National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

127

capabilities. Also, it offers specialized training courses and Qualifying Examinations such as the

Retail Banking Professional Certificates and Saudi Stock Exchange (Tadawul) to certify

brokerage firms’ employees to work on the Saudi brokerage system (Institute of Finance,

2016).

One of the first research centers in Islamic economics “Islamic Economics Research Center”

was established at King Abdul Aziz University in Jeddah, Saudi Arabia in 1977. It was later

converted to the Islamic Economics Institute in 2011. Several universities have also initiated

academic programs in Islamic banking and finance. ICD and TR (2015: 119) report that that

there are 20 organizations offering courses in Islamic finance in Saudi Arabia.

4.8.8. Summary and Conclusions

While the constitution and laws of the country stipulate that Shariah is the basis of the legal

system in Saudi Arabia, specific issues related to the financial infrastructure for Islamic finance

appear to be lacking. Currently, the legislative and regulatory framework applied to Islamic

banking and finance is similar to that of the conventional system. In order to reduce

uncertainty and other associated risks in the application of Islamic finance, there is a need to

make the application of Shariah to Islamic finance more transparent and accessible by

codifying all associated laws. When this is successfully done, there is also the need to

harmonize all the existing committees into a form that is much more easily accessible by

surrendering all their functions to a specialized court. This means that the rules and principles

of Shariah should be enforced as the primary source of law. Islamic financial products should

be supervised and approved by a single Shariah board consisting of jurists, lawyers,

economists and others. This should have a positive effect in helping to develop the rules,

reducing the risk of disputes, realizing the objectives of Shariah and instilling confidence in the

market.

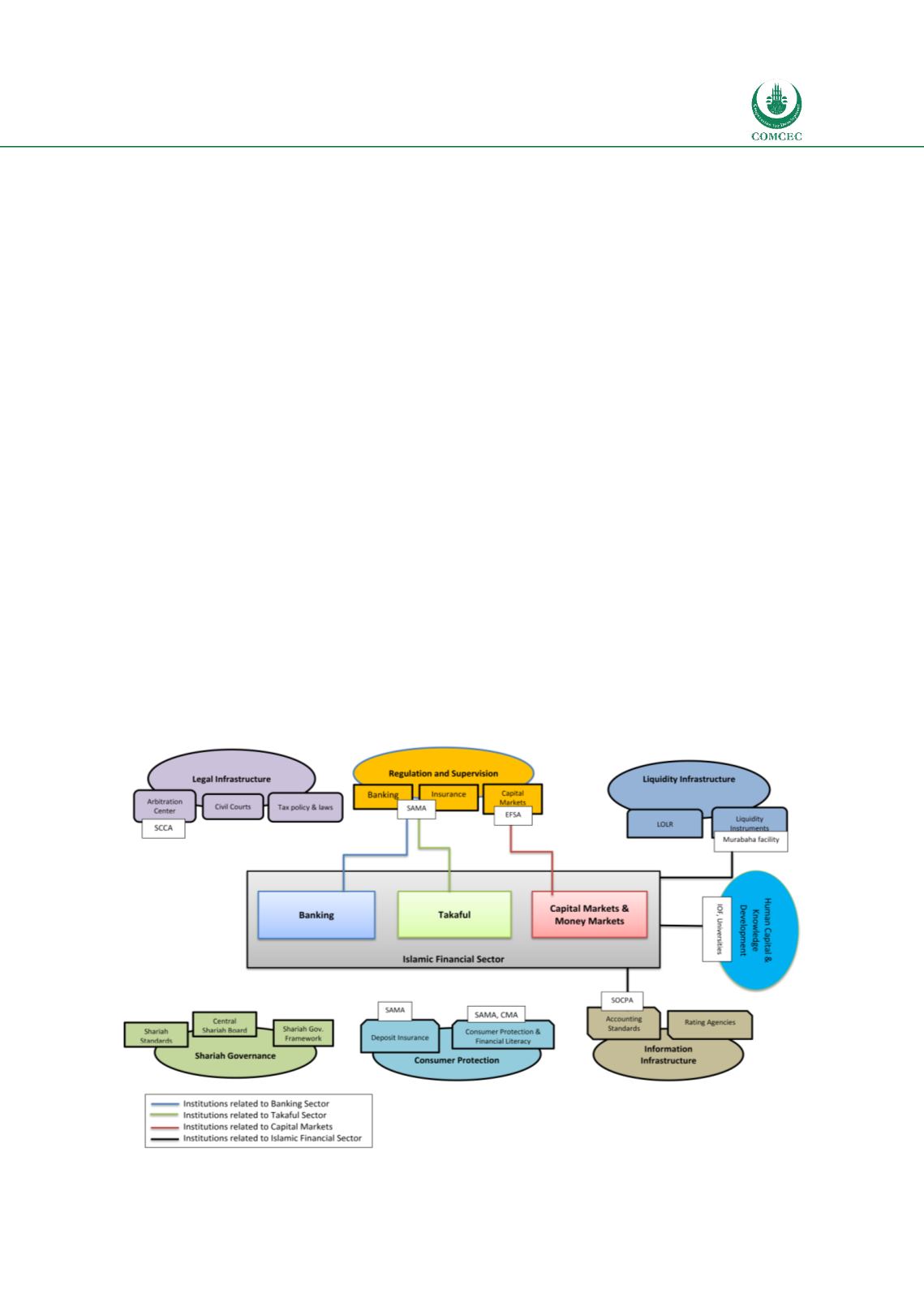

Chart

4.8: Islamic Financial Architecture Institutions—Saudi Arabia