Reviewing Agricultural Trade Policies

To Promote Intra-OIC Agricultural Trade

151

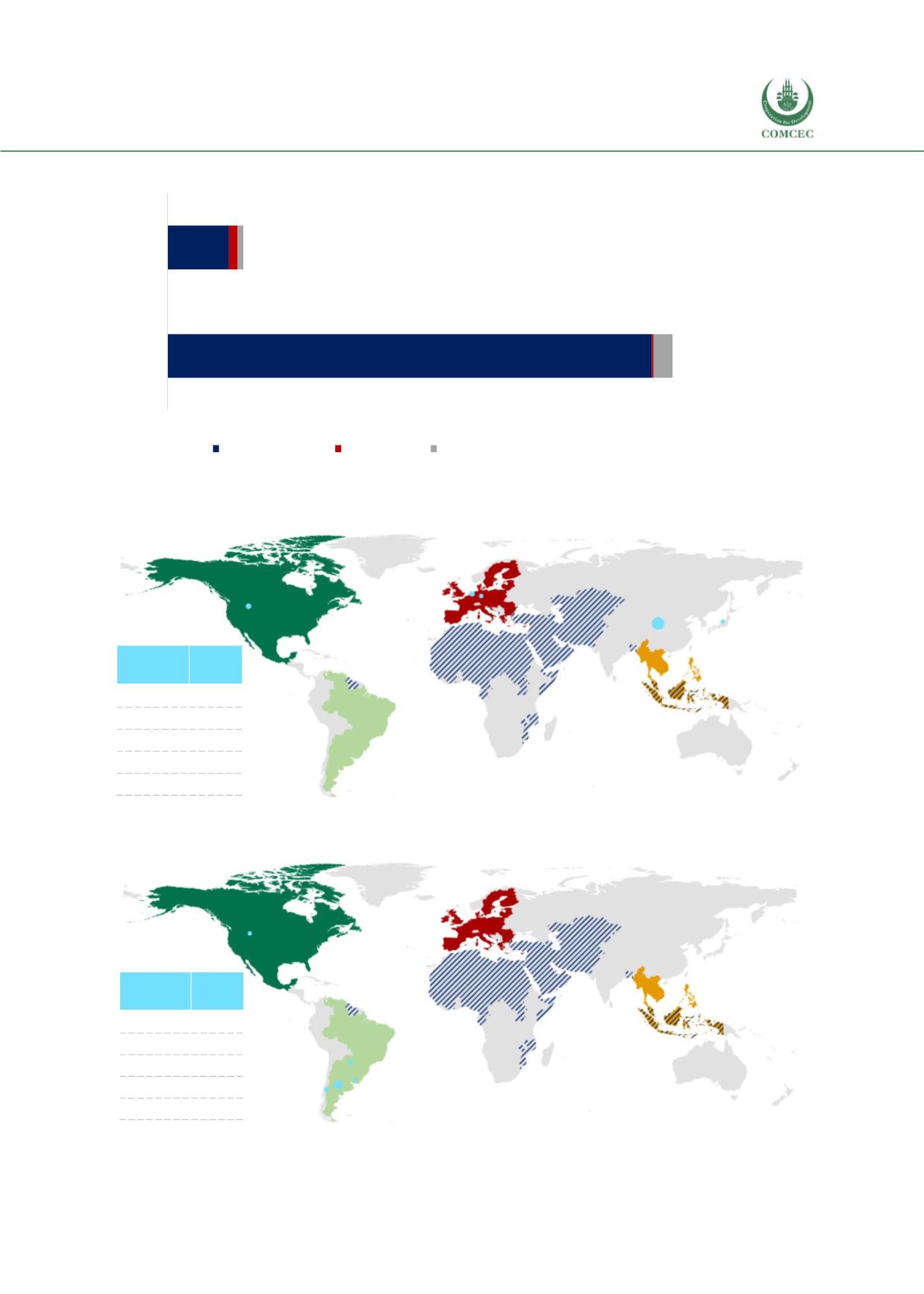

Figure 4. 61 Agricultural Exports and Imports, Product Groups, Billion USD, Brazil, 2016

Source: CEPII BACI, Eurostat RAMON, UN Comtrade, UN Trade Statistics, and authors’ calculations

Figure 4. 62 Breakdown of Brazil’s Agricultural Export Destinations, 2016

Source: CEPII BACI, Eurostat RAMON, UN Comtrade, UN Trade Statistics, authors’ visualizations

Figure 4. 63 Breakdown of Brazil’s Agricultural Import Origins, 2016

Source: CEPII BACI, Eurostat RAMON, UN Comtrade, UN Trade Statistics, authors’ visualizations

Agri-food products;

70.2

Agri-food products; 8.9

Fish products; 0.3

Fish products; 1.2

Agri-rawmaterials; 2.7

Agri-rawmaterials; 0.9

-

10.0

20.0

30.0

40.0

50.0

60.0

70.0

80.0

Export

Import

Agri-food products

Fish products

Agri-rawmaterials

EU-28

%19

NAFTA

%6

MERCOSUR

%3

ASEAN

%8

OIC %23

Top 5

Partner

Share

China

24%

USA

5%

Netherlands

5%

Germany

3%

Japan

3%

EU-28

%16

NAFTA

%9

MERCOSUR

%43

ASEAN

%8

OIC %7

Top 5

Partner

Share

Argentina

28%

Chile

9%

Paraguay

8%

USA

7%

Uruguay

7%