Improving the SMEs Access to Trade Finance

DRAFT

in the OIC Member States

80

Absence of capacity management through syndications and other forms of risk-

sharing, or development of additional capacity

It must be noted in terms of product innovation however, that the various support and

enabling institutions around trade and trade finance are increasingly looking to leverage and

promote the use of leading techniques, certainly in the context of conventional trade finance,

with bankers and trading companies showing increased interest in supply chain finance

mechanisms, despite a long-standing preference among MENA Region countries and parts of

sub-Saharan Africa, for traditional mechanisms like documentary letters of credit.

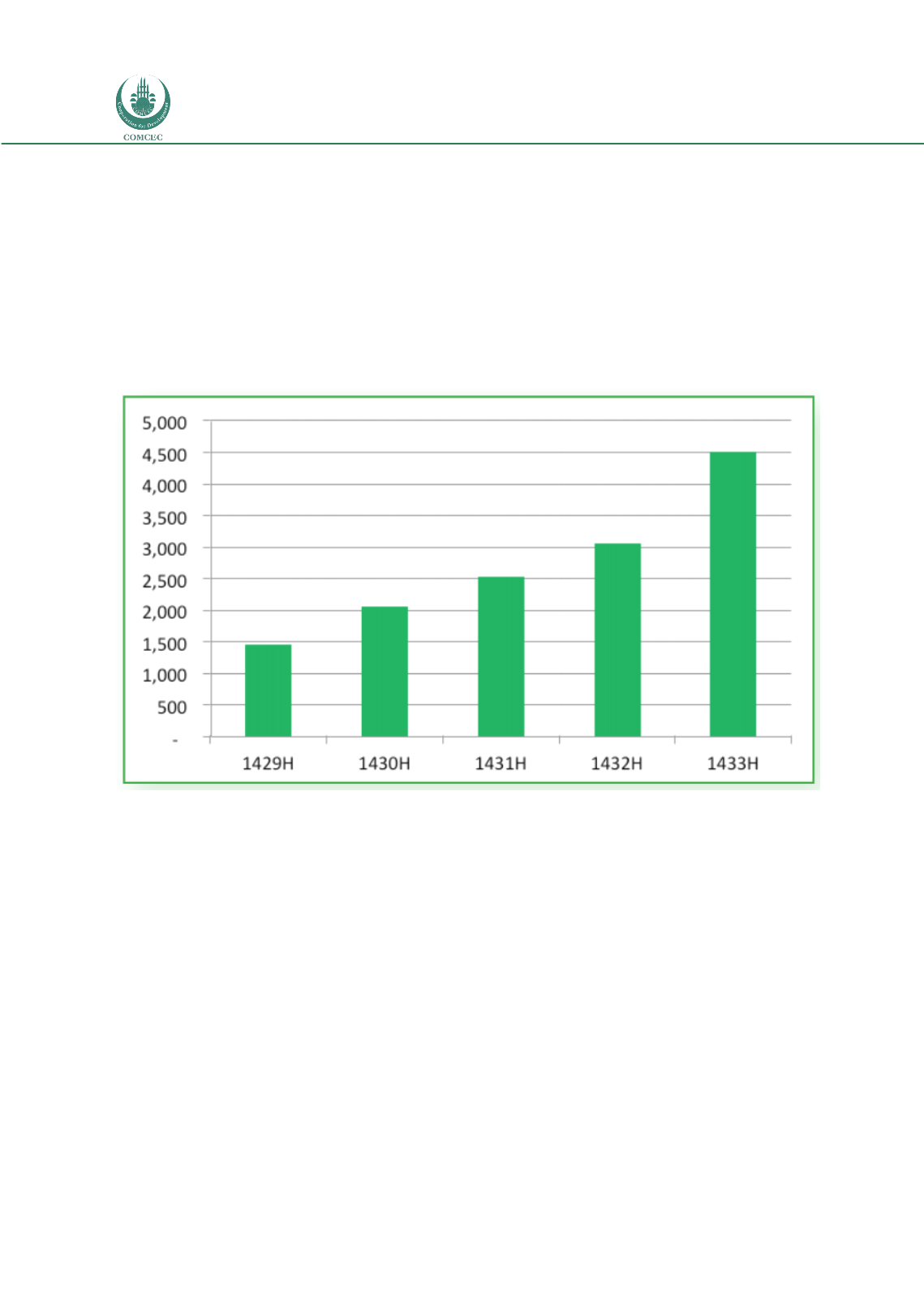

Figure 27: IDB Trade Finance Operations

Source: Connecting to Global Value Chains, IDB 2013

While the trade finance operations conducted by ITFC, ICIEC and other key institutions

engaged in trade support is clearly on a growth trajectory, these institutions are required to

exercise appropriate caution in their lending and financing activity, and do operate in a

resource-constrained environment. The growth and development of Islamic Finance is integral

to the related growth of Islamic Trade Finance, and both require adequate levels of liquidity

and balance sheet (or funding) capacity to be able to respond to gaps in financing, and to be

able to adequately support projected growth rates in trade, including intra-OIC trade flows.

One means of assuring adequate levels of capacity, is to attract additional non-bank and non-

IFI capital to support the conduct of trade. This issue of capacity has been discussed in the

context of the global state of the trade finance market, and exists to some degree today in the

context of OIC Member States. The development of trade finance funds, and the attraction of

non-bank investors and capital pools (including sovereign wealth funds) to the trade finance

asset class, is fundamental to the global sustainability of trade and supply chain finance

activity, and will become increasingly central to considerations around trade and supply chain

finance in OIC Member States.