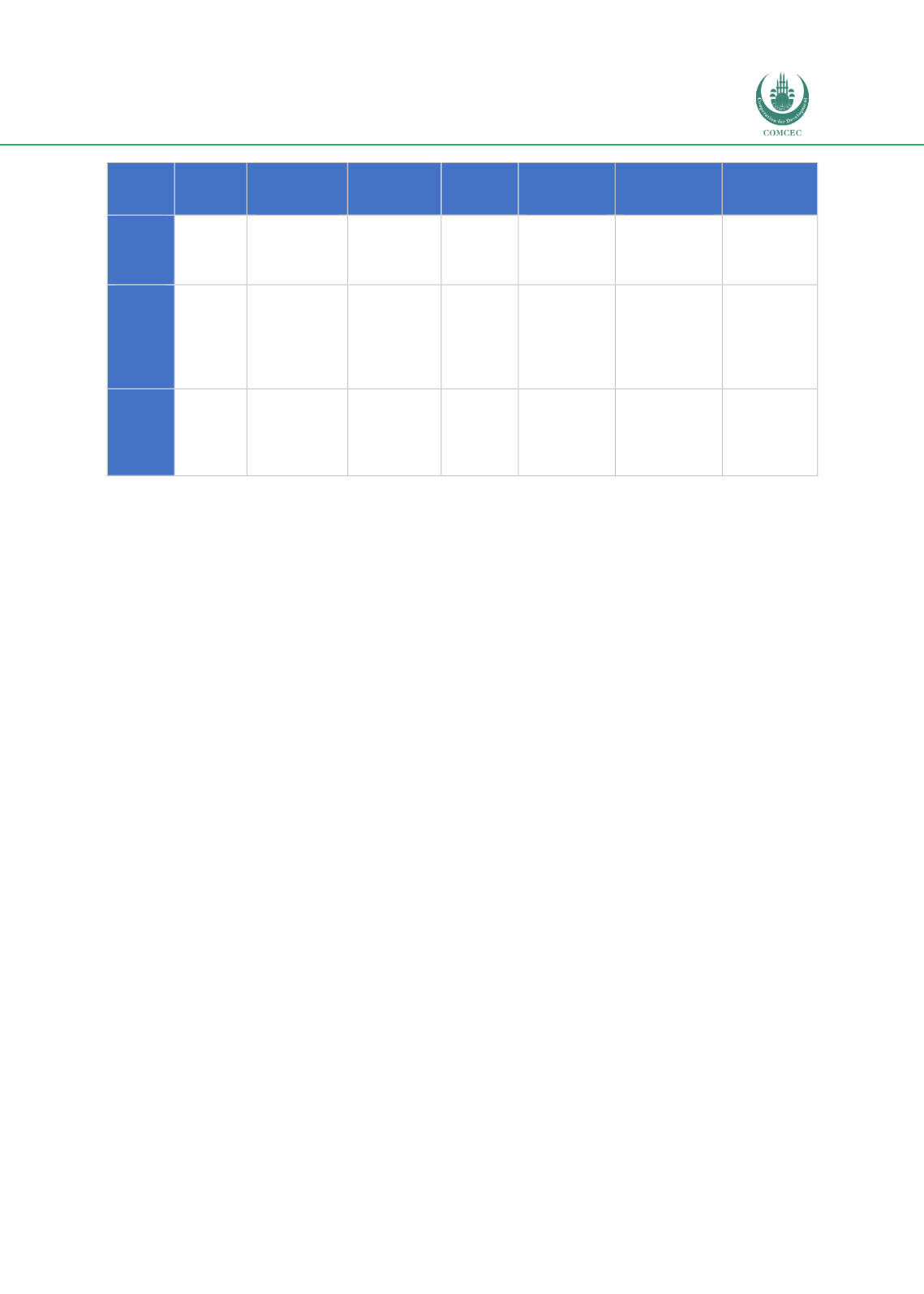

Islamic Fund Management

33

Vehicle Publicly

Offered

Redemption

& Trading

Practice

Settlement

Method

Solvency

Risk

Leverage

via

Borrowings

Portfolio

Leverage

(Derivatives)

Investor

Base

ETF

Yes

Infrequent

(primary)

Intraday

(secondary)

In kind

(primary)

Cash

(secondary)

Low

Possible,

with cap

Yes, with cap

Retail,

institutional

Private

Equity

Fund

No

Not

applicable

(close-

ended, with

long-term

finite life)

Cash

High

Some yes,

no cap

No

information

Institutional

Hedge

Fund

No

Quarterly +

lock-up + 90

days

advance

notice

Cash

High

High, no cap

High, no cap

Institutional

Source: IMF (2015, April, p 98)

In a

wakalah

-based (i.e.

wakalah

between investors and fund manager) Islamic fund, the

investors/unit holders are the principal (

muwakkil

) who act like partners (

musharik

) among

each other, and the fund manager is the agent (

wakil

) entrusted with the management of the

funds. In this case, the investors will share among themselves the profits in proportion to their

capital contributions or based on an agreed profit-sharing ratio that is determined upfront.

Meanwhile, the fund manager may charge an upfront fee before the funds are invested, or

charge performance-related fees. The fund manager is not liable for any loss of investment

value except in the case of negligence, misconduct or breach of terms. However, it is the duty of

the fund manager to employ appropriate risk-management tools and techniques that comply

with Shariah principles. In addition, the fund manager must ensure that investments in Islamic

funds do not entail any Shariah prohibitions such as speculation and gambling. As such, highly

leveraged investments should be strictly avoided.

2.2.2

The Importance of Fund Management in Islamic Capital Markets

Efficient financial intermediation

is key to channelling capital from domestic and foreign

sources to fund the needs of users of capital. Different financial intermediaries, including

AMCs, as illustrated in

Figure 2.9 ,play their unique roles in mobilising the entire financial

system, thereby creating an effective transfer of risks and management of liquidity, regardless

whether they are Islamic or conventional entities.

In this context, AMCs receive funds from various sources, including commercial banks,

insurance companies, pension funds, mutual funds, business entities, government institutions

and retail investors. They then channel those funds for investment in the financial markets.

Financial intermediation via AMCs helps investors to easily diversify their assets and provide

funding to the real economy, even when banks face financial distress. Banks, due to their

fractional reserve capital structure and regulatory issues, are prevented from funding capital

users in the same way as AMCs. The latter can invest funds in many more ways than banks

(which tend to provide debt funding to other banks, governments, larger companies and retail