Promoting Agricultural Value Chains

In the OIC Member Countries

17

The high growth rates of emerging and developing economies therefore put the spotlight

increasingly on regional market development, including intra-regional and South-South

trade.

However, many barriers continue hindering farmers and other value chain actors to

participate more profitably in regional or global trade. Tariff barriers, in particular, tend to

remain higher for agricultural products than for manufactured goods. Other market

interventions and non-tariff barriers, such as phytosanitary measures, further complicate

obtaining market access. Reports confirm that addressing tariff barriers would have

significant pay-offs. For instance, a study by Moise et al. (2013) finds that a decrease of

tariffs by 10 percent would lead to an increase of agricultural trade volume by about 3.7

percent. In light of the negative impact of tariffs on agriculture, trade policy, including

different forms of regional and international cooperation, has been identified as critical in

establishing reliable systems for moving goods.

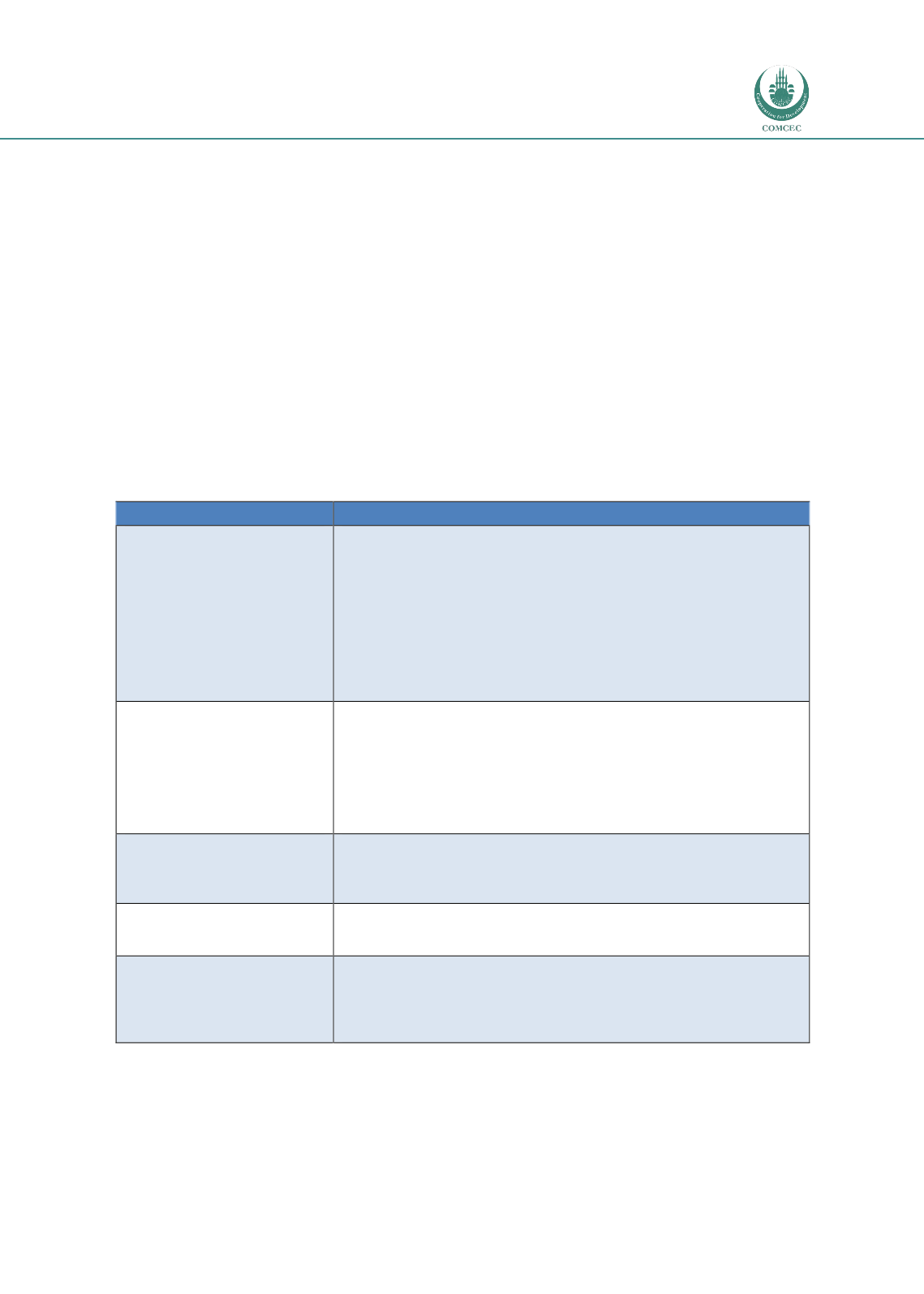

Table 1-1 Framework used to analyse agricultural value chains

Dimension

Indicators

1.

Institutional framework

and public policies

National strategy for agricultural development

Strategic focus on certain commodities/products

Support to chain actors and organisations, e.g. extension, research,

credit facilities, etc.

Specific governmental organisations that develops and promote the

subsector

International programs to support and develop agricultural value

chains

2.

Standards

Quality standards and control

Health & safety standards

Sector codes of conduct

Sustainability standards

Multi-stakeholder initiatives

Government support to help producers comply with international

market requirements, e.g. standards, MRLs, etc.

3.

Infrastructure and logistics

Opportunities and barriers in terms of existing infrastructure

Targeted investments by private and public actors

Electricity and water

Cold chain facilities, transport, processing facilities

4.

Governance and value

chain actors

Actors involved in the value chain

Linkages between actors

Marketing channels and markets

5.

Trade

Exports and imports

Value adding activities

Trade related obstacles (tariff barriers) and opportunities (tax

exemptions; preferential trading areas, free trade agreements)

Non-tariff barriers to trade (e.g. phytosanitary standards, etc.)