Promoting Agricultural Value Chains:

In the OIC Member Countries

62

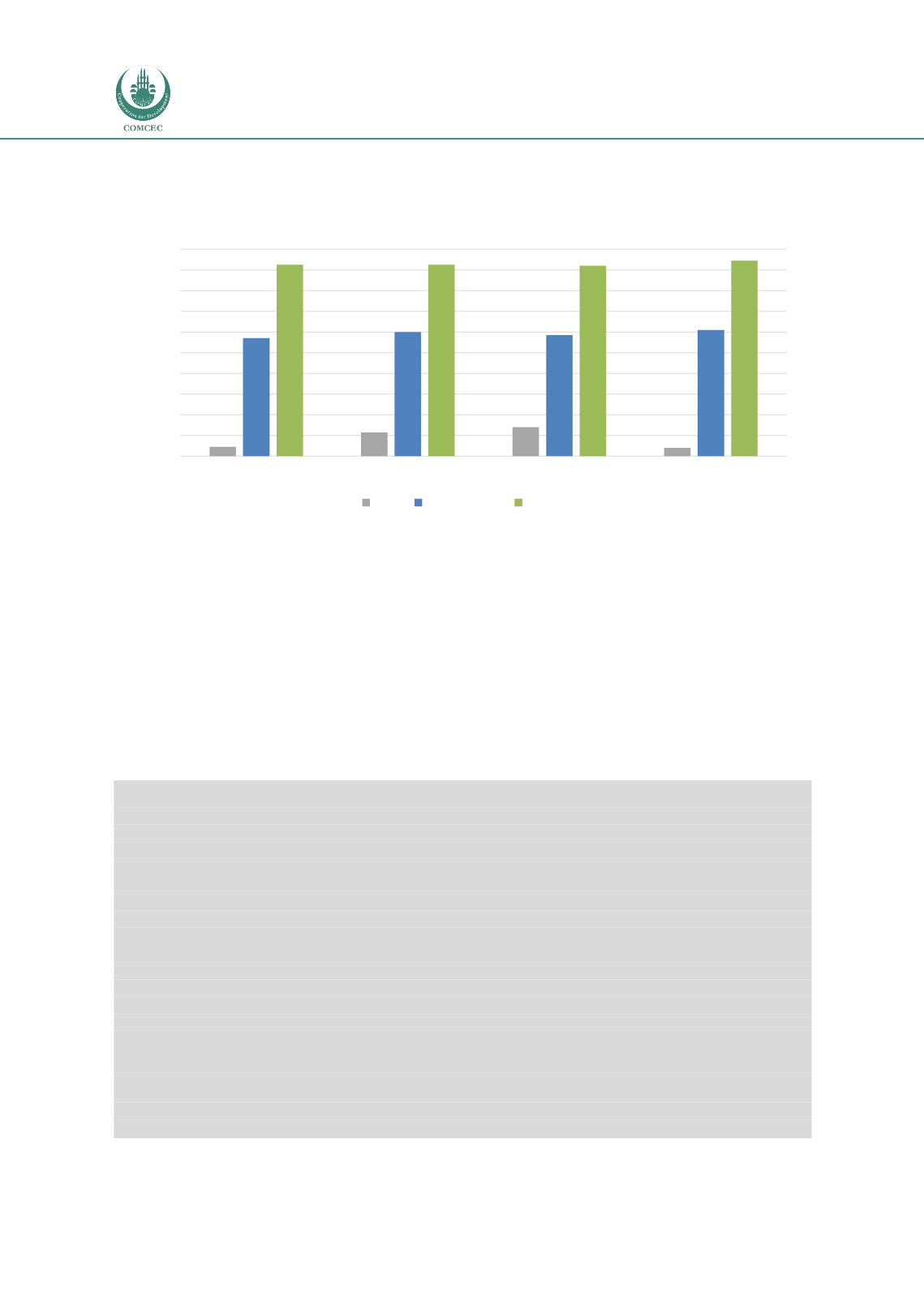

When looking at some of the indicators required for investment in agricultural value chains,

the picture is similar (se

e Figure 4-4).

Figure 4-4 Indicators for ease of agricultural investments, 2015

Source: World Bank Doing Business Study, 2015

Explanation: Number of ranked countries: 189. The higher the score of a country, the worse the business climate.

This means that procedures, time and costs to start a company are high; credit facilities are

difficult to access; and contract enforcement when dealing with suppliers or customers is

difficult. Addressing these issues has been identified as important for facilitating investments

in agro-processing facilities in OIC countries (COMCEC, 2013). Trading across borders is

particularly relevant for export purposes and the import of raw materials, machinery and

equipment. While OIC countries on average are ranked at a relatively low 122

nd

place, this is

one of the areas of the business environment where OIC countries have improved most over

the past year. For instance, Benin, Cote d’Ivoire, Morocco and Uzbekistan reduced the number

of documents required for customs; and Algeria, Jordan, Kazakhstan strengthened transport or

port infrastructure (World Bank, 2015).

Box 3. Uzbekistan’s investment in cotton value adding

Over the past five years, Uzbekistan’s cotton spinning and weaving industries have been investing heavily in

new equipment and upgrading of existing equipment to satisfy growing domestic and export demand for

cotton yarn. Many local textile mills are aiming to broaden their production assortment in order to expand to

high value added products. Currently, there are more than 50 joint ventures established in the textile industry

with partners from Turkey, Germany, South Korea, Japan and Switzerland. In 2013, total foreign investments

in the textile industry exceeded US$ 2 billion. The main products produced and exported by textile mills

remain cotton yarn (320,000 tons), grey fabrics (225 million sq. meters), knitted fabrics (55,000 tons), knitted

garments (179 million units) and hosiery (45 million pairs). Despite existing economic problems, the local

spinning industry is optimistic about textile production and export growth. In 2013, 252 enterprises of light

industry exported textile products worth of US$ 827 million, which is for 17 percent higher than in 2012.

Compared with 2012 levels, in 2013 export volumes of knitted linen have increased 2.2-fold, cotton yarn by

28.7 percent, fabrics by 27.7 percent and knitted garments by 23 percent. Currently, Uzbekistan exports its

textile products to 48 countries, including new exports markets such as Tunisia, Nigeria, Kenya, Sri Lanka or

Estonia.

The government also implemented a number of tax incentives to stimulate investment in value adding

activities in the cotton sector:

Producers of hosiery & ready garment are exempted from all taxes (except VAT);

Textile exporters (more than 80% to be exported) are exempted from property tax (3.5%).

Kyrgyz

Republic

Malaysia

Uzbekistan

UAE

Chad

Yemen

Suriname

Uzbekistan

0

20

40

60

80

100

120

140

160

180

200

Starting a business

Getting credit

Enforcing contracts Trading across borders

Country ranking

Best

OIC average Worst