Promoting Agricultural Value Chains

In the OIC Member Countries

87

The ESK and the MFAL do not wield control over the whole value chain, but there are moves

towards increased central influence over red meat production (as illustrated by the growth of

the companies mentioned above). This is particularly evident in efforts to consolidate (and

prevent fracturing of) patches of land into larger pastures, for more effective cattle grazing.

Without these centralised efforts to move beyond the current small-scale nature of red meat

production, effective governance of the value chain remains elusive.

A consequence of the continuing small-scale nature of red meat production is relatively low

carcass productivity. Productivity per cattle is roughly 187 kg (FAOSTAT, 2012). This is due to

a combination of several unfavourable factors:

Small size of the farms;

Low production and high cost of feed: fodder planting is limited and pastures are not

properly managed. Most animals are fed with a high content of straw in the diet, which

restricts growth rates;

Indigenous or Holstein and Brown Swiss breeds reared are not suitable for high quality

beef production.

The introduction of new, more appropriate breeds of cattle, coupled with more effective land

use and farming inputs aims to increase this average carcass productivity, and modernise the

sector.

5.3.5

Trade

The contemporary nature of red meat imports and exports in Turkey are fluid. While the EU

remains one of Turkey’s biggest agricultural partners, there is increasing demand for Turkish

red meat imports from countries in the Middle East (Şanliurfa, 2014). Protection of prices is

ensured through import tariffs on livestock products and the restrictions on the import of beef

and live bovine animals from the EU (and other countries), which keep the price of red meat

higher than it would otherwise be.

In 2009, the Government intervened in meat prices by issuing import licenses for foreign red

meat and livestock. The cheaper livestock from abroad pushed down domestic red meat prices

(Erdem, 2012). Turkish imports of red meat were worth US$ 3.22 billion between June 2010

and January 2013 (Zaman, 2013) (see als

o Table 5-3).

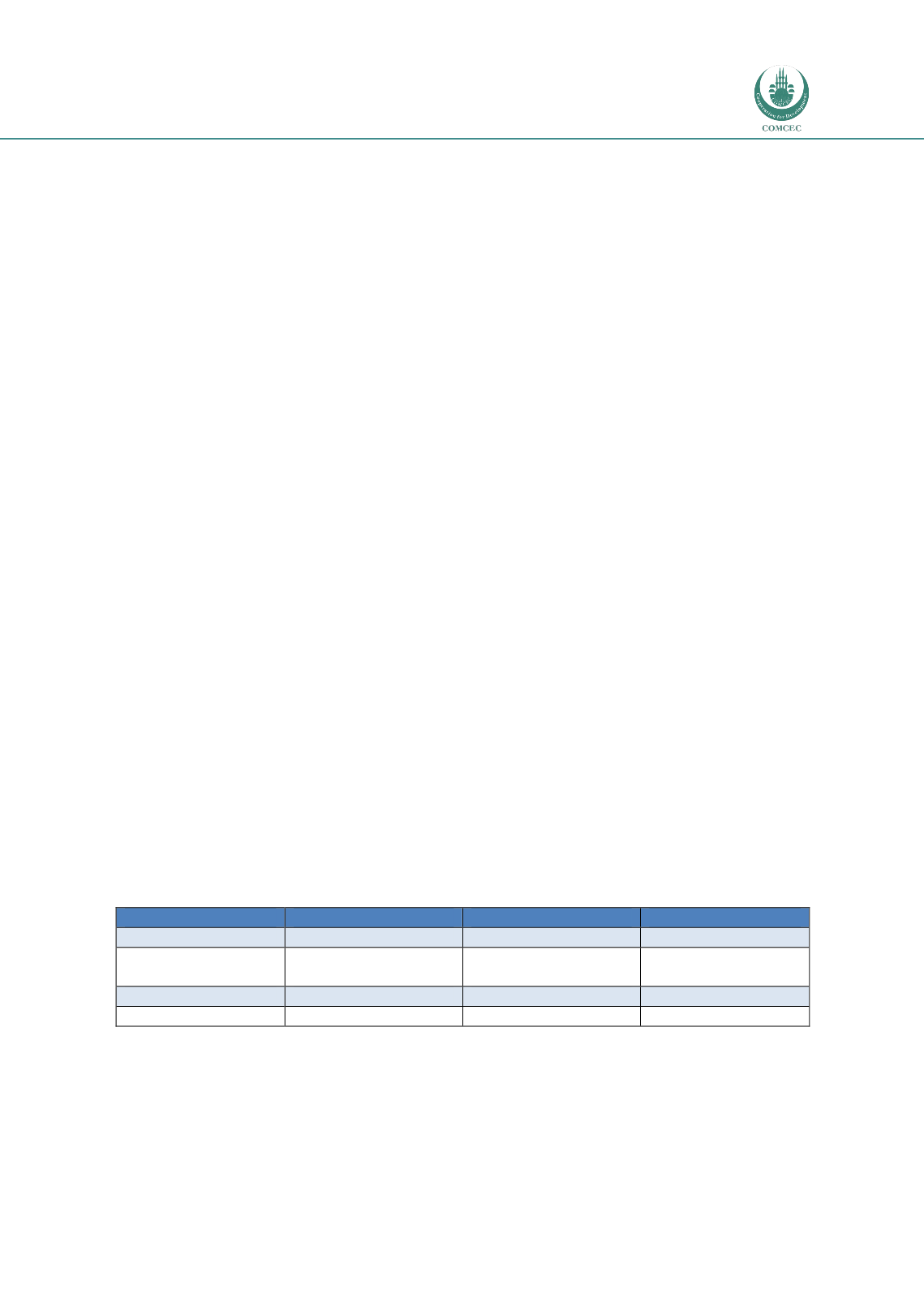

Table 5-3 Turkish red meat imports in 2012

Item

Year

Unit

Value

Meat, Cattle

2012

1000$

95,979

Meat, beef,

preparations

2012

1000$

1013

Meat: Bovine (Fresh)

2012

1000$

95,992

Bovine Meat

2012

1000$

97,062

Source: FAOSTAT, 2012