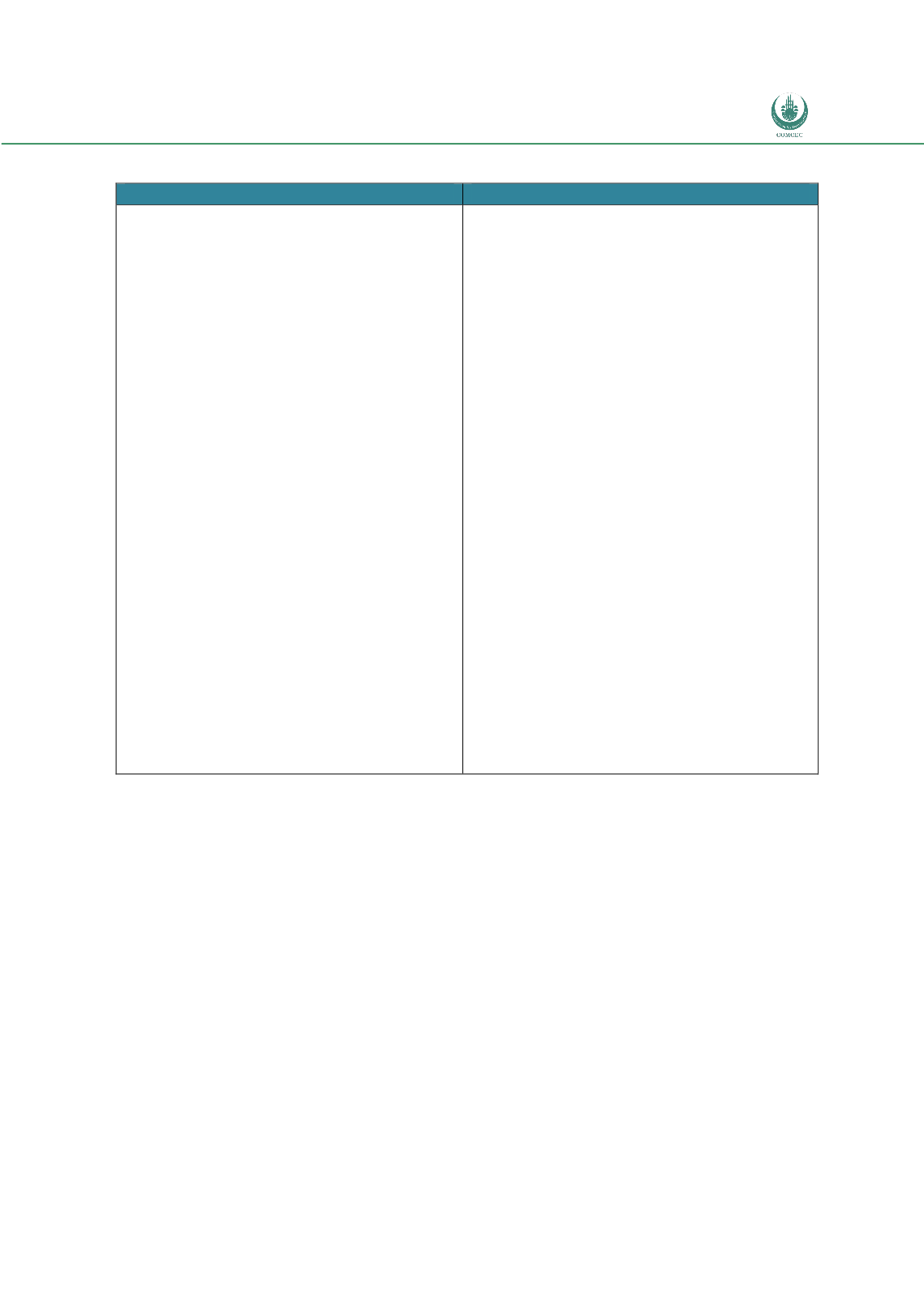

Table 5: Objectives and Benefits of Post Clearance Audit

OBJECTIVES

BENEFITS

To assure that Customs declarations have been

completed in compliance with Customs

requirements, via examination of a trader’s

systems, accounting records and premises;

To verify that the amount of revenue legally

due has been identified and paid;

To facilitate international trade movements of

the compliant trade sector;

To ensure goods liable to specific

import/export controls are properly declared,

including prohibitions and restrictions,

licenses, quota, etc;

To ensure conditions relating to specific

approvals and authorizations are being

observed, e.g. pre-authenticated transit

documents, preferential origin/movement

certificates, licenses, quota arrangements,

Customs and excise warehouses and other

simplified procedure arrangements.

Compliant trade is facilitated at the point of

Customs clearance as border controls can be

reduced;

Enables Customs to gain better information on

and understanding of clients’ business;

Risk levels can be more easily assessed and

reviewed: a premises visit provides the

opportunity to identify risks and weaknesses in

traders’ systems;

Facilitates client education, long-term and

comprehensive compliance management

focus;

Customs administrations’ resources are more

effectively deployed;

Customs can promote the concept of voluntary

compliance and self-assessment;

Suspected fraudulent activities may be

identified and referred to enforcement unit for

appropriate action;

Provides a platform for evaluating continued

entitlement to Authorized Economic Operator

status, where applicable.

Source: WCO (2012) “Guidelines for Post Clearance Audit Volume 1”

-Authorized Economic Operators (AEO)

The AEO is another concept which is developed as a result of Customs Administrations

efforts to deal with increasing flow of goods among the countries. Since physical

examination of all the goods moving across borders is impeding international trade, the

Customs Administrations are selecting the cargo based on their risk management. The

idea is to trust the reliable companies and focus on the goods which are considered as

more risky.

WCO Framework of Standards (WCO SAFE) defined the AEO as “a party involved in

the international movement of goods in whatever function that has been approved by or

on behalf of a national Customs administration as complying with WCO or equivalent

supply chain security standards”. According to the WCO SAFE, AEOs may include

manufacturers, importers, exporters, brokers, carriers, consolidators, intermediaries,

ports, airports, terminal operators, integrated operators, warehouses, distributors and