DRAFT

Improving the SMEs Access to Trade Finance

in the OIC Member States

49

PayPal processed $14 billion in mobile payment volume in 2012 – more than 3 times

the mobile payment volume of $4 billion that it processed in 2011.

PayPal expects to process $20 billion in mobile payment volume in 2013.

Source: PayPal, 2013

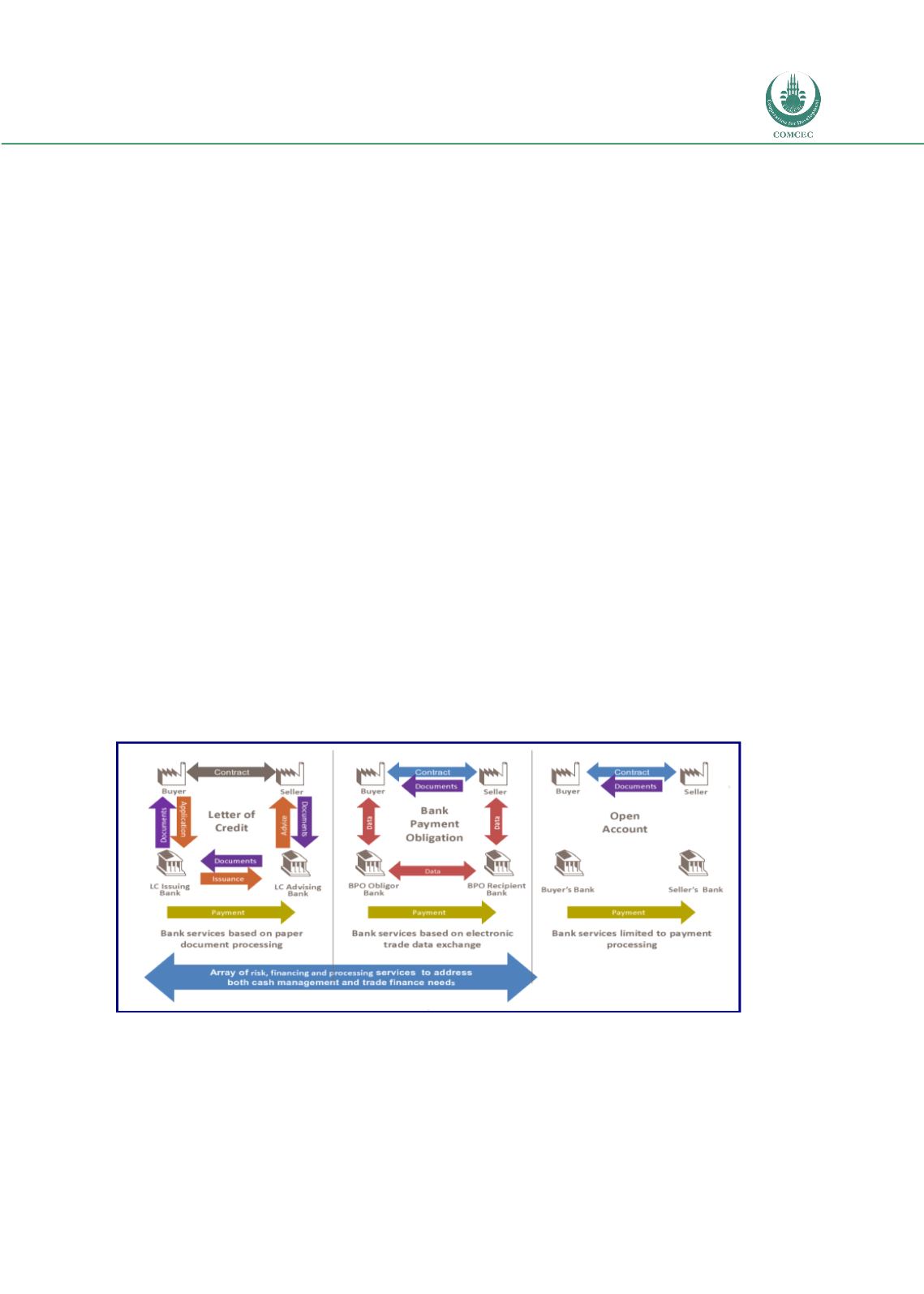

2.5. The Bank Payment Obligation

The Bank Payment Obligation is a new instrument of trade finance, positioned precisely

between a traditional documentary letter of credit and an open account transaction. The Bank

Payment Obligation (or BPO) has the advantage of being endorsed by the International

Chamber of Commerce, and of being subject to a widely agreed and unanimously adopted set

of ICC rule called the Uniform Rules for Bank Payment Obligations, or URBPO.

The BPO is a significant innovation at the product and solution level; it represents successful

leveraging of leading-edge technology and involves a significant level of industry education

and of promotion of the new solution to end-clients and other interested parties. The BPO aims

to accelerate and automate transaction processing, and to advance trade financing in

significant ways.

A BPO, in contrast to a documentary letter of credit, operates on the basis of an exchange and

comparison of data elements, instead of a comparison of physical documents against the terms

and conditions stipulated in the documentary credit. An objective, technology-driven process

of data-matching which triggers an agreed payment, is not subject to misunderstanding or

differing interpretation, and in the normal course, should be significantly faster than a manual

document verification process.

Figure 17: Positioning of the Bank Payment Obligation

Source: SWIFT/ICC Industry Education Group on the BPO

In the end, the BPO represents a serious and viable attempt to innovate in the trade finance

space, targeting a proposition that combines attractive features of both documentary letters of

credit, and open account transactions.