National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

132

Islamic finance. While Senegal was first to issue a sukuk and is poised to become a hub for

Islamic finance in the West African region, the country has to overcome the regulatory

environment challenge of allowing Islamic finance institutions to prosper through a specific

legal infrastructure taking into account all of its specifics. One of the problems of developing a

sound financial architecture for Islamic finance is that Senegal has to follow the laws and

regulations at the regional level. For example, while the Central bank of West African States

(BCEAO) was a pioneer in 1982 to allow Islamic banking under the existing laws, not much has

been done to meet the specific needs of the Islamic financial industry. The promotion of Islamic

finance in the country would require more specific financial infrastructure that can support the

industry and cater to the huge demand in Islamic finance products in the country.

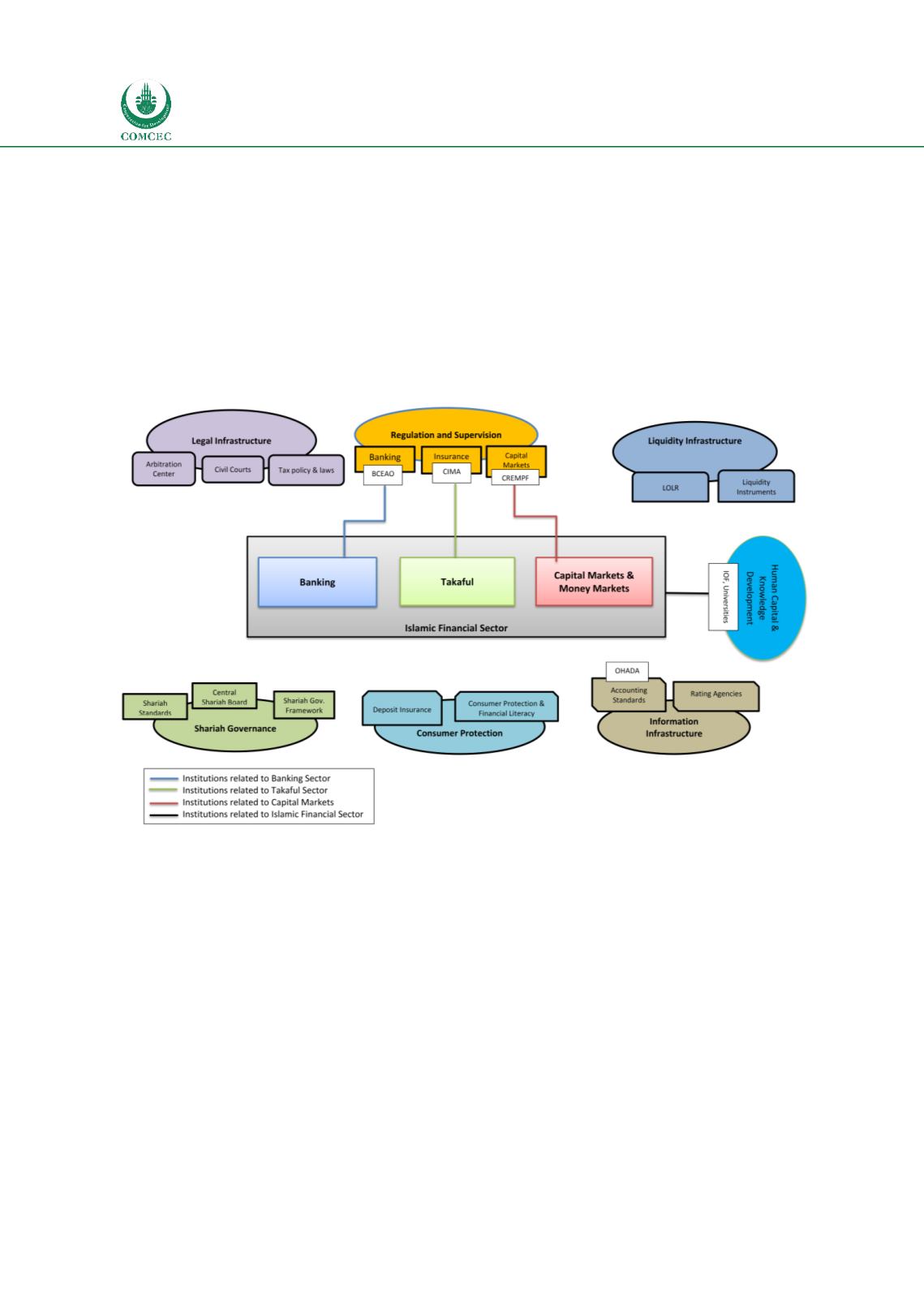

Chart

4.9: Islamic Financial Architecture Institutions—Senegal