Promoting Agricultural Value Chains

In the OIC Member Countries

71

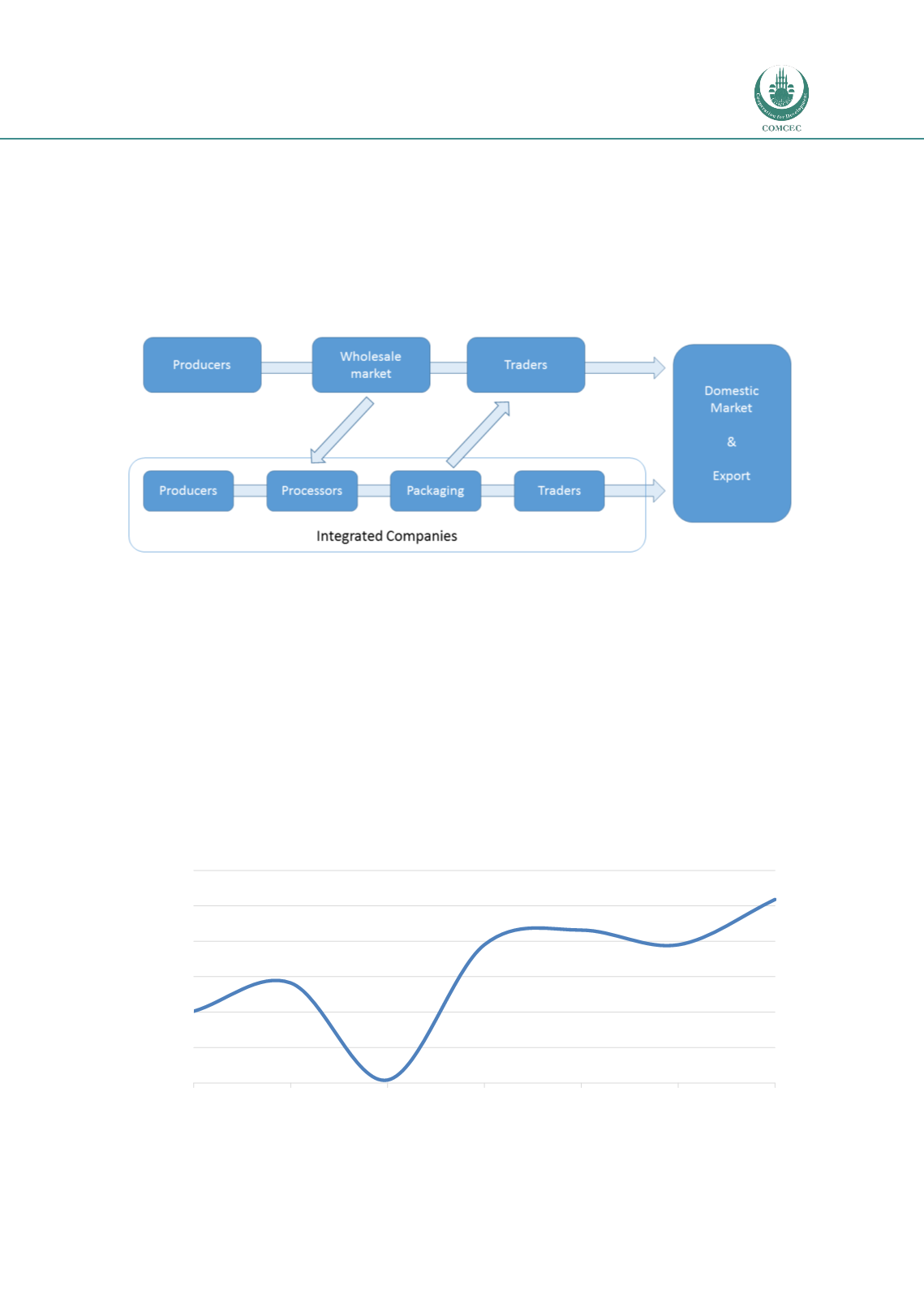

companies that own large palm groves for date production and have their own processing,

packaging and exporting activities (Beers et al., 2014). In this marketing channel proper

sorting, grading, washing, packaging, transport and storage are critical factors for quality

control and to ensure that the dates can either be exported or processed (Elsabea, 2012).

Figure 5-3 Date value chain in Saudi Arabia

Source: Authors’ elaboration

5.1.5

Trade

In 1999, Saudi Arabia established an export programme under the Saudi Fund for

Development (SFD) to encourage exports of dates and date products to existing markets and to

access new markets, as part of a broader policy initiative to diversify export revenues and

national income (Ali et al., 2014). However, exports of Saudi dates are still weak and stagnate

between 7-8 percent of national production (Ali et al., 2014; El-Habba & Al-Mulhim 2013). In

2013, exports of dates reached a value of US$ 103.6 million up from US$ 40.5 million in 2007

(se

e Figure 5-4).

Figure 5-4 Date exports from Saudi Arabia, 2007-2013

Source: IndexBox, 2015

0

20

40

60

80

100

120

2007

2008

2009

2010

2011

2012

2013

million US$