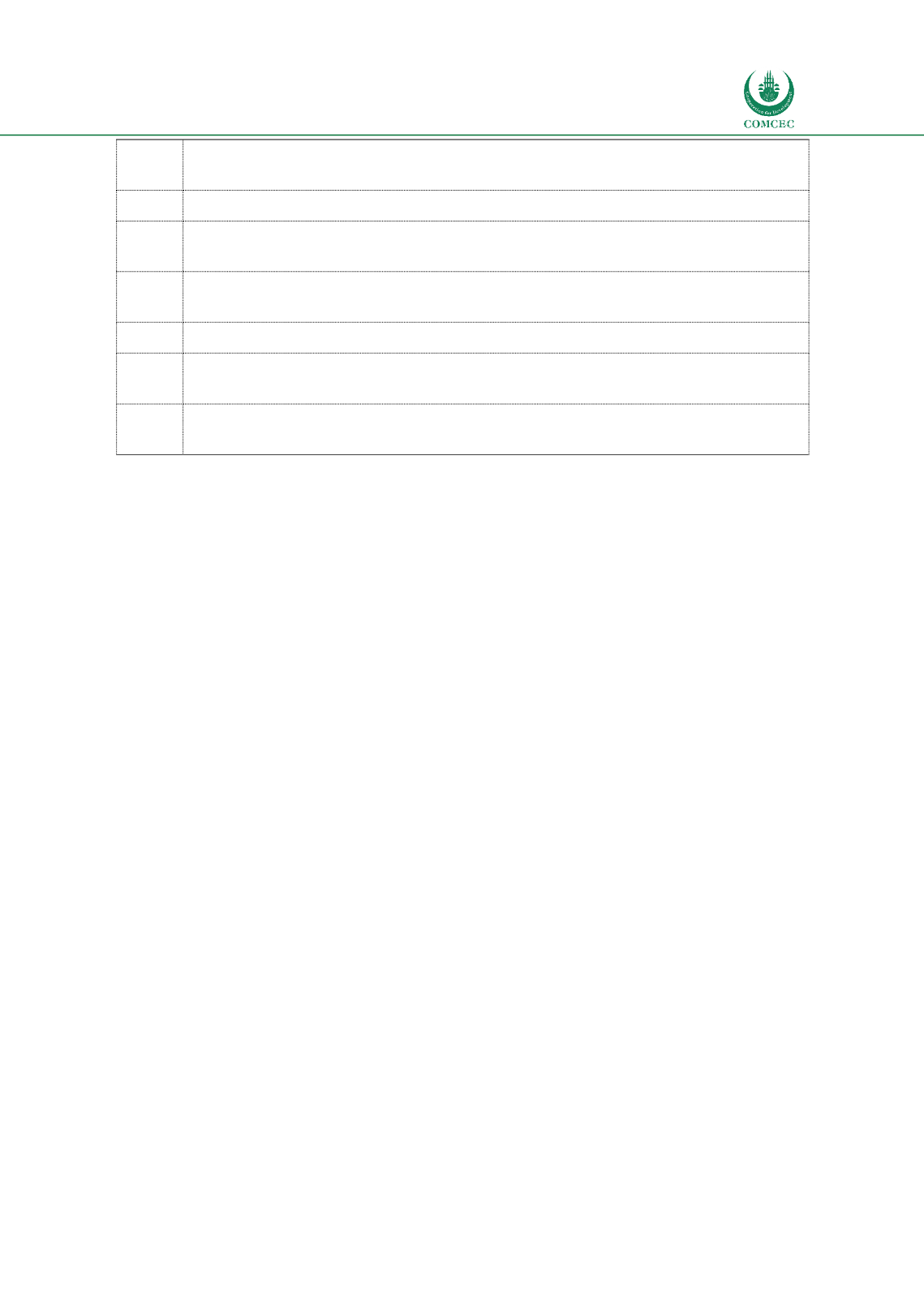

Enhancing Public Availability of Customs Information

In the Islamic Countries

19

points to respond within a reasonable time. Payment of a reasonable fee permitted.

Can be done on a regional basis for countries in customs unions.

1.4

Notify WTO of publication places, websites, and contact details of enquiry points.

2.1.1

Provide interested parties the opportunity to comment on proposed laws affecting

movement, release, and clearance of goods, including goods in transit.

2.1.2

Make information available on new laws related to the movement, release, and

clearance of goods prior to entry into force.

2.2

Provide for consultations between border agencies and the trade community.

3.1

Issue binding advance rulings on tariff classification and origin in a reasonable, time-

bound manner, as well as reviews.

4

Must have procedures for administrative appeal or review of customs decisions,

and/or judicial review.

Source: WTO website, author’s summary.

Following concerns among developing countries that the TFA would impose onerous new

requirements on them that could potentially be the subject of WTO dispute settlement

proceedings, the architecture of the TFA contains unique flexibilities as part of its approach to

special and differential treatment. Developing countries—which is a very wide group in the

WTO—can notify each provision of the agreement under either Category A, Category B, or

Category C. Category A obligations enter into force for the member immediately upon entry into

force of the agreement (one year later for LDCs). Category B obligations, by contrast, include a

transition period set out by each member. Finally, Category C obligations do not come into force

until a transition period has ended, and technical or capacity building assistance has been

forthcoming. The decision as to which articles to put into which category is exclusively a matter

for each developing country WTO member individually, which creates great flexibility. Having

said that, trade facilitation performance is an important determinant of a country’s ability to

attract trade and investment flows, so there is an incentive for countries to be ambitious in their

notifications.

The TFA entered into force on February 22

nd

, 2017, after the required number of ratifications

by WTO members was attained. As of December 2018, 140 of the WTO’s 164 members have

ratified the agreement, which indicates that it has very widespread acceptance. (See Annex 3 for

a list of OIC countries that have ratified the Agreement.) According to the WTO Secretariat, as of

November 2018, 60.4% of the TFA’s commitments have already been implemented, based on

full implementation of the whole agreement by developed countries upon entry into force, and

implementation by developing countries of their Category A commitments at the same point in

time. A further 8.6% of the agreement’s commitments will be implemented between December

2018 and February 2038, based on Category B notifications. An additional 11.9% of

commitments will be implemented between December 2018 and February 2032 upon receipt

of external assistance, based on Category C notifications. A further 19% of commitments have

not yet been scheduled for implementation. Based on this review of the evidence, it is clear that

developing countries have been relatively ambitious in their scheduling of TFA commitments,

particularly in Category A. This ambition reflects both the competitive dynamic above, as well

as the fact that the TFA is now the baseline for trade facilitation performance: the best