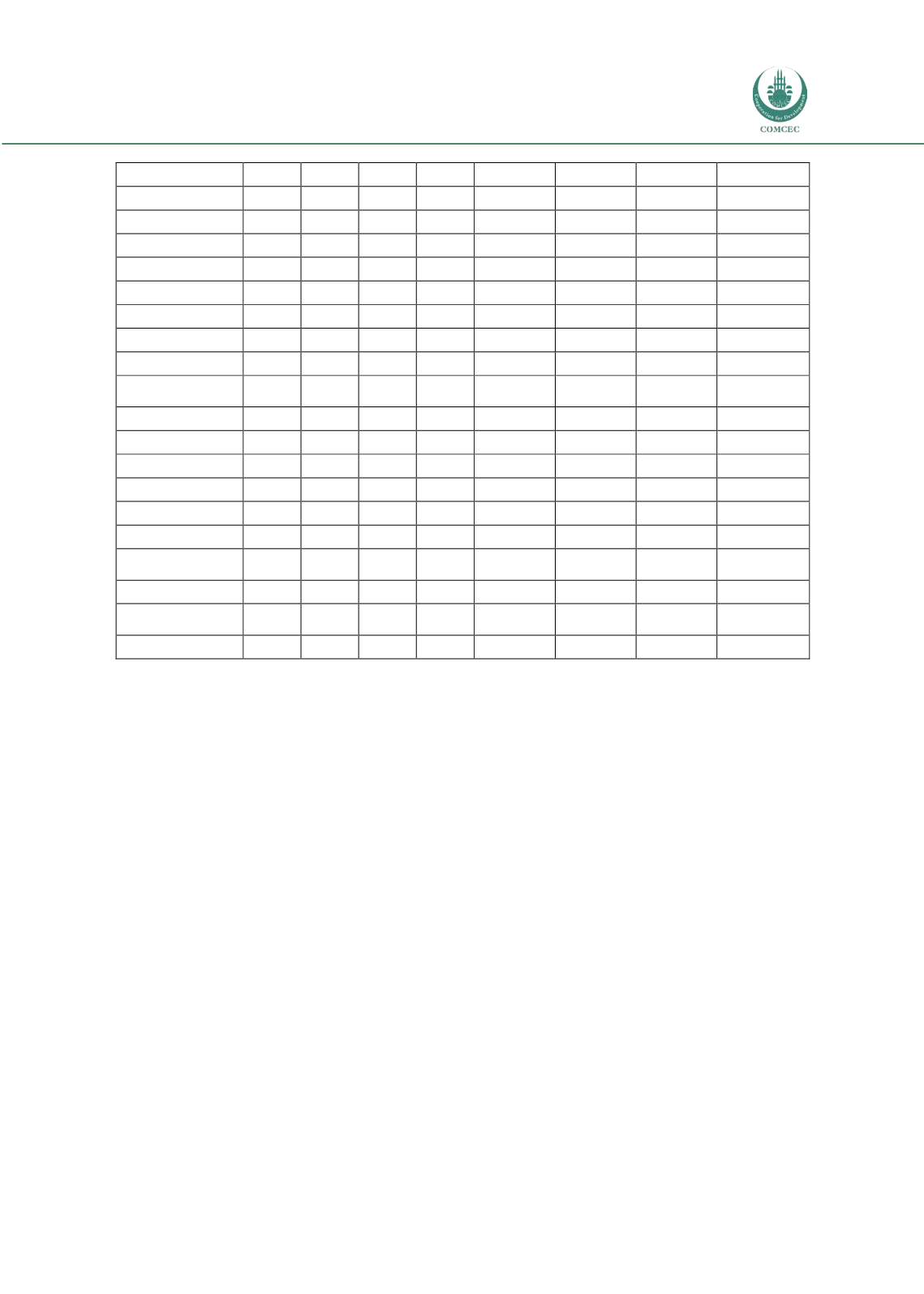

Retail Payment Systems

In the OIC Member Countries

41

Oman

48.00

70.22

159.00

157.75

..

..

..

..

Pakistan

9.00

13.80

61.81

73.33

4.73

0.13

2.94

8.71

Qatar

69.00

91.49

120.48

145.76

51.82

..

..

..

Saudi Arabia

47.50

63.70

194.51

179.56

60.70

11.53

63.62

69.41

Senegal

9.80

17.70

70.16

98.84

4.57

1.08

5.87

11.92

Sierra Leone

0.90

2.10

36.43

76.66

0.41

0.65

5.19

14.15

Somalia

1.25

1.63

18.17

50.90

..

0.59

2.36

7.86

Sudan

17.30

24.64

68.78

72.20

3.51

0.40

10.34

15.27

Suriname

32.00

40.08

100.71

170.57

36.84

..

..

..

Syrian Arab

Republic

22.50

28.09

59.24

70.95

7.40

..

..

..

Tajikistan

13.03

17.49

80.92

95.13

6.64

0.75

4.16

11.46

Togo

3.50

5.70

41.64

68.97

3.20

0.52

2.27

17.61

Tunisia

39.10

46.16

115.20

128.49

21.72

6.83

12.25

27.26

Turkey

43.07

51.04

89.41

94.79

58.84

32.82

43.25

56.51

Turkmenistan

5.00

12.20

103.79

135.78

..

0.00

1.24

1.79

Uganda

13.01

17.71

47.50

52.43

3.68

1.65

17.82

27.78

United Arab

Emirates

78.00

90.40

131.40

178.06

54.35

37.42

76.90

83.20

Uzbekistan

30.20

43.55

90.37

73.79

4.36

1.40

24.63

40.71

West Bank and

Gaza

41.08

53.67

70.12

72.08

16.42

..

..

..

Yemen, Rep.

14.91

22.55

50.07

68.49

3.67

0.37

1.86

6.45

Source: World Development Indicators (Last Updated: 07/28/2015)

While we can gain some understanding of the scale of retail payment systems overall in the

OIC, it is difficult to make accurate comparisons since some data are not available for certain

items/countries/years. Neverthless, we can note certain commonalities and a few key

differences. We shall see in the case studies in chapter 4 that the interrelationships and

dynamics of key institutions create specific conditions that allows us to explain the character

and trends of payment systems with greater confidence.

First and foremost, almost all countries have their own networks of ATMs installed. This gives

an indication that electronic retail payments in that form are available in all those countries.

However, we lack information regarding the kinds of operator/switch systems used. We

cannot yet compare, for example whether they are inter-operable or whethre the transactions

are processed in real time. The highest proportion of ATM users are in Brunei Darussalam

(78.96), Kazakhstan (65.45), Saudi Arabia (60.70), and Turkey (58.84). The lowest are in

Sierra Leone (0.41), Chad (0.48), and Afghanistan (0.64).

With regard to card payments, it appears that debit cards in general tend to be more popular

than credit cards. The highest rate of debit cards use is in the United Arab Emirates (76.90),