DRAFT

Improving the SMEs Access to Trade Finance

in the OIC Member States

81

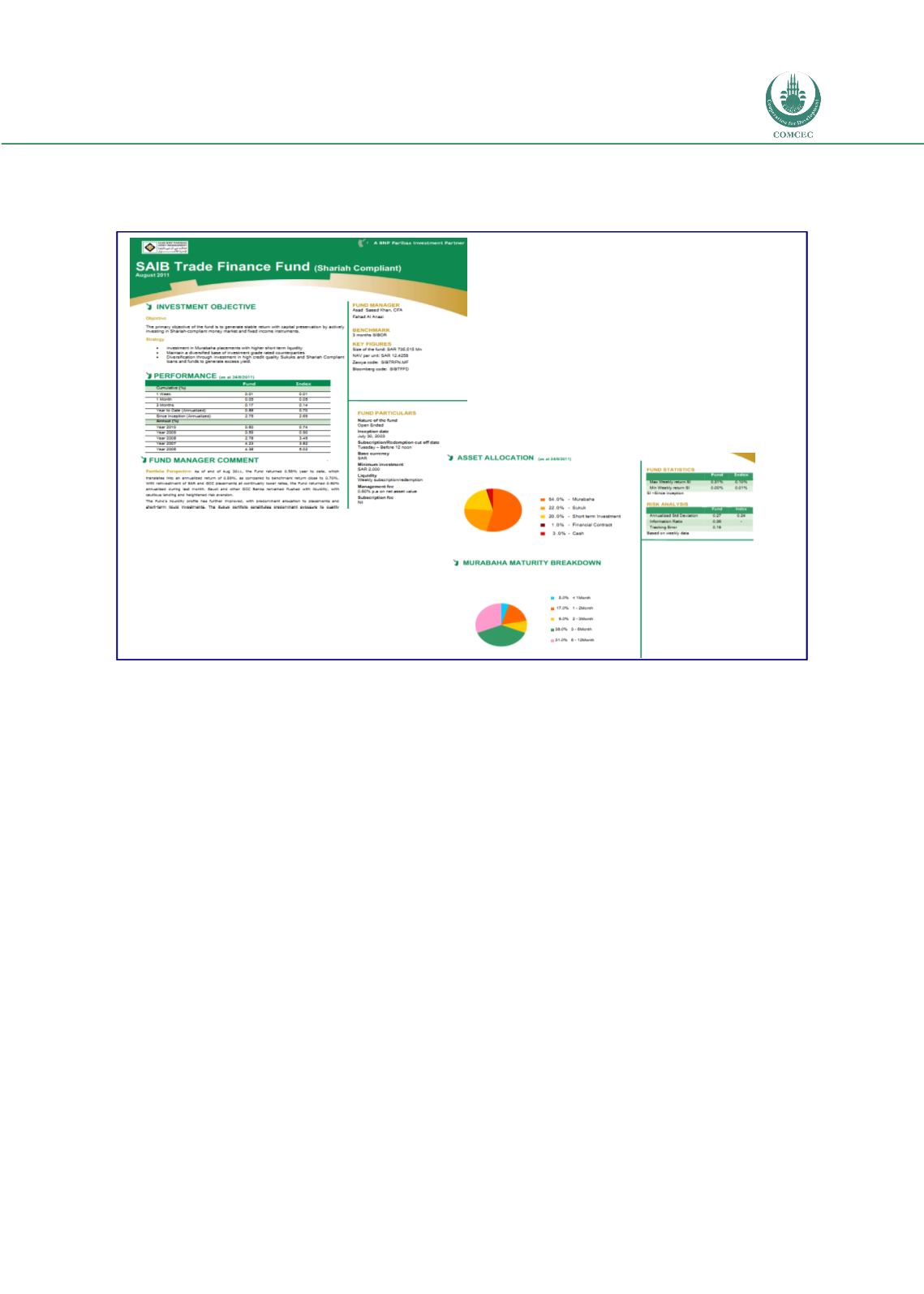

One such example is the SAIB Shari’ah-Compliant Trade Finance Fund:

Figure 28: SIAB Trade Finance Fund

Source: SAIB/BNP Paribas, 2011

Amid a challenging environment for short term Money market and Trade Finance, the

Fund is well positioned to achieve an attractive return for the unit holders in FY 2011,

as the Manager aims to proactively manage the credit, duration and liquidity risk,

through prudent credit controls, market conditions and substantial allocation to liquid

instruments. The Fund’s return is reflective of its superior performance over the

comparable term deposit opportunities, with capital preservation and weekly liquidity.

Source: SAIB Fund Manager Commentary, 2011

A more recent initiative in this space, launched by Kuwait-based Asiya Investments, aims to

support trade flows with Asia, and specifically targets supporting SMEs engaged in trade,

seeking to fill a gap left by the retreat of international banks from the trade finance market, as

perceived by Asiya.

Kuwait-based Asiya Investments has launched an Islamic trade finance fund with $20

million in seed capital, aiming to cater to small Asian manufacturers. Asiya, whose

largest shareholder is sovereign wealth fund Kuwait Investment Authority, aims to fill a

gap left by Western banks that are scaling back their trade finance business, making

credit scarce for small and medium-sized firms.