Facilitating Smallholder Farmers’ Market Access

In the OIC Member Countries

126

Promote Appropriate, Market-based Institutional and Organizational

Arrangements

Previous chapters have described how modern retailing outlets and supermarkets are

profoundly changing the structure of production and wholesale marketing. Supermarkets

and modern retail outlets increasingly bypass spot markets and turn to modern

procurement systems to source produce. They may rely on dedicated wholesalers or move

on to buy directly from farmers—individual farmers, farmers in chain-agribusiness

relations, or groups of farmers belonging to producer organizations or cooperatives.

Producers who supply supermarkets and processors frequently must conform to these

buyers’ private standards, which tend to exceed national standards.

199

Because it is

difficult for smallholders, with their very limited assets, to meet rigorous quality and

safety standards, smallholders’ exclusion from modern agri-food supply chains is a real

and growing concern. Supermarket buying agents and agents for other agribusinesses may

also prefer to purchase from medium and large farmers because the transaction costs are

lower than the costs of purchasing small amounts from a large number of dispersed

smallholders. Working with a group of farmers, rather than a large number of individuals,

also reduces the costs of disseminating information on agricultural practices, quality, and

other buyer requirements.

Modern food retail outlets (supermarkets and hypermarkets) account for an increasing

share of food retail in transforming, urbanizing, and urbanized economies

(Table 25). For

example, Turkey’s mini-markets, convenience stores, and supermarkets account for 54

percent of food retail; the comparable figures for Malaysia and Indonesia are 45 percent

and 44 percent, respectively. In other OIC member countries, such as Nigeria and

Bangladesh, traditional markets and grocery stores are still the main food retail formats.

As urbanization intensifies and incomes grow, however, modern retail formats are

expected to expand rapidly. In several Asian countries (China, India, Indonesia, and

Malaysia), supermarket sales expanded faster than GDP growth.

200

One reason for this

development is that as incomes grow and more consumers enter the middle class, food

safety becomes a more sensitive issue. As consumers become more aware of food safety

issues, they tend to shift from wet markets to supermarkets. Another reason for

burgeoning supermarket sales is that sourcing efficiencies and scale enable supermarkets

to charge lower prices than wet markets and attract even more customers.

201

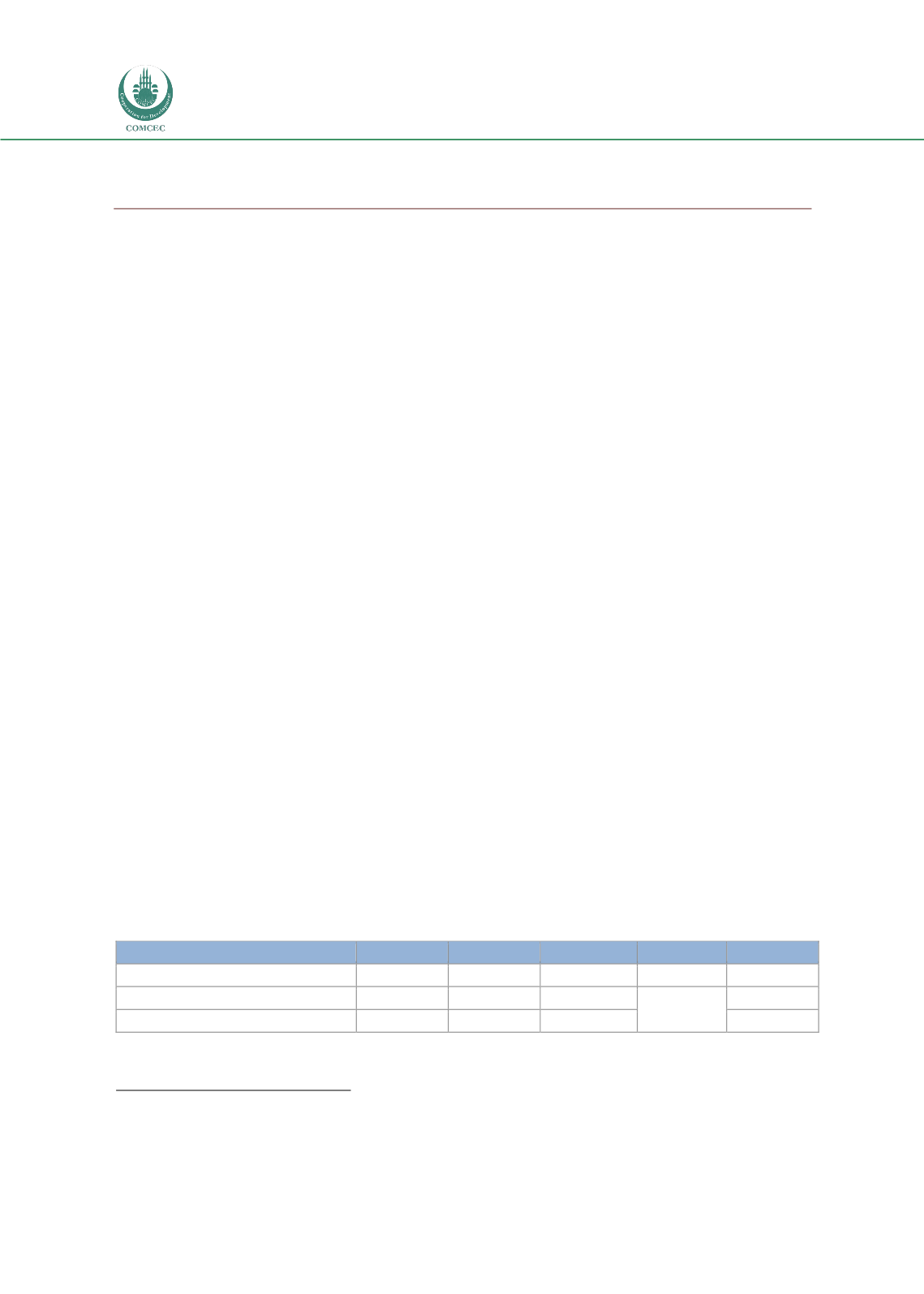

TABLE 25: PERCENTAGE SHARE OF FOOD RETAIL BY RETAIL FORMAT IN SELECTED OIC

COUNTRIES

Food retail format

Indonesia

Nigeria

Bangladesh

Turkey

Malaysia

Traditional markets, grocery stores

55.8

65

–

46

56

Mini markets, convenience stores

22.4

34

–

54

a

1

Supermarkets, hypermarkets

21.8

1

2

43

Source:

USDA Gain Reports.

a

Includes mini-markets, convenience stores, and supermarkets.

199

Reardon (2011).

200

Reardon (2011).

201

Reardon (2011).