Promoting Agricultural Value Chains

In the OIC Member Countries

63

100% exemption of custom payments on importing technological equipment;

100% exemption from custom payments on importing raw materials not produced in Uzbekistan

(synthetic fibre, fabric, etc.);

15% discount from world cotton price;

Special rules to finance the cotton lint purchases by 15% cash payment and remaining 85% payable in 90

days, covered by bank guarantee;

Zero rating VAT (20%) on textile exports;

Up to January 1, 2016, exemption from paying import and customs duties on chemicals, dye-stuff,

accessories and fittings, as well as other auxiliary materials that are imported to the Republic for

production purposes, but are not manufactured domestically.

Source: USDA, 2014b

4.8

Trade costs and policies

Trade costs are influenced by distance and transport costs, tariff and non-tariff measures, and

logistics. Countries tend to use trade policy measures to discourage imports of foreign

products, together with industrial policy measures, in order to spur industrial growth and

economic diversification. Accordingly, support measures for particular sectors, combined with

tariff and/or other trade measures aim to protect them from foreign competition on the

domestic market and boost their export performance at the same time. Such trade policies

affect economic activity and well-being not only in the country enacting these policies but in

their partner countries as well.

A study undertaken by the Statistical, Economic and Social Research and Training Centre for

Islamic Countries (SESRIC) in 2014 found that trade costs in OIC countries are higher than in

developed and other developing countries. Trade costs among OIC Member Countries are

lower than trade costs between OIC and other developing countries, but significantly higher

than trade costs between OIC and developed countries (SESRIC, 2014).

On average, in developed countries trade costs fell about 20 percent between 1995 and 2010.

In OIC Member Countries trade costs only decreased 9 percent in the same period. OIC

Member Countries are, in general, more protectionist when compared to other countries.

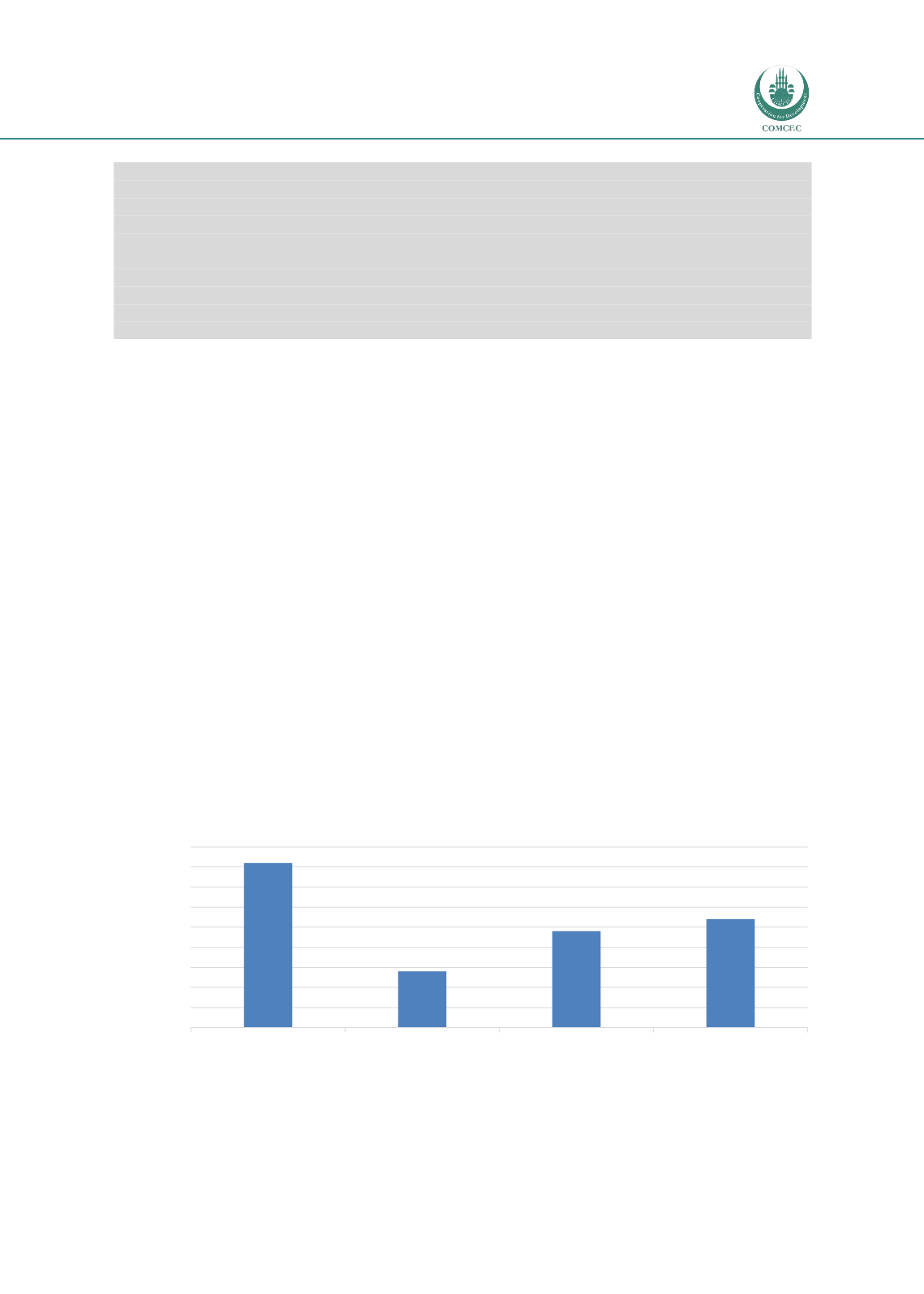

Figure 4-5below shows the OIC Member Countries tend to have higher tariff rates for

agricultural products than others:

Figure 4-5 Average tariff rates for agricultural products

Source: World Tariff Profiles, WTO/ITC/UNCTAD, 2014

12.5

13

13.5

14

14.5

15

15.5

16

16.5

17

OIC average

Other developing

World average

Developed

Percentage