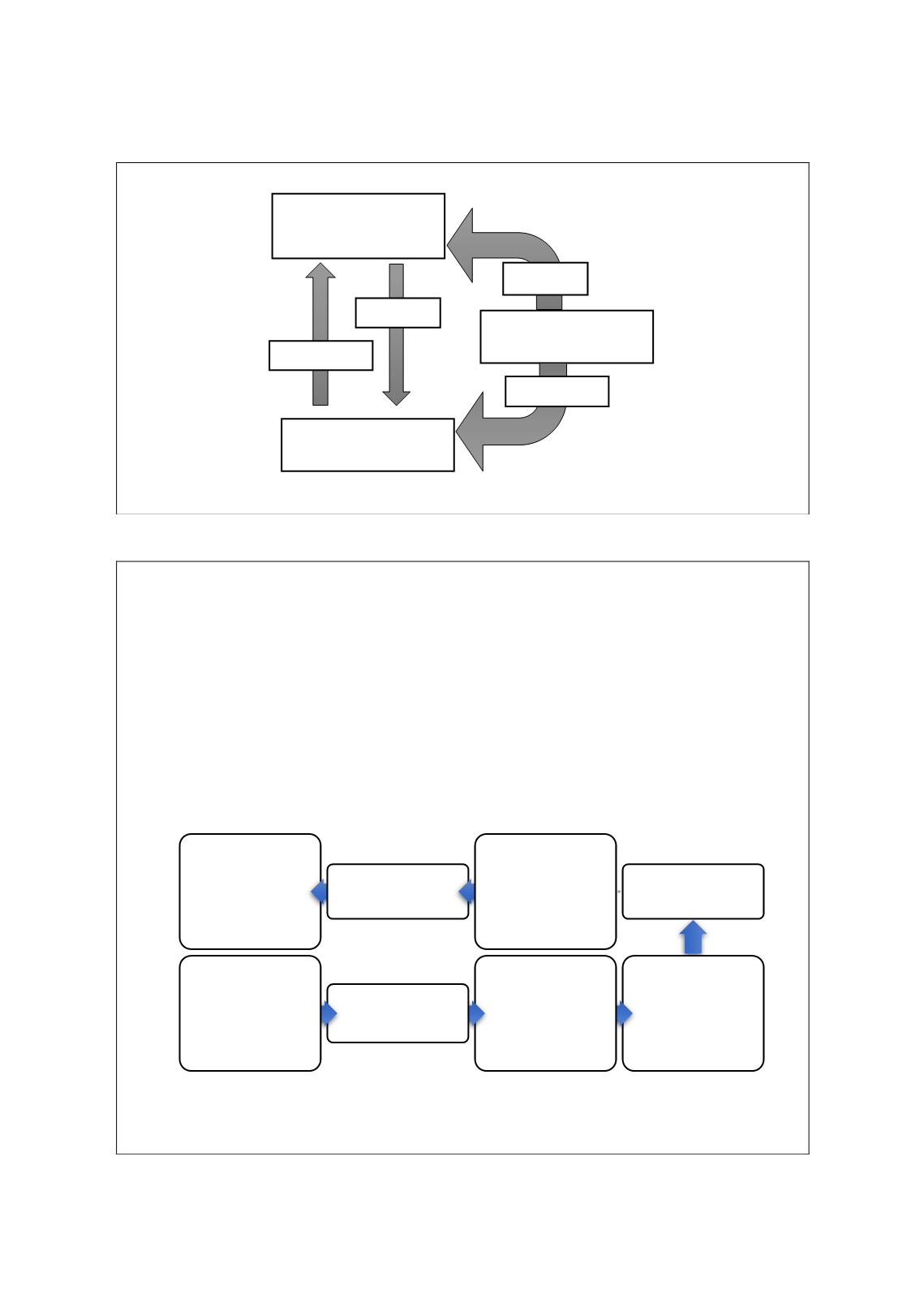

120

Model 2

F

IGURE

29: C

OBALT

T

AKAFUL

M

ODEL

Source: Cobalt (2014)

Takaful Alternative Student Finance

The

Takaful

Alternative Student Finance (TASF) model is a unique product backed by

legislative intervention in the UK and ready to be rolled out to students in 2020. In 2012, the

UK government, through a survey, sought the views of major stakeholders in the UK and

beyond to provide

Shari'ah

-compliant student loans for Muslims. It is meant to promote

financial inclusion, particularly to avoid a subtle exclusion of those who are averse to interest-

bearing student loans due to their religious beliefs. After a series of exploration, the final

model which has gone through necessary

Shari'ah

filters is presented i

n Figure 30.F

IGURE

30: T

HE

S

TRUCTURE OF

T

AKAFUL

A

LTERNATIVE

S

TUDENT

F

INANCE

Source: Adopted from Alamad (2019)

It is pertinent to briefly analyse how this ground-breaking model will be utilised for

Shari'ah

-

8. Student applies for

funds through Student

Loans Company (SLC)

7. Takaful finance fund

6. Student payments

remain in the fund

and are used to

provide finance to

future students

5. Takaful finance fund

4. Revenue and

Customs (HMRC)

3. Student makes

payments via the tax

system back into the

fund when they are

above the repayment

threshold

2. Takaful finance fund

1. Fund provides

finance to the student

(during the period of

study)

Policyholder/

Cedant

Cobalt

Broker

Advice

Claims

Premiums

Placement