Enhancing Public Availability of Customs Information

In the Islamic Countries

18

in Article X of the GATT, which provides for publication of some trade-related information,

focusing on measures that directly affect duties levies. In the TFA, public availability of

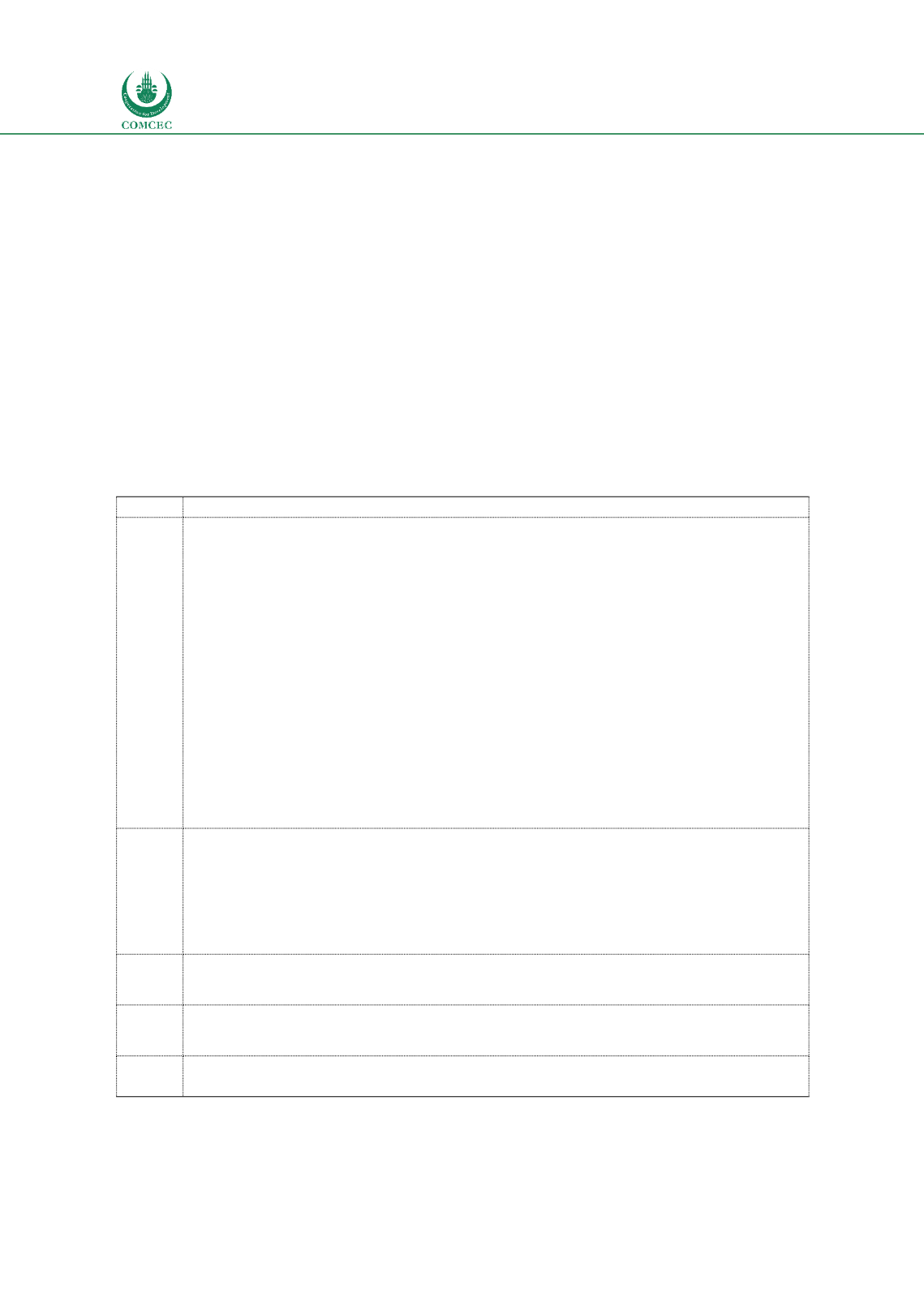

information is primarily dealt with in the first four articles of the Agreement. Table 1 sets out a

summary of the relevant provisions. As is clear from the table, the TFA sets out a general

transparency regime that mirrors what is already found in domestic laws in many countries, as

well as in other international instruments. Provisions on publication, including online, are not

onerous to comply with, except in countries where administrative capacity is very weak and

technical resources are limited, which makes compiling the necessary information quite

burdensome. But this situation is quite limited on the ground, as trade-related agencies tend to

be among the higher capacity agencies in any government, and so are typically quite well

equipped to deal with these requirements. Some other provisions go further, such as the

requirement to allow for advance rulings, as well as administrative and judicial review. Many

countries already have these measures in place to varying degrees, but in the developing world,

there is generally more need to adapt institutions and rules in place on the ground to deal with

these requirements than with publication, even online.

Table 1: Key TFA provisions on public availability of customs and trade-related information.

Article Content

1.1.1

Publication of:

Procedures for importation, exportation, and transit, and required forms

and documents.

Applied rates of duties and taxes imposed in connection with importation or

exportation.

Fees and charges in connection with importation, exportation, or transit.

Rules for customs valuation or classification.

Laws, regulations, and administrative rulings relating to rules of origin.

Import, export, or transit restrictions or prohibitions.

Penalty provisions for breaches of import, export, or transit formalities.

Procedures for review or appeal.

Agreements with other countries relating to importation, exportation, or

transit.

Procedures relating to the administration of tariff quotas.

1.2.1

Make available and keep updated through the internet:

Description of importation, exportation, and transit procedures, including

procedures for appeal and review.

Forms and documents required for exportation, importation, and transit.

Contact information for enquiry points.

1.2.2

Where possible, make the information under 2.1 available in an official WTO

language.

1.2.3

Encouragement to make additional information available through the internet,

including the information referred to in 1.1.

1.3

Establish enquiry points to answer reasonable queries from interested parties on

the matters in 1.1, and to provide required forms and documents under 1.1. Enquiry