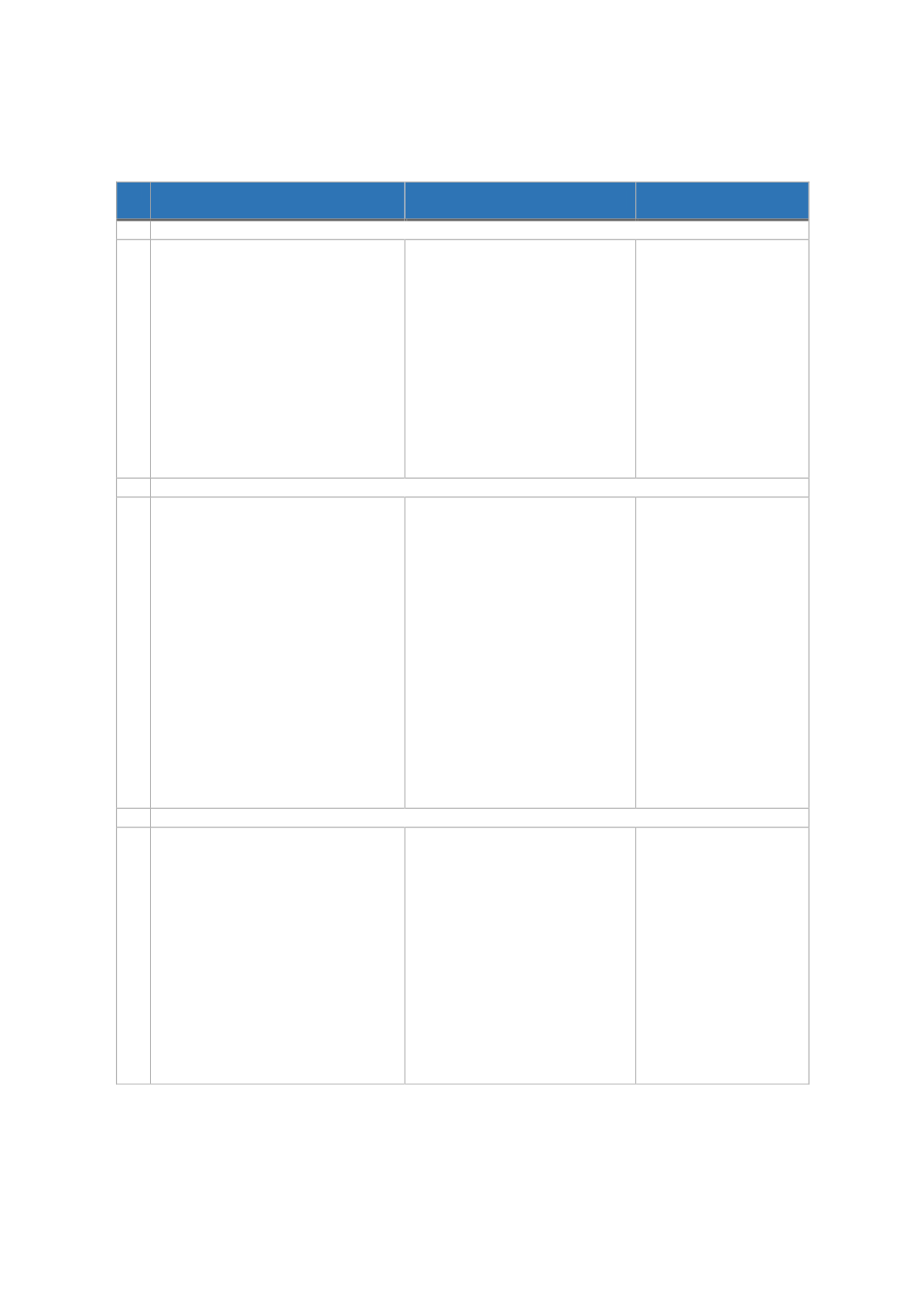

122

T

ABLE

20:

I

SSUES AND

P

OLICY

R

ECOMMENDATION FOR THE

UK

Issues

Recommendations

Implementing

Authority

1.

National Policy

Apart from the

Takaful

Alternative Student Finance,

the UK has not projected the

Takaful

sector as a prime

policy of the government as it

did in the Sukuk sector.

As an international financial

centre, the UK has not been

exporting its

Takaful

models

to other jurisdictions as it has

done in the conventional

insurance sector.

Take relevant step to

promote

Takaful

as part of

the general policy of

financial inclusion in the

UK.

To support

Takaful

initiatives, including the

efforts of the Islamic

Insurance Association of

London (IIAL) in

projecting London as a

global financial centre.

Relevant

government

ministry

Relevant

government

ministry and IIAL

2.

Legal and Regulatory Framework

There are no relevant

provisions on

Takaful

or

alternative insurance

arrangements in the Financial

Services and Markets Act

2000 and Financial Services

and Markets Act 2000

(Regulated Activities) Order

2001.

Prudential standards and

Shari'ah

governance need to

be tailored to the UK

Takaful

needs

Relevant provisions

should be introduced into

the laws to reflect

alternative insurance

arrangements. Since tax

issues may still evolve in

some

Takaful

models, and

there is a need to level the

playing field.

Since the Bank of England

is a member of the Islamic

Financial Services Board,

there is some scope for the

adoption of best practices

in

Takaful

and

Re-Takaful

sector in the UK

Relevant

government

ministry

Bank of England,

Financial Conduct

Authority,

Prudential

Regulation

Authority, IFSB

3.

Takaful

Operators and Product Development

Since some early experiments

of

Takaful

in the UK failed,

there has not been many

efforts on product

development.

The education

Takaful

model

in a secular environment

known as

Takaful

Alternative

Student Finance will serve as

a good model for other

Western countries.

There should be proactive

measures towards

product development to

ensure

Takaful

products

are not only seen as

Shari'ah

-compliant but are

conventionally viable and

competitive.

Other jurisdictions,

including OIC countries,

may introduce such

education

Takaful

for

student financing.

TOs and IIAL

OIC member

countries

Source: Authors