85

6.2. Case Study: Saudi Arabia

6.2.1. Background

The Islamic financial services industry in Saudi Arabia has rapidly grown over the years to the

extent that the Kingdom is now considered among the front-runners of Islamic finance. Saudi

Arabia is one of the leading countries in the Islamic finance industry globally and has a deep-

rooted history in the industry compared to other Muslim countries. Currently, the position of

the country is stable in all the three segments of Islamic finance, namely Islamic banking, capital

market and

Takaful

. Saudi Arabia is the largest

Takaful

market (with 38% of global

Takaful

contributions), followed by Iran (34%), Malaysia (7%) and the UAE (6%). However, as a result

of the economic slowdown due to low oil prices in 2018, the growth in Saudi Arabia dropped to

2.1% (IFSB, 2018).

In Saudi Arabia, the

Takaful

industry, which is called cooperative insurance, is based on a

cooperative model enforced by the Cooperative Insurance Companies law issued in 2005. The

cooperative insurance industry consists of 33 cooperative insurance and reinsurance, 38

Brokers, 68 Agents, 3 Consulting firms, 13 Loss Assessors and Loss Adjusters, 10 Third Party

Administrators, and 3 Actuarial Services (

SAMA, 2019a

).

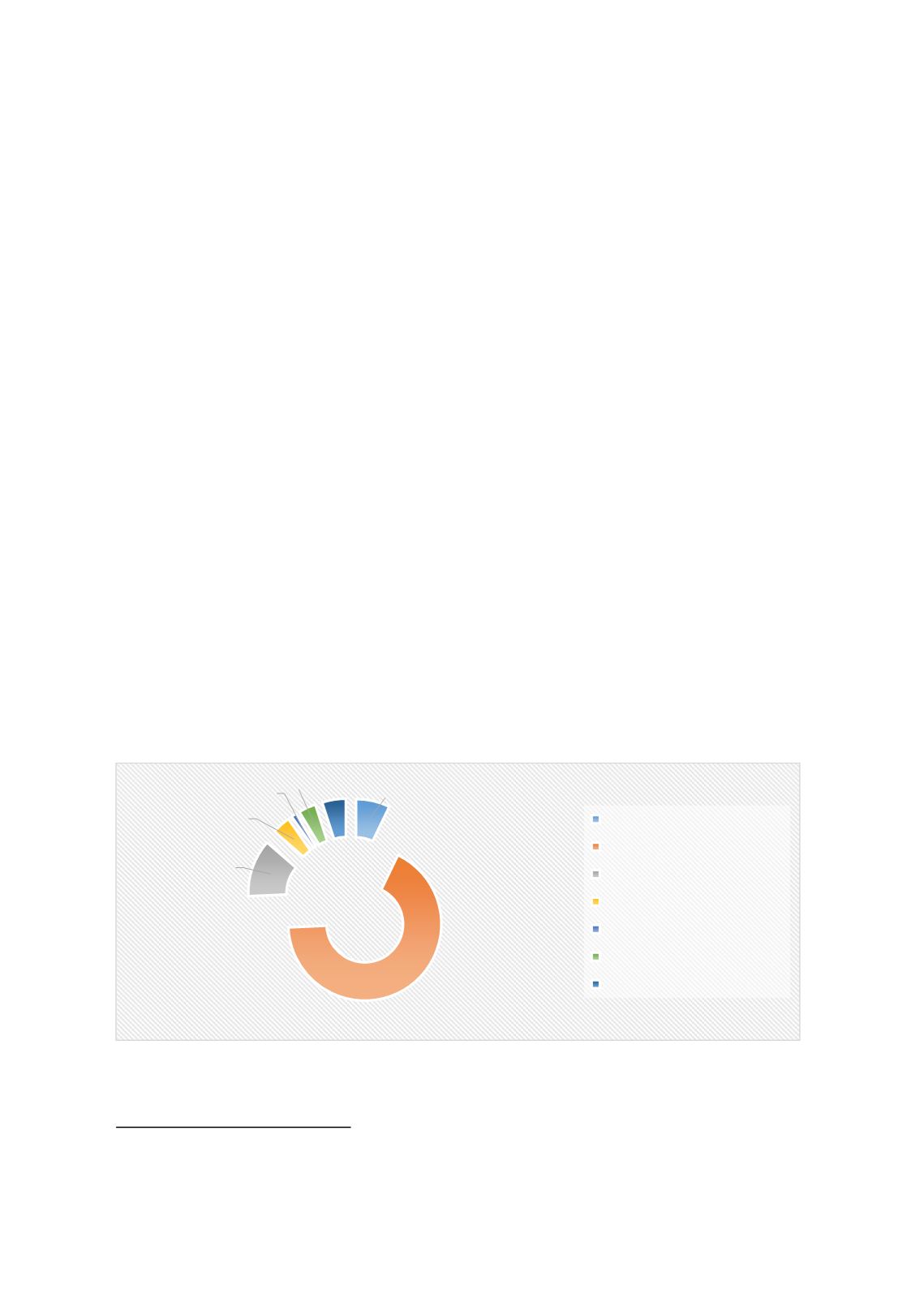

The cooperative insurance in Saudi Arabia consists of General cooperative insurance, health

cooperative insurance and life cooperative insurance. General cooperative insurance consists of

Motor 67%, followed by Property/ Fire 12%, Accidents, Liability and Others 5%, Engineering

5%, Energy 4%, Marine 4%, and lastly Aviation 1% as of 2018 as presented i

n Figure 14 below:

F

IGURE

14: G

ENERAL

T

AKAFUL

C

OMPONENTS IN

S

AUDI

A

RABIA

(2018)

Source: SAMA Yearly Statistics 2018

12

12

www.sama.gov.sa/en-US/EconomicReports/Pages/YearlyStatistics.aspx7%

67%

12%

4%

1%

4%

5%

Accidents, Liability and Others

Motor

Property / Fire

Marine

Aviation

Energy

Engineering