Islamic Fund Management

32

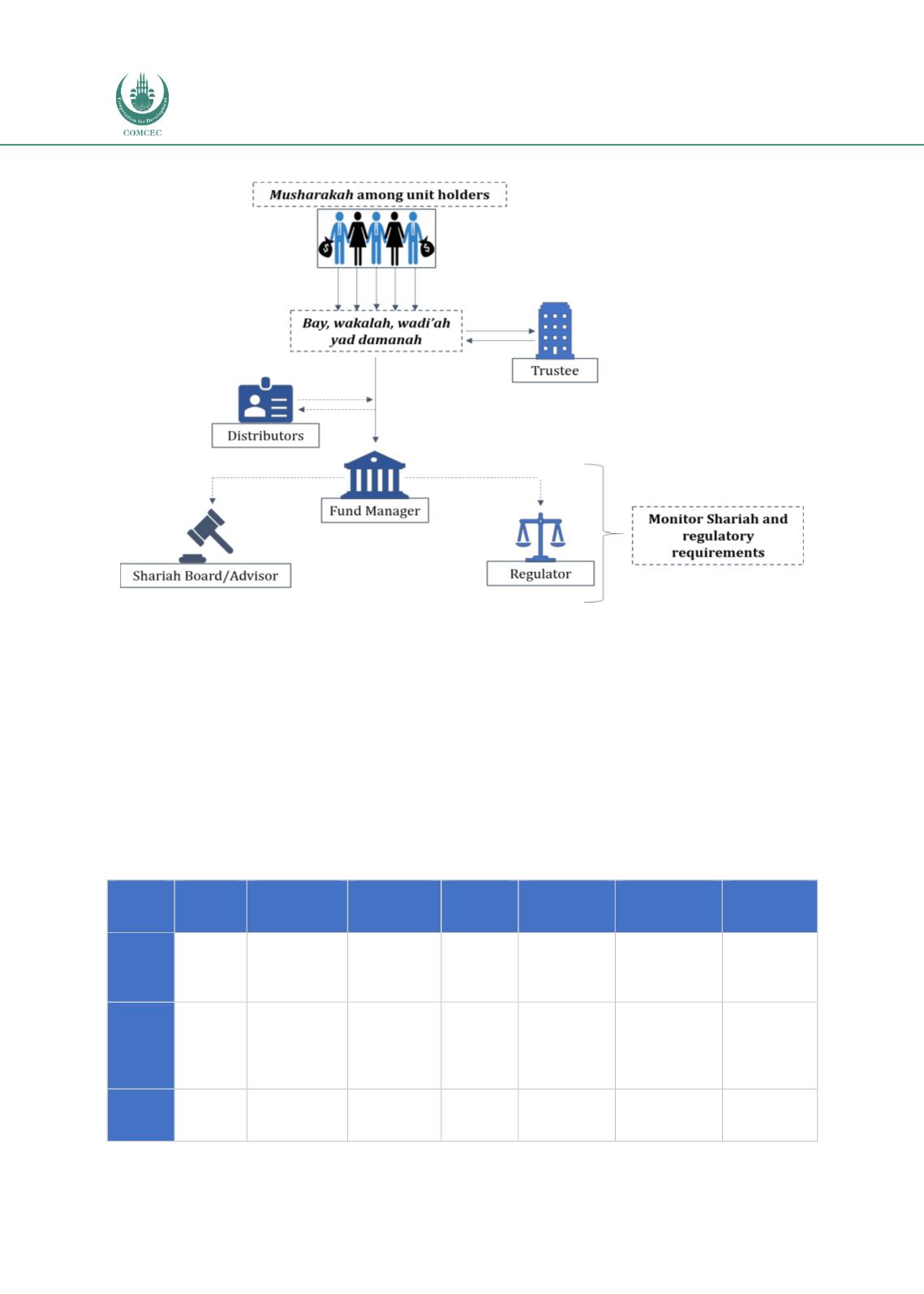

Figure 2.8: Shariah Contractual Relationships in an Islamic Fund

Sources: Adapted from ISRA (2015), ISRA

Profit- and Loss-Sharing Mechanism of Islamic Funds

The profit- and loss-sharing mechanism features prominently in all Islamic fund management

products; the underlying concept is purely based on risk and reward. The risks taken should

commensurate with the returns gained and the losses suffered; the higher the risk, the higher

the return and loss and

vice versa

.

As risks and rewards are interdependent, it is important to

be prudent when determining the investment strategies and asset allocations of Islamic funds.

The IMF’s study (2015, p. 97) on various types of conventional mutual funds shows that plain-

vanilla and ETF structures are less risky than hedge funds (which can incur high leverage costs

and adopt complex strategies with less disclosure requirements), as depicted i

n Table 2.5 .Table 2.5: Characteristics and Risk Profiles of Major Categories of Investment Funds

Vehicle Publicly

Offered

Redemption

& Trading

Practice

Settlement

Method

Solvency

Risk

Leverage

via

Borrowings

Portfolio

Leverage

(Derivatives)

Investor

Base

Open-

Ended

Mutual

Fund

Yes

End of day

Cash

Low

Possible,

with cap

Yes, with cap

Retail,

institutional

Close-

Ended

Mutual

Fund

Yes

Not

applicable

(primary)

Intraday

(secondary)

Cash

Low

Some yes,

with cap

Yes, with cap

Retail,

institutional

Money

Market

Fund

Yes

End of day

Cash

Low

Possible,

with cap

Yes, with cap

Retail,

institutional