Authorized Economic Operators

In the Islamic Countries:

Enhancing Customs-Traders Partnership

32

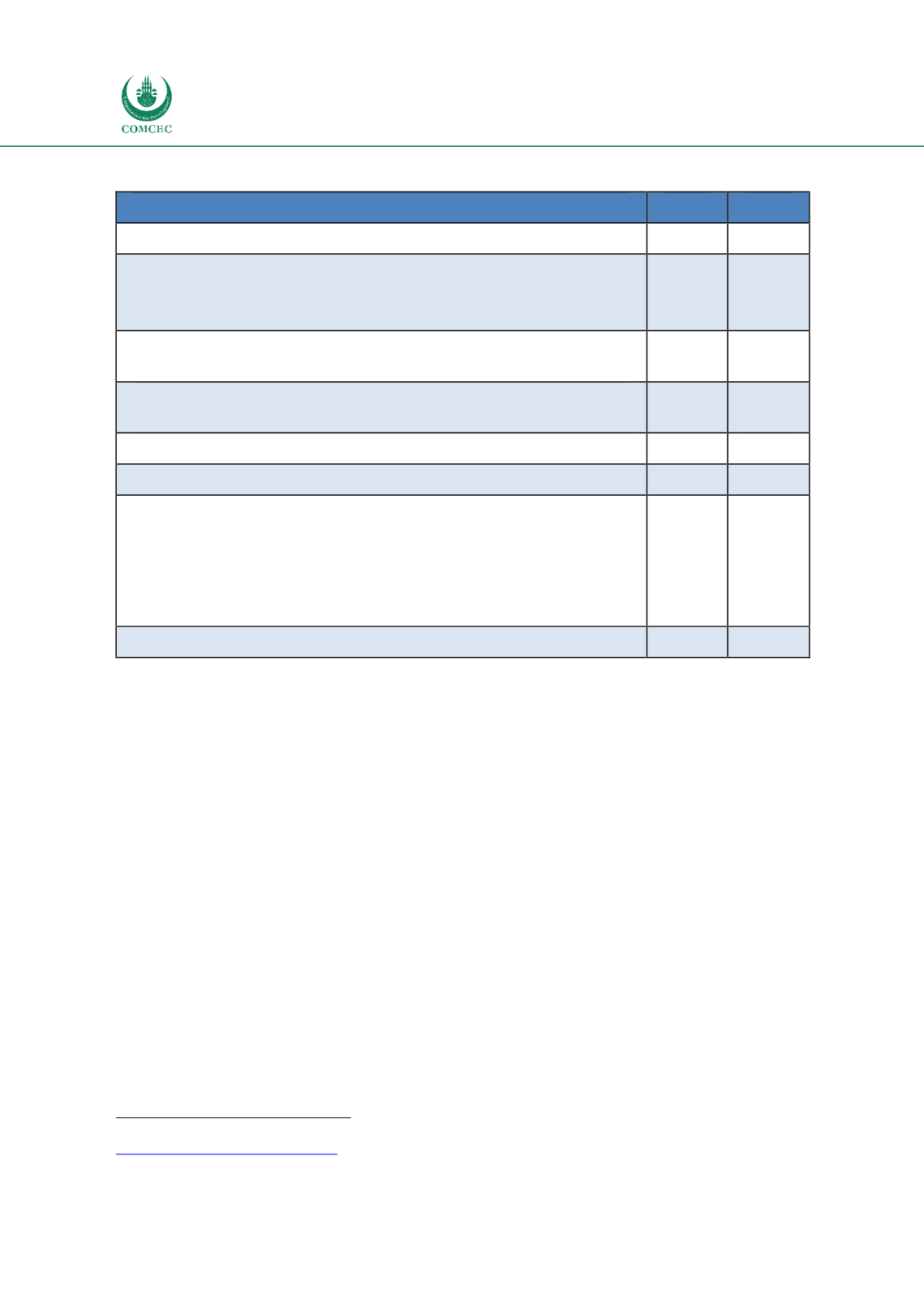

Table 2.2. Benefits for AEOC and AEOS operators

Benefit

AEOC

AEOS

Easier admittance to Customs simplifications

X

Fewer physical and document-based controls

related to security & safety

related to other Customs legislation

X

X

Prior notification in case of selection for physical control (related to

safety and security)

X

Prior notification in case of selection for Customs control (related to

other Customs legislation)

X

Priority treatment if selected for control

X

X

Possibility to request a specific place for Customs controls

X

X

Indirect benefits

(Recognition as a secure and safe business partner, Improved

relations with Customs and other government authorities; Reduced

theft and losses; Fewer delayed shipments; Improved planning;

Improved customer service; Improved customer loyalty; Lower

inspection costs of suppliers and increased co-operation etc.)

X

X

Mutual Recognition with third countries

X

Source: European Commission (2018)

Implementation of the AEO Program

At the legal level, the AEO program is governed by European Community law, which is

the Union Customs Code (UCC) and its Implementing Provisions

,

as follows:

UCC: Regulation (EU) No 952/2013 of the European Parliament and of the Council of 9

October 2013

UCC Implementing Act

: Commission Implementing Regulation (EU) 2015/2447of 24

November 2015

UCC Delegated Act

: Commission Delegated Regulation (EU) 2015/2446of 28 July 2015

In addition to the legal provisions regulating the AEO program, the AEO Guidelines were

drawn up to ensure systematic application of the program and to guarantee transparency and

equal treatment of economic operators. For an increased efficiency, the guideline is reviewed

regularly.

At the implementation level, 127 central and regional Customs offices operating under the

Taxation and Customs Union across the EU’s 28 Member States are responsible for certifying

AEO members

4

. A successful and efficient implementation of the AEO program also requires

4

According

to

the

Taxation

and

Customs

Union

database

(Customs

office

list),

available

at:

http://ec.europa.eu/taxation_Customs/ ,in June 2018