Improving the SMEs Access to Trade Finance

DRAFT

in the OIC Member States

50

Detailed process flows can be reviewed as a step in determining the applicability and viability

of the BPO in addressing the trade needs of OIC Member States, and in particular, the needs of

SME in the conduct of trade.

Some of the transactional benefits of a Bank Payment Obligation can be identified in comparing

this instrument to traditional mechanisms such as the documentary letter of credit.

The degree to which the BPO can serve as an effective instrument of trade finance in

transactions involving developing market economies, and SME’s located in such markets, is to

be determined, but on first view, appears promising.

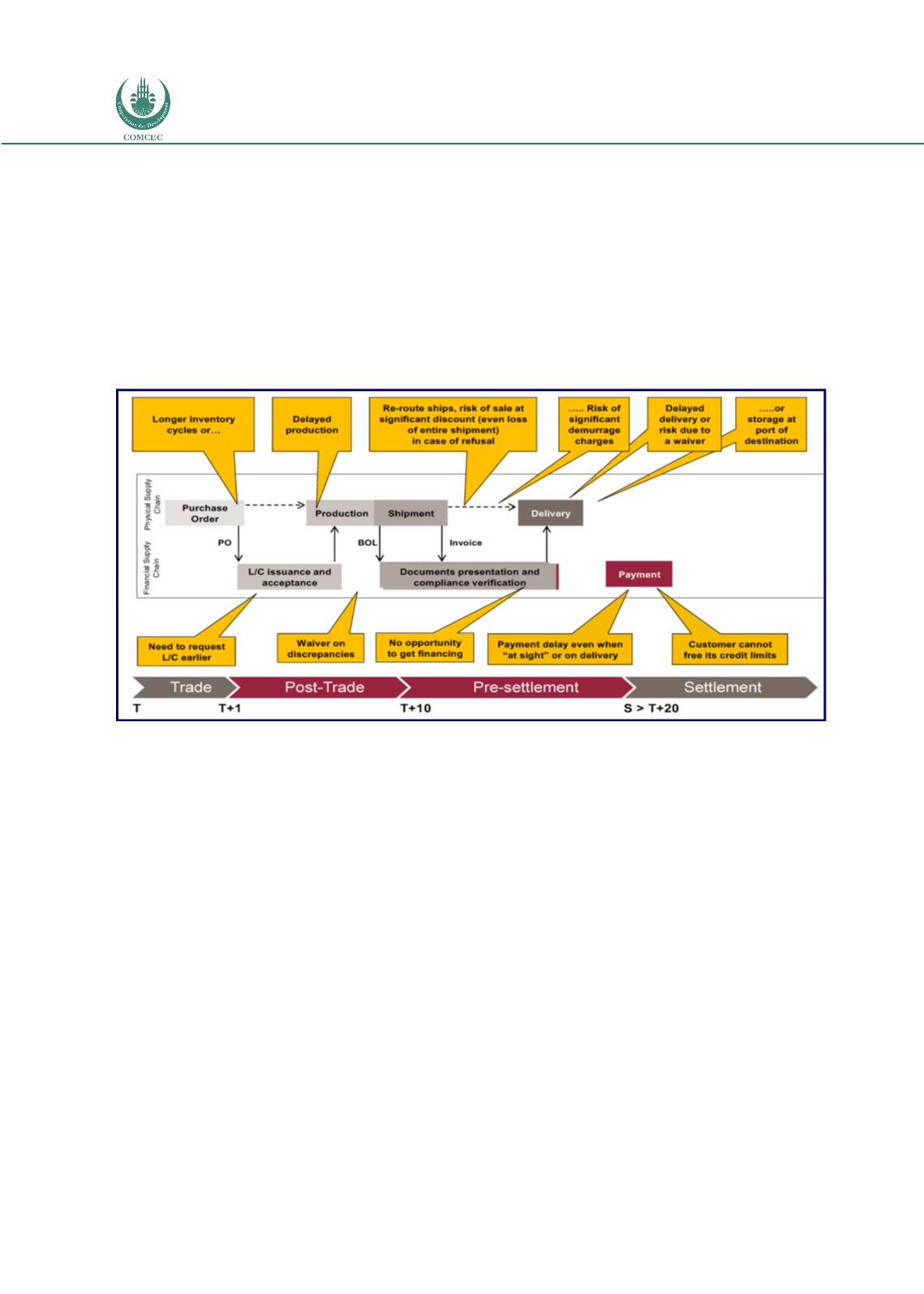

Figure 18: Challenges and Pain Points in Using Letters of Credit

Source: ICC/SWIFT Bank Payment Obligation Webinar

The Bank Payment Obligation is, currently, a bank-to-bank instrument, and as such, the risk

related to a BPO is bank risk – the basis on which numerous trade support programs are

currently devised, particularly among international financial institutions.

The BPO is still in very early stages of development and deployment – since the first live

transaction in 2010, the volume is limited, numbering in the dozens per year, however, bank

adoption is advancing, and is expected to accelerate following the recent adoption of the ICC

Rules for Bank Payment Obligations, paralleling the long-established Uniform Customs and

Practice for Documentary Credits.

The BPO leverages technology and automation, increases options related to trade and supply

chain financing, allowing importers and exporters to improve their respective working capital

positions, as well as enhancing processes and efficiencies, improving inventory management

and addressing other commercial objectives related to trade activities and trade and supply

chain finance.

At last count, over forty banks internationally had signed on in principle to be providers of BPO

solutions. There remain numerous issues and transactional details to be ironed out as relates

to the BPO, including pricing, accounting and regulatory treatment, and eventual extension of