The Role of Sukuk in Islamic Capital Markets

23

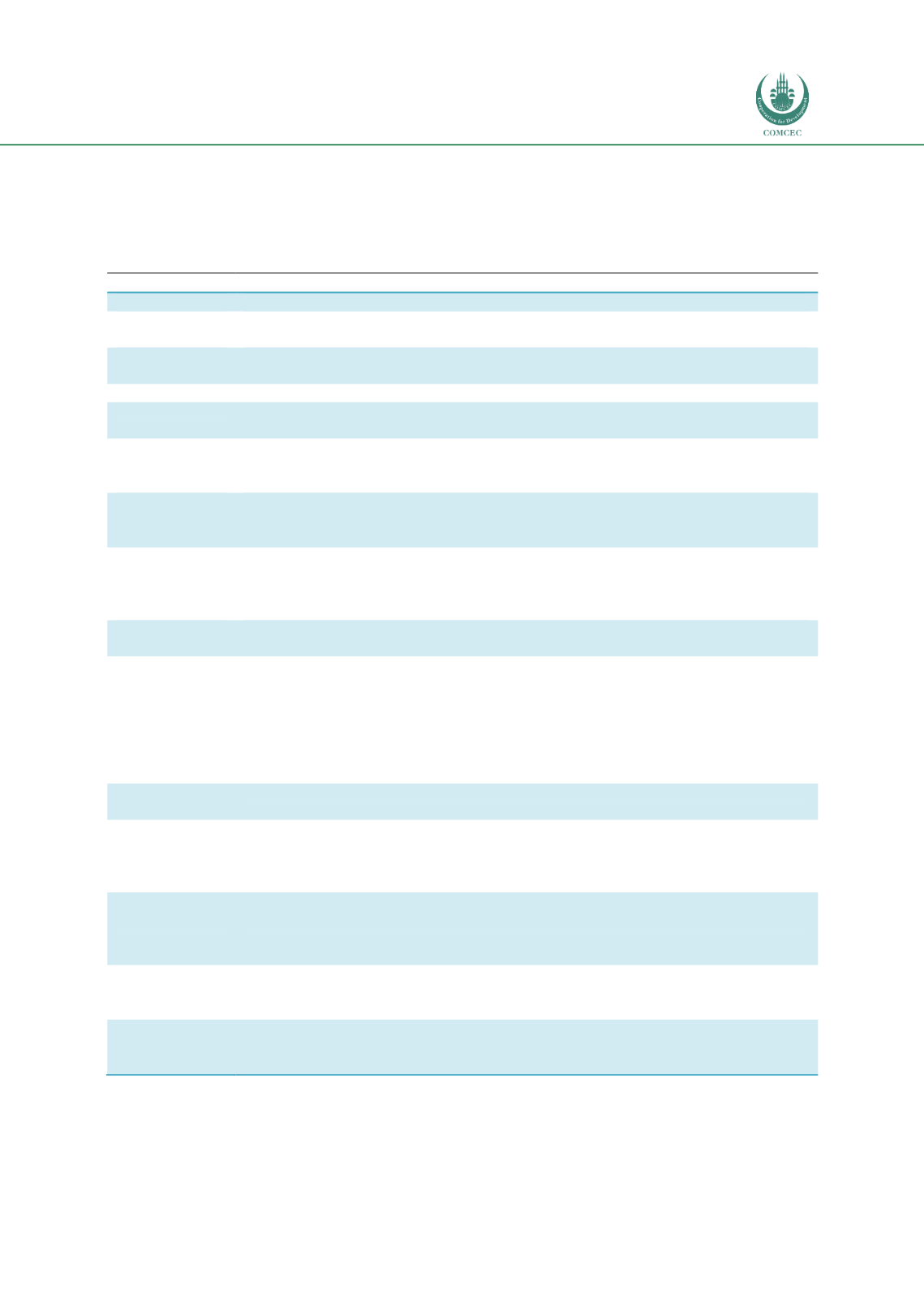

Nonetheless, any generic sukuk issuance would involve the parties listed in Tables 2.2 and 2.3.

While Table 2.2 describes the essential or required parties and their roles, Table 2.3 delineates

some optional parties involved in a sukuk issuance.

Table 2.2: Required Parties in Sukuk Issuances and Their Roles

Parties

Roles and Responsibilities

Issuer

An entity which offers and issues the sukuk; can either be the obligor or an SPV.

Obligor

An entity which needs the funding and is responsible for paying the sukuk holders –

coupon payments and principal amount at redemption.

Originator

An entity which sells the asset(s) to the SPV issuer and receives the proceeds from

the sale of the sukuk. Can also be the obligor or related to the obligor.

Sukuk holder

Owner of the sukuk; can either be the primary subscriber or a secondary investor.

Primary

subscriber

Entity or individual that subscribes to the sukuk offering and is the first holder.

Special-

purpose

vehicle

An entity incorporated in onshore or offshore jurisdictions; this corporate entity is

used to nominally own assets and/or facilitate other aspects of the sukuk issuance

and structure for various purposes, including tax efficiency and asset protection.

Shariah

adviser

The formal authority which approves the sukuk structures in terms of Shariah

compliance; it can be at the institutional level issuing the sukuk and/or at the central

level (e.g. the SAC of the SC).

Regulator

Sovereign approving body; all capital market offerings need to be approved or

exempted by a regulator. Typically, there is a main regulator where the sukuk

is

primarily offered (in the country of the obligor), but international-currency issuances

will need to be approved by the relevant regulators.

Credit

enhancer

A third party (e.g. a government agency, bank or

takaful

company) or a related party

(holding company) that provides a guarantee or some form of credit enhancement.

Investment

bank

A single or small group of investment banks which primarily act the

lead arranger

(arranging the sukuk

offering, advising the issuer/obligor on market conditions, and

coordinating the offering, including marketing); a

rating adviser

(providing advice

on how to achieve an optimal rating); a

book runner

(managing the fundraising,

approaching potential investors, providing guidance on pricing, market conditions

and appetite, and monitoring sukuk

demand and orders); and a

lead manager

(a

significant subscriber of the sukuk

issuance that provides credibility).

Trustee

A professional firm or unit of a bank or law firm which mechanically acts on pre-

agreed instructions; acts and holds the sukuk assets on behalf of the holders.

Facility agent

A professional firm or unit of a bank or law firm which manages the operational

aspects of the sukuk structure, such as the disbursement of the issuance amount and

profit payments to investor accounts. A facility agent can also act as a security

agent/trustee.

Security

agent/trustee

A professional firm or unit of a bank or law firm which manages the assets

securitized/collateralized under the sukuk deal (e.g. holds specific security assets for

the benefit of the holders, realizes/liquidates any mortgage or other collateral in the

event of a default).

Credit rating

agency

A pre-approved professional firm which provides opinions on credit risk and

examines the parties in the transaction and the structure. Credit rating opinions are

issued upon or soon after issuance, and updated throughout the life of the sukuk.

Legal adviser

A law firm which advises on the legal and regulatory requirements (e.g. a legal

opinion on structure and enforceability, and may cover legal due diligence, which

may be a requirement, and guidance on commercial matters.

Source: ISRA (2017)